Placeholder

Placeholder

Placeholder

Placeholder

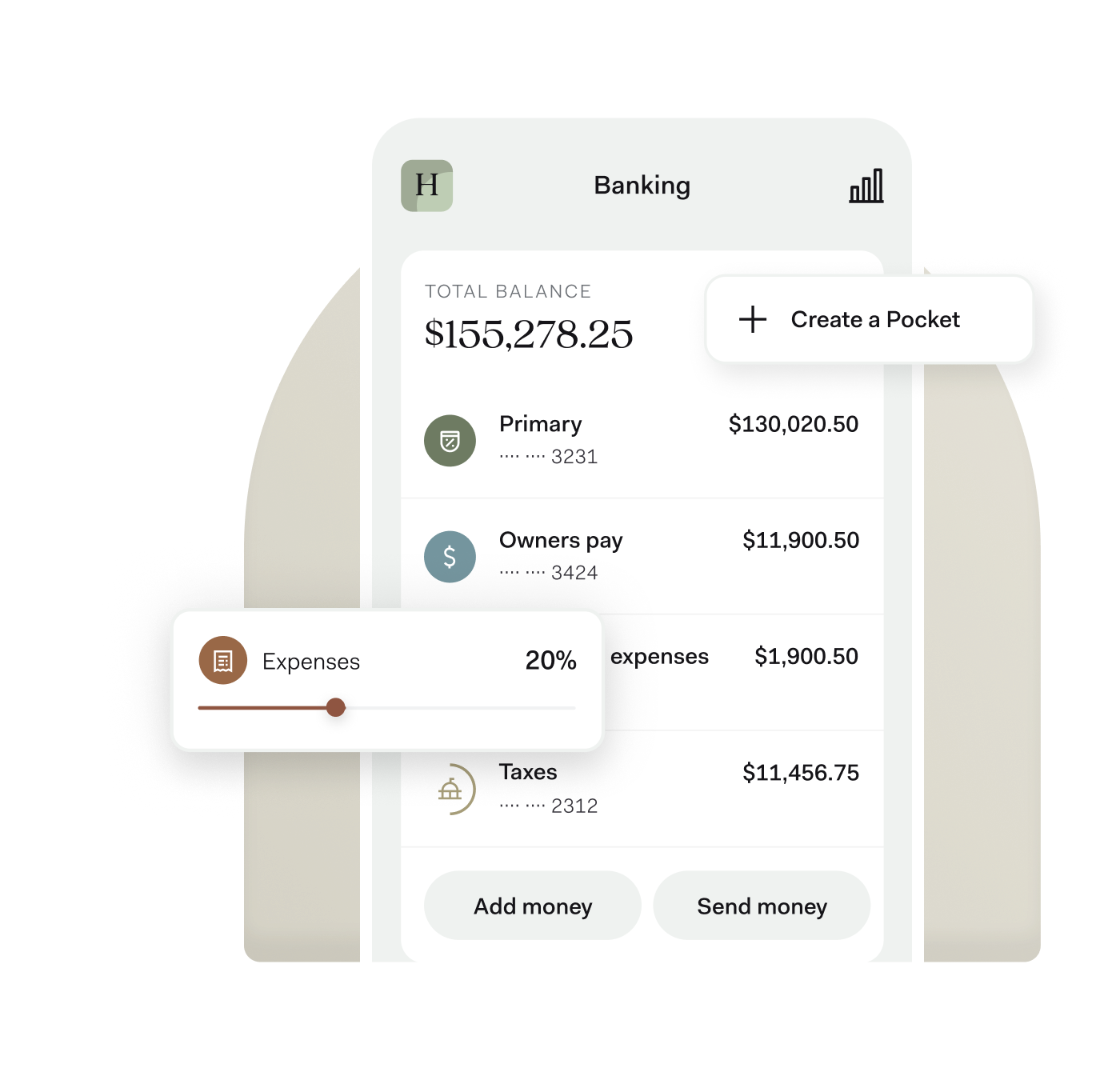

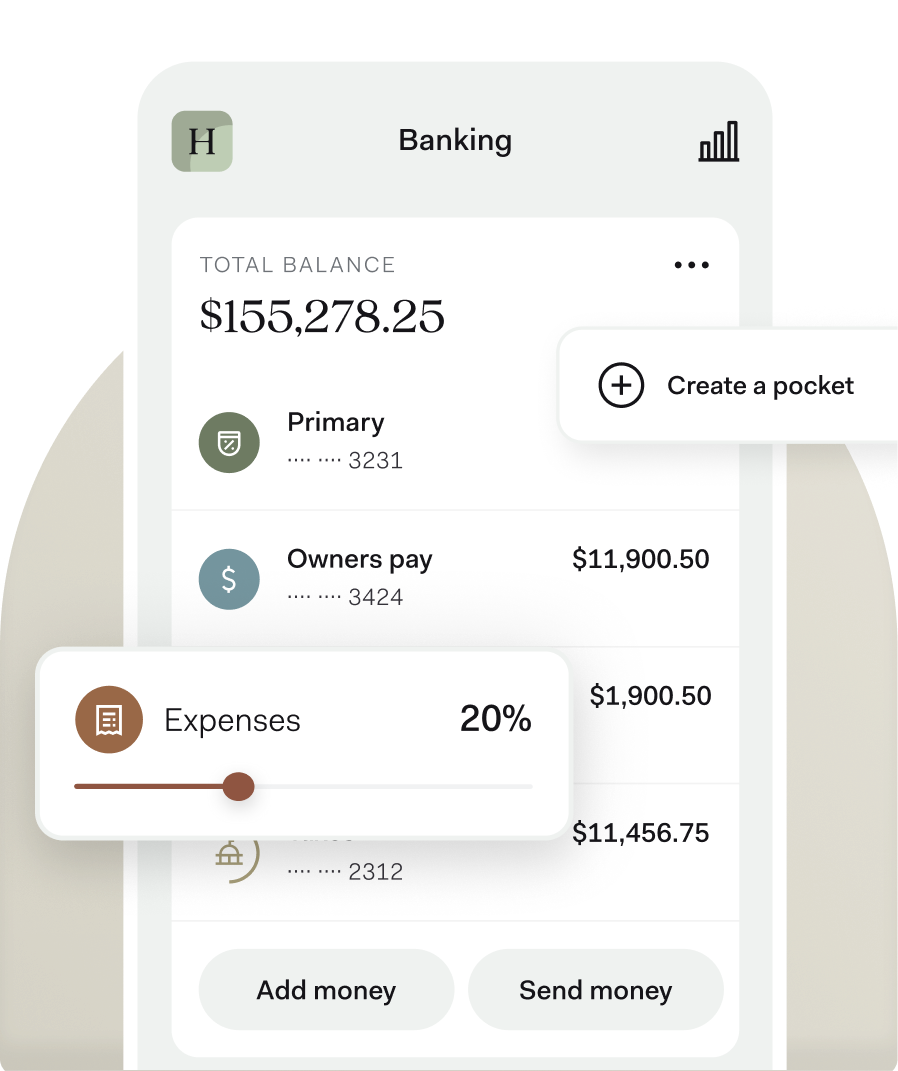

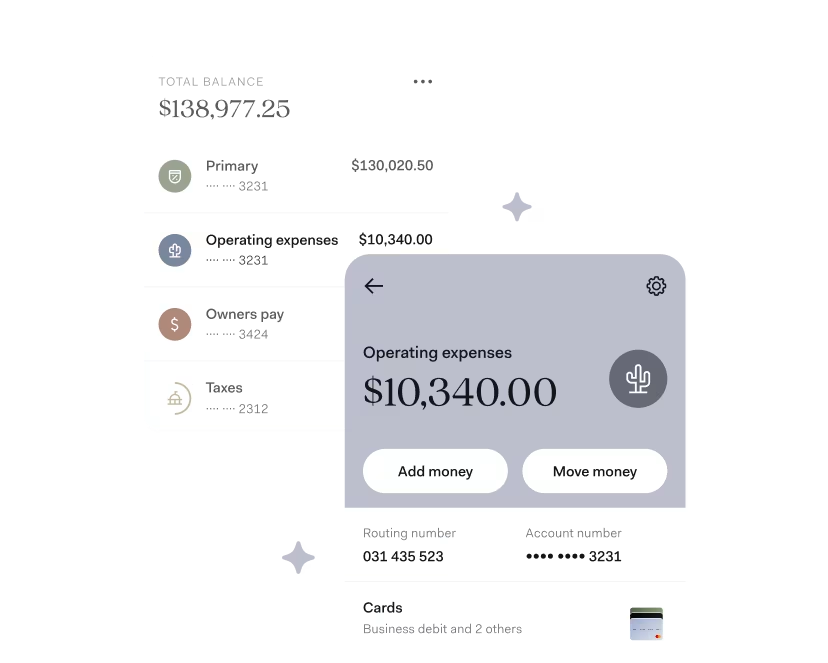

PLAN, TRACK, AND SAVE WITH POCKETS

Manage your cash flow with ease

Placeholder

Pockets are sub-accounts that give you clarity and control over your finances—whether you’re budgeting for a specific goal, saving for taxes, or tracking different revenue streams.

No hidden fees

No minimum balance

Easy sign up, no credit checks

Unlimited transactions

Placeholder

Placeholder

Placeholder

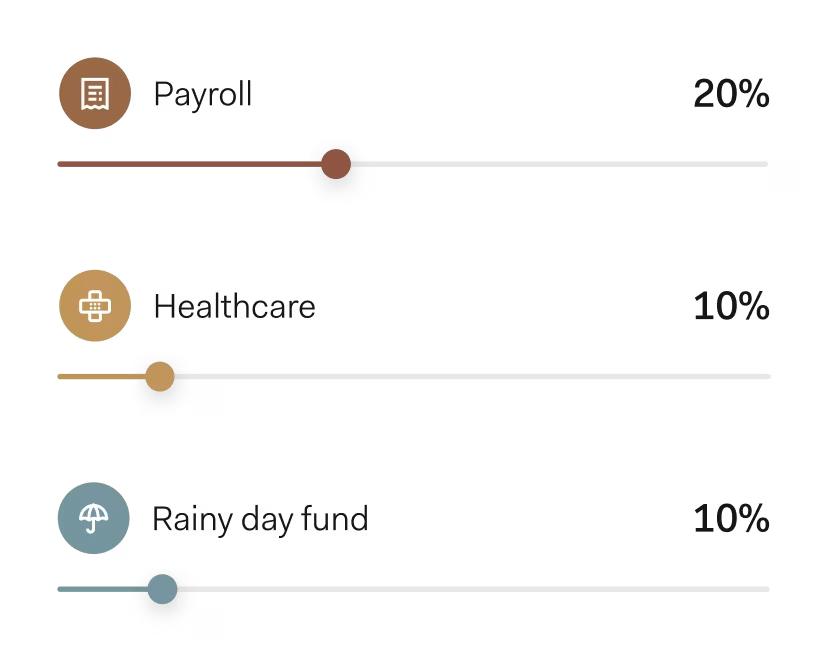

Auto-allocate funds to each Pocket

Pay taxes, pull payroll, and more—directly from Pockets

Set savings goals and track progress

**Direct deposit funds may be available for use for up to two days before the scheduled payment date. Early availability is not guaranteed.

Running a seasonal business used to be a cash flow nightmare, but Pockets' automatic savings eliminated my biggest financial headache.”

Rachel Linderman

Rachel Jocelyn Photography

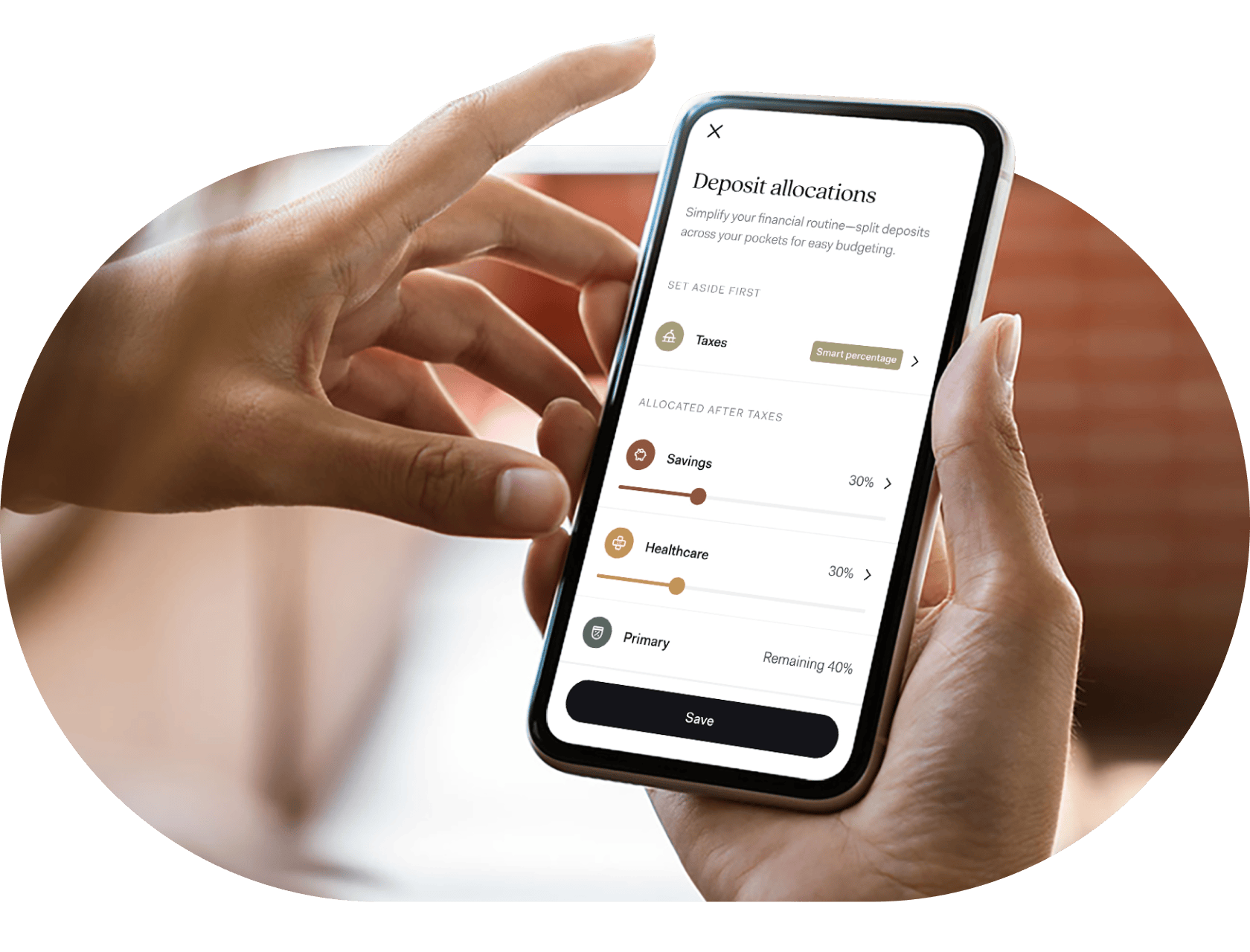

Automatically assign money to Pockets

Allocate a percentage of every deposit to a specific Pocket—or seamlessly move money between Pockets whenever you need.

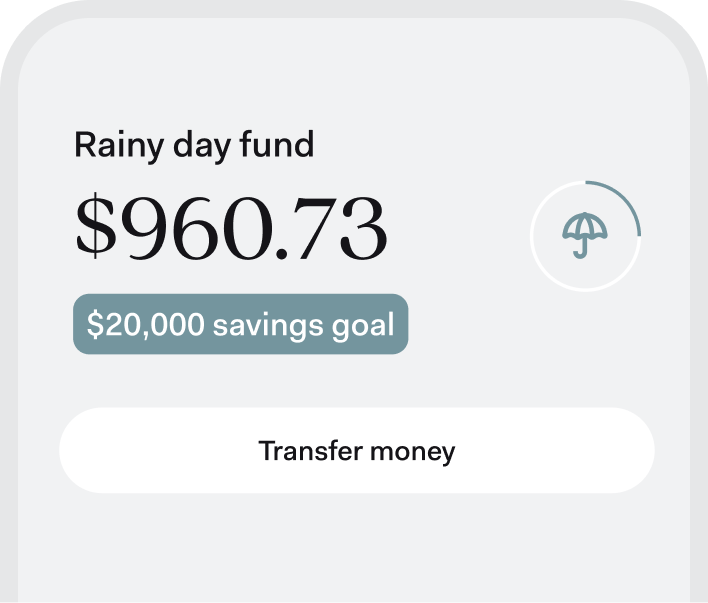

Set savings goals to help you stay on track

Whether you’re saving for insurance premiums or a rainy day, Pockets let you set per-Pocket savings and track your progress.

Spend directly from a Pocket

Have cash earmarked for specific needs? Make payments and transfers directly from the Pocket you want to use. You can also link virtual cards to a Pocket—so you always know where your money is coming from.

Use Pockets to simplify taxes

With Found’s real-time tax estimate, you can set aside money in a tax-specific Pocket every time you get paid. When tax season rolls around, you can pay taxes directly from that Pocket.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

How to use Pockets to manage your cash flow

A step-by-step guide to using Pockets to get clarity over your finances.

See why over 700K business owners have chosen Found

Frequently Asked Questions

Sign up in as little as 5 minutes.

Easy sign up

No credit check

No minimum balance

No maintenance fees

your business finances

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. FDIC insurance only covers the failure of an FDIC-insured depository institution.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

¹⁷Cash Back Terms and Conditions apply.

The information on this website is not intended to provide, and should not be relied on for, tax or legal advice.

Found partners with various providers to enable you to compare offers from participating institutions, such as lending, filing service, and insurance providers. Found is not a lender, a filing service, nor an insurance provider.

This website contains advertisement of Found and third party products and services.

According to NerdWallet, Found is the Best Business Checking for Paying Contractors and Saving for Taxes. (Source)

Terms of Service ・ Privacy Policy ・ Accessibility statement ・ © 2026 Found

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC.