Surprises may be welcome when it comes to gifts or parties—but when it comes to taxes, most of us want to know what to expect well before the refund comes back. For small business owners, the tax-time surprise can sometimes feel like it comes with the territory since it can be tough to stay on top of everything without a traditional employer to help guide you. But one piece of the puzzle that should help the self-employed rest a little bit easier is knowing what to do and when to do it.

From filing federal income taxes to paying estimated taxes and registering for self-employment taxes, staying on top of these deadlines will prevent last-minute panic. So get your pen and planners ready, and mark down these 2026 tax deadlines.

Before we dive in, there’s one important thing to know about dates: the taxes you will file in 2026 are for the income you earned in the 2025 calendar year.

Staying on top of self-employed tax deadlines is crucial if you want to avoid penalties or fines. Mark these key dates in your calendar:

January 15, 2026: 2025 fourth quarter estimated tax payment is due

Late January 2026: The 2025 tax filing season kicks off

January 31, 2026: Deadline to issue 2025 1099 contractor forms

March 15, 2026: Deadline to issue 2025 Schedule K-1 forms

April 15, 2026: Deadline to file your 2025 personal tax return (or an extension).

April 15, 2026: First quarter estimated tax payment is due

April 15, 2026: Last day to make 2025 retirement contributions

June 15, 2026: Second quarter estimated tax payment is due

September 15, 2026: Third quarter estimated tax payment is due

October 15, 2026: Deadline to file your extended 2025 personal tax return

January 15, 2027: Fourth quarter estimated tax payment is due

January 15, 2026: You may be tempted to think you have a break until tax season really kicks off, but your final quarterly estimated tax payment for the 2025 calendar year is due by January 15, 2026.

Late January 2026: The IRS typically starts processing submitted tax returns in the last week of January. For the 2025 tax season, the agency hasn't yet announced when it will begin accepting and processing 2025 tax year returns.

If you’re expecting a refund, you still won’t receive it until approximately three weeks after your return is processed. So, if you’re filing early to get your refund, you should still factor in the processing time.

January 31, 2026: This is the last date to issue 1099-NEC and 1099-K forms. Many small business owners use 1099 contractors to support their businesses.

If you hired a freelancer in 2025, you’re required to issue a 1099-NEC form to each contractor who earned more than $600.

If you were paid more than $600 as a freelancer in 2025, you should expect to receive a 1099-NEC from a client or employer. Remember: January 31, 2026 is the last day for payers to postmark these forms, so even if you haven’t received yours by the 31st, it may still be on the way to you.

Important update: The One, Big, Beautiful Bill retroactively reinstated the original Form 1099-K reporting threshold that was in effect before 2021. This means that for the 2025 tax year (and retroactively for 2024), third-party settlement organizations like Venmo, Cash App, and PayPal are only required to issue 1099-K forms if both of the following conditions are met:

The gross amount of reportable payment transactions exceeds $20,000, AND

The total number of transactions exceeds 200

This is a significant change from the lower thresholds the IRS had been working to phase in. If your peer-to-peer payment app transactions for goods and services don't meet both of these criteria, you won't receive a 1099-K form—though you're still responsible for reporting all business income on your tax return.

It’s important to wait to file your tax return until you’ve received these documents, even if you’ve been keeping track of your income throughout the year. Why? The IRS also gets a copy of any 1099s issued to you, so you must ensure the income reported on your 1099 forms matches the income in your tax return. If there are any discrepancies, you’ll want to sort those out with the payer before you submit your return.

March 15, 2026: If you're a partner in a partnership or shareholder in an S-corporation, this is the deadline for the business to issue Schedule K-1 forms. The K-1 reports your share of the business's income, deductions, and credits that you'll need to include on your personal tax return.

If your business is structured as a partnership or S-corp and you have partners or shareholders, you're required to issue K-1 forms by March 15, 2026.

If you're waiting on a K-1 to file your personal taxes, don't file until you receive it—just like with 1099 forms, the IRS gets a copy too, and your return needs to match.

Quarterly taxes—or “estimated taxes”—are tax payments that self-employed individuals may be required to pay throughout the year if they receive income that doesn’t have taxes already withheld from it.

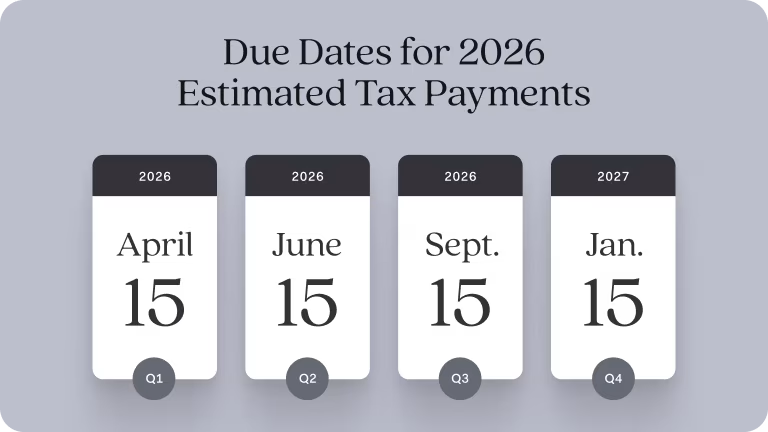

For estimated tax purposes, a year has four payment periods, and taxpayers must make a payment each quarter. For most people, the due date for the first quarterly payment is April 15. The following payments are due June 15 and September 15, with the last quarter’s payment due on January 15 of the following year. However, the deadline is the next business day if these dates fall on a weekend or holiday, as they do in the 2025 calendar year.

Here are the 2026 tax deadlines for quarterly estimated tax payments:

April 15, 2026: First quarter estimated tax payment for is due for income earned in Q1 2026

June 15, 2026: Second quarter estimated tax payment is due for income earned in Q2 2026

September 15, 2026: Third quarter estimated tax payment is due for income earned in Q3 2026

January 15, 2027: Fourth quarter estimated tax payment is due for income earned in Q4 2026

If you’re a Schedule C filer, then paying your taxes through Found makes your quarterly federal tax payments a breeze. Use Found’s tax estimate feature to estimate how much you owe and use the separate tax pocket to set money aside. When the quarterly tax payment deadline comes around, Found Plus subscribers⁴ who file Schedule Cs can pay quarterly federal tax payments in-app.¹⁰

April 15, 2026: 2025 taxes are due on April 15, 2026. The tax deadline typically falls on April 15 each calendar year, unless it falls on a weekend or holiday.

Need more time to prepare your individual tax return? You can file for an extension of time to file to buy a few extra months to prepare your federal taxes. Filing for an extension gives you until October 15 (or the next business day) to file a return.

If you are planning to file for an extension, here are some important things to know:

An extension of time to file your return does not grant you any extension to pay your taxes.

In order to determine how much you owe, you need to estimate the amount of taxes you owe and pay that amount to avoid any late payment penalties. If you end up owing more, you’ll have to pay additional taxes when you file. If you end up owing less, you may receive a refund.

You must file your extension request by the regular due date of your return.

Note: The IRS often extends filing deadlines for taxpayers affected by disaster situations. Visit the agency’s website to see if you are eligible.

April 15, 2026: If you plan to make any contributions to your traditional or Roth individual retirement accounts (IRAs) for the 2025 tax year, today is your deadline! The IRS regularly assesses retirement account contribution limits to ensure they keep up with inflation, and while they don’t increase annually, most limits increased in 2025.

October 15, 2026: If you’ve requested an extension on filing your tax return, this is the deadline to file your extended 2025 tax return. If you miss this deadline, your late filing penalties will start to accrue.

The more organized you are with your tax records, the easier it will be to manage your business finances and keep up with tax deadlines. Here are a few things you can start doing now to be ready for tax season:

Separate your business and personal expenses from one another. If you haven’t done so, set up a separate business bank account to streamline your business operations and save you time and hassle come tax season.

Track your business transactions in a bookkeeping system to make sure you’re as quickly and efficiently as possible. Found is a great option to keep your business records organized and IRS-ready.

Set aside money for taxes throughout the year based on your estimated income to cover the taxes you will owe.

Found’s tax tools help you run your business with clarity and ease. With Found, you can automatically set aside money for estimated taxes in your Tax pocket, see your tax estimate in real-time, and find and track write-offs to reduce your taxable income. Sign up today.

The standard deadline to file your 2025 individual tax return is Wednesday, April 15, 2026. If you need an extension, you must file for one by April 15, 2026, and you’ll have until October 15, 2026 to file. However, any taxes owed are still due by April 15th to avoid penalties and interest.

If you miss a quarterly estimated tax payment deadline, you will likely owe a “late payment” penalty—a monthly penalty of .5% of any owed tax that you failed to pay—for every month you’re late. Late payment penalties accrue over time, and are capped at 25% of your total owed tax. The sooner you pay any shortfall, the lower the penalty will be. However, you may be able to avoid the underpayment penalty if you meet certain criteria, such as owing less than $1,000 in total for the year, or if your payments equal at least 90% of your current year's tax liability or 100% of the previous year's tax liability.

The deadline for businesses to issue 1099-NEC forms to contractors and 1099-K forms for third-party payment transactions is January 31, 2026.

This means if you paid a contractor $600 or more in 2025, you need to issue them a 1099-NEC by January 31, 2025. Similarly, third-party payment processors like PayPal must issue 1099-K forms by this date for accounts.

The deadline for partnerships and S-corporations to issue Schedule K-1 forms is March 15, 2026. If you're a partner or S-corp shareholder, you should receive your K-1 by this date showing your share of the business's income, deductions, and credits for the 2025 tax year.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax or legal advice.

Related Guides

A Small Business Owner’s Guide to Quarterly Taxes

Accounting and TaxesThe Guide to Filing 2025 Self-Employment Taxes

Accounting and Taxes

Unfiled Tax Returns: What to Do and Where to Get Help

Accounting and Taxes