The U.S. tax system can be so confusing to navigate that it’s almost comical, especially for business owners. In fact, only 22% of self-employed people feel confident in their ability to claim all the right deductions and minimize their tax bills.

Paying for expert help can make things much easier, but it’s impossible to outsource your tax duties entirely. You’ll always need to be involved to some degree, even if only to implement your tax advisor’s recommendations.

Because of that, it's best to keep up with changes in tax laws that can affect your business. Let's explore some of the most significant self-employed tax changes in 2023, which will come into play when you file your taxes in 2024.

Update: As of November 27, 2023, the IRS delayed the new $600 Form 1099-K reporting threshold requirement for third-party payment organizations for tax year 2023 and is planning a threshold of $5,000 for 2024 to phase in the new law.

Form 1099-K is an official tax document that third-party payment networks must send to you and the Internal Revenue Service (IRS) each year that your activities on their platforms exceed a certain threshold.

Historically, you’d get a 1099-K when you processed at least $20,000 in gross receipts and completed at least 200 transactions on a platform. However, the IRS recently reduced the requirement to just $600 in gross receipts.

You’ve likely been hearing about this change for a while. Originally supposed to take effect in 2022, there was a lot of concern over the timeline from taxpayers and tax professionals alike. As a result, the change was delayed by one year to give everyone time to adjust.

That period has now passed. As of January 1, 2023, third-party payment networks like Venmo and Airbnb will send you and the IRS a 1099-K form if you received $600 or more through their platforms. There’s no longer a transaction requirement.

This change shouldn’t affect you much if you’ve been reporting all of your income each year. However, it’ll make it much harder to get away with collecting income from these sources under the table.

As an independent contractor, your net business earnings are subject to ordinary income taxes, like wages from a traditional employment arrangement. While the income tax rates haven’t changed in 2023, each income tax bracket has expanded.

For example, here are the differences between the 2022 and 2023 federal income tax brackets for single filers:

2023 Federal Income Tax Brackets

Similarly, the long-term capital gains tax brackets have also expanded. These tax rates apply to profits you generate by selling an asset after holding it for a year. For example, here’s the difference between the 2022 and 2023 brackets for single filers:

2023 Long-Term Capital Gains Tax Brackets

Generally, you don’t have access to an employer-sponsored retirement plan or company match as a self-employed person. Without that assistance, it’s important that you maximize contributions to your retirement accounts.

While they don't increase annually, the IRS regularly assesses the contribution limits for retirement accounts to ensure they keep up with inflation. As a result, most of them increased in 2023.

Here are the 2022 and 2023 annual contribution limits for some of the most popular retirement accounts among small business owners:

2023 Retirement Contribution Limits

Individual taxpayers can subtract either itemized tax deductions or the standard deduction from their taxable income, reducing the income taxes they have to pay.

Since the Tax Cuts and Jobs Act (TCJA) reduced the list of allowable itemized deductions and nearly doubled the standard deduction in 2017, most people have been better off taking the standard deduction since then.

In 2023, the standard deduction increased again. Here’s a comparison of the current and previous year’s amounts:

2023 Standard Deduction

To clarify, you must itemize or take the standard deduction regardless of your employment or self-employment status. In other words, they’re separate from the deductions you can claim for business expenses.

Vehicle expenses are one of the most common types of deductions for freelancers. Many business models require driving a car, whether to meet up with a client or complete an Uber trip.

Because there are so many indirect expenses associated with driving a vehicle, such as insurance, depreciation, and registration costs, the IRS lets self-employed people calculate their vehicle deductions using a simplified method.

Rather than keeping meticulous records of all your vehicle expenses and mileage to calculate the deductible portion, it lets you multiply your business miles by a flat rate that the IRS provides.

In 2023, that rate increased to 65.5 cents per mile. That’s a significant jump from 2022, when it was 58.5 cents per mile for the first six months and 62.5 cents for the last six.

The qualified business income (QBI) deduction is available to self-employed people who run a trade or business through a passthrough entity. That includes sole proprietorships, partnerships, and S Corporations, but not C corporations.

Fortunately, self-employed people start as sole proprietors by default, without doing any paperwork or paying any fees. As a result, the QBI deduction is available to most people who work for themselves, including the average gig worker.

If you’re one of the many who meet the qualifications, the net profit from your primary business activities is generally considered qualified business income, and you may be able to claim a deduction for up to 20% of it.

However, your QBI deduction amount may be limited if your taxable income before taking it exceeds a certain threshold. In 2023, that threshold has increased, making the deduction more accessible to high income earners.

Here are some of the current and previous year thresholds to help you understand how much of your deduction you’ll be able to claim:

The QBI deduction can be one of the more complicated tax deductions available to the self-employed, but it’s also one of the most lucrative, so you can’t afford to ignore it. If you think you might qualify, consider asking a tax professional for help in claiming it.

If you meet with clients or business partners to discuss professional matters over a meal, the IRS has historically allowed you to claim 50% of the cost as a tax deduction.

For example, a self-employed personal trainer who meets with a client at a healthy restaurant to discuss their nutrition plan could write off half of their food and beverages.

However, the Taxpayer Certainty and Disaster Relief Act of 2020 created a temporary exception to the rule in response to COVID-19. It allowed businesses to deduct 100% of business meals purchased from restaurants during 2021 and 2022.

Unfortunately, that exception expired on December 31, 2022. Starting January 1, 2023, the deduction for business meals has returned to the previous rate of 50%.

Last but not least, the Inflation Reduction Act (IRA) increased the tax credits available to small businesses. Many of its changes take effect in 2023 and can help you save money on energy costs. For example, some of the most significant ones include:

Solar panel credits: The IRA raised the tax credit for solar panels to 30% in 2023, up from what would have been 22%. If you own a rental property or do business out of an office building, you could claim a non-refundable tax credit for up to 30% of the cost of installing solar panels.

Clean Commercial Vehicle Credits: The IRA also allows small businesses that use vehicles to take a non-refundable tax credit for up to 30% of the cost of switching to clean commercial vehicles, such as electric and fuel cell models. That's an attractive opportunity if you’re a rideshare or delivery driver.

Fortunately, these aren’t the only tax benefits available to small businesses through the IRA. If you haven’t explored the possibilities, ask your tax professional to discuss the opportunities it presents.

It’s true self-employed taxes can be more complex than those of a traditional employee. While the extra complexity can be burdensome, if you’re willing to put in the extra forethought and keep up with tax changes, each new challenge is an opportunity to pay less in taxes.

Whether or not you work with a Certified Public Accountant or file your taxes on your own, it’s essential to stay on top of bookkeeping.

An easy way to make your job easier is to use Found! It’s a checking account designed with the self-employed in mind and can streamline everything from tracking your income and expenses to saving for your estimated tax payments. Found makes it easy for self-employed professionals to take control of their financial future. Sign up for Found and manage your taxes with ease.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax advice.

Related Guides

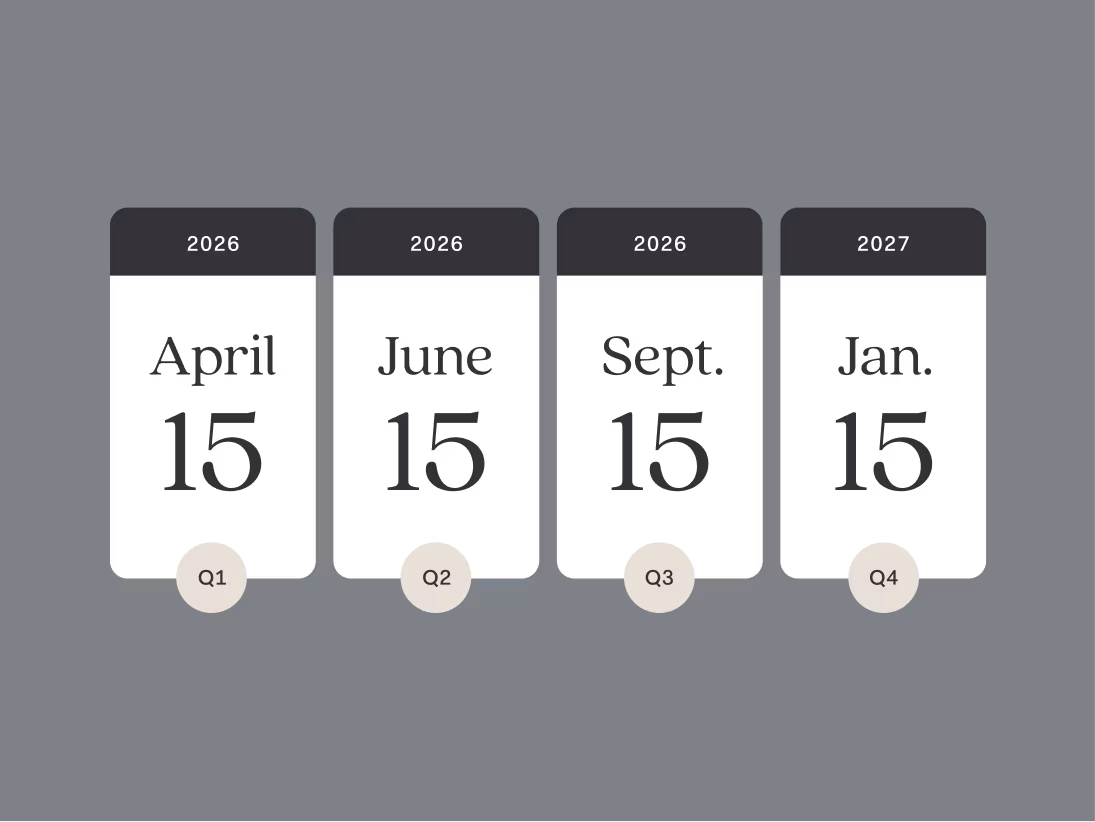

2026 Tax Deadlines for Small Business Owners

Accounting and TaxesThe Guide to Filing 2025 Self-Employment Taxes

Accounting and Taxes5 Ways To Make Your Small Business Taxes Easier Next Year

Accounting and Taxes