Placeholder

Placeholder

Placeholder

Placeholder

Placeholder

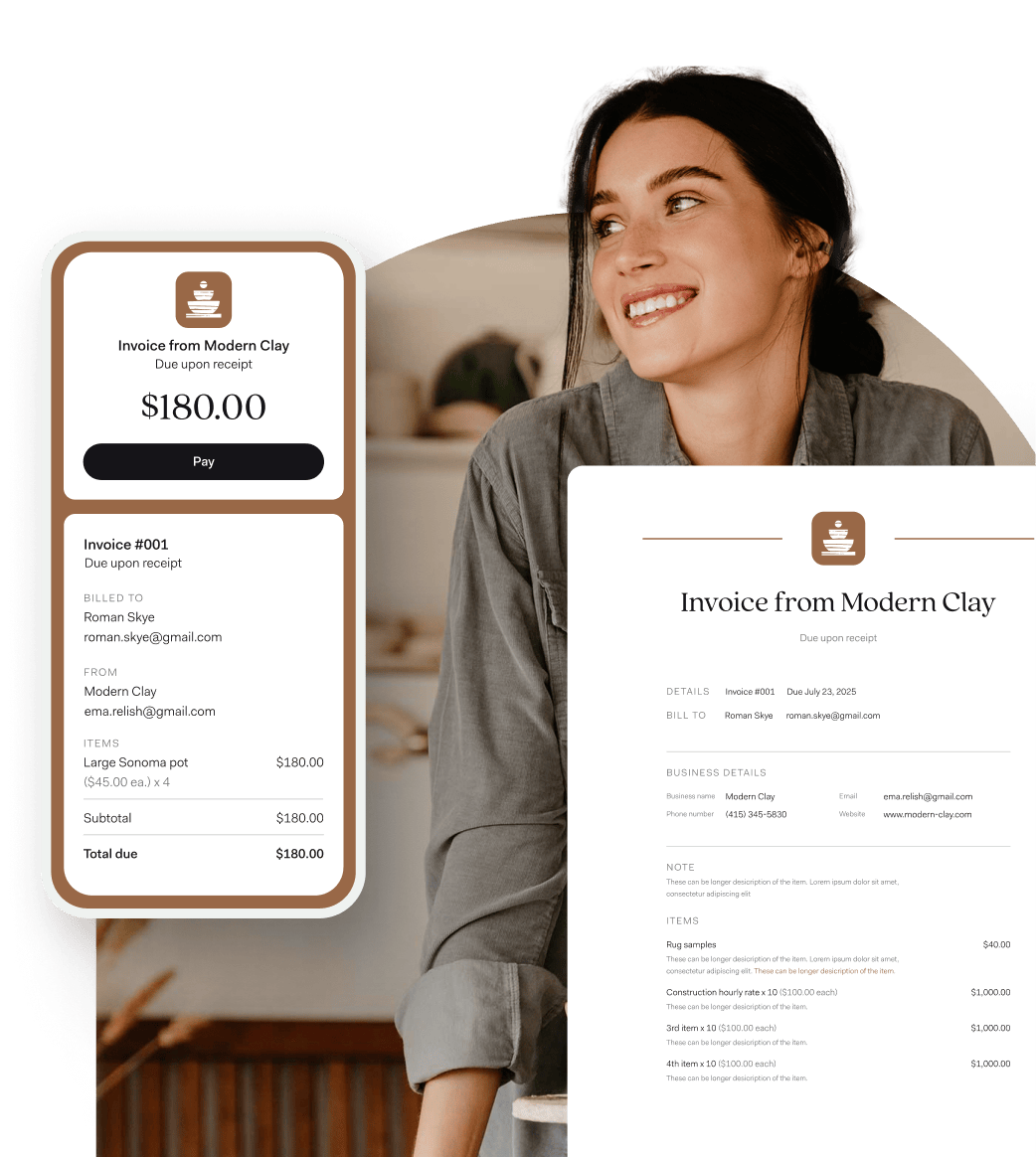

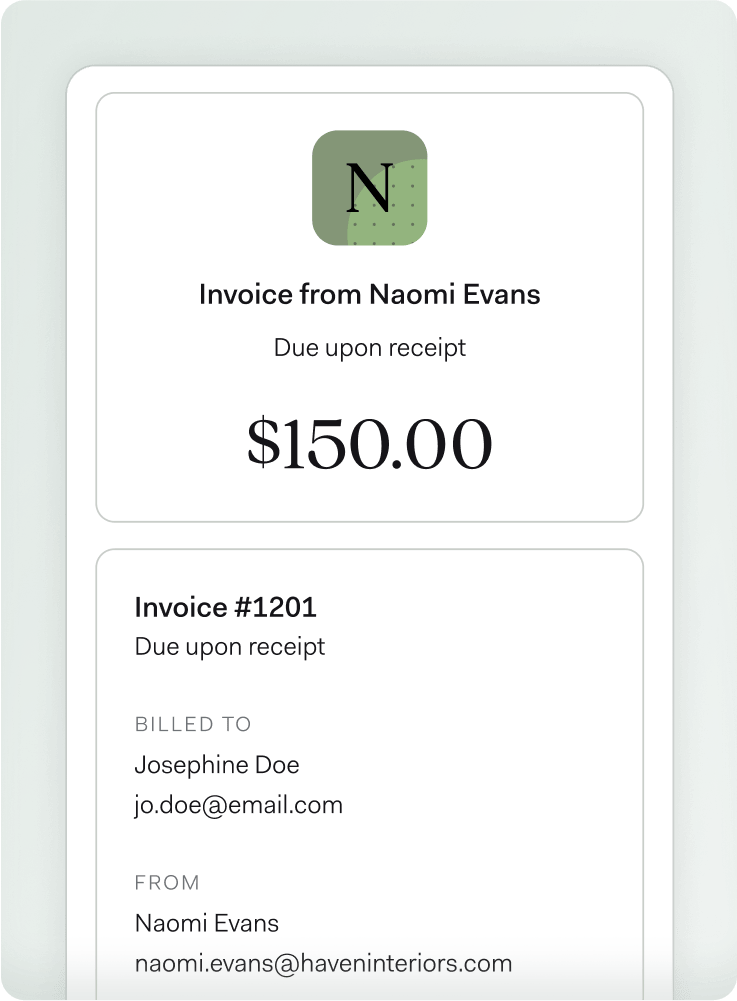

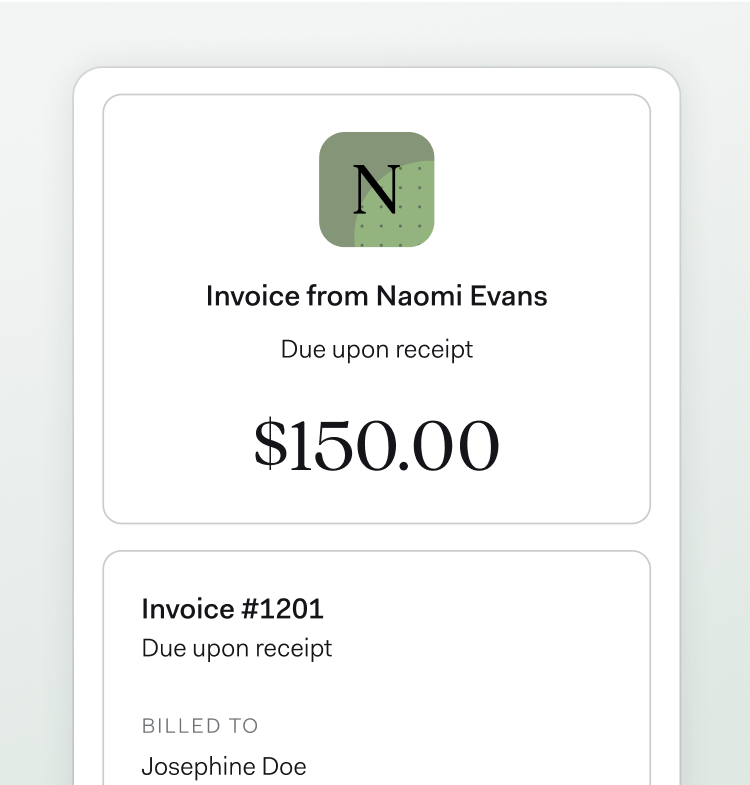

Built-in invoicing that skips the busywork

Placeholder

Placeholder

Placeholder

Placeholder

Placeholder

Placeholder

Placeholder

Placeholder

Placeholder

Speed up repeat invoices

When you invoice a repeat client, we’ll auto-fill the details from a previous invoice

Convert estimates easily

Skip the extra step—convert an estimate to an invoice in just a few taps

Avoid fee confusion

Easily include things like service charges or processing costs to your invoices at the start

Best app by far for sending invoices and for repeat series of invoices.

Along with being able to keep up with taxes, it makes it so much better than the competition.

Austin A.

FOUND CUSTOMER

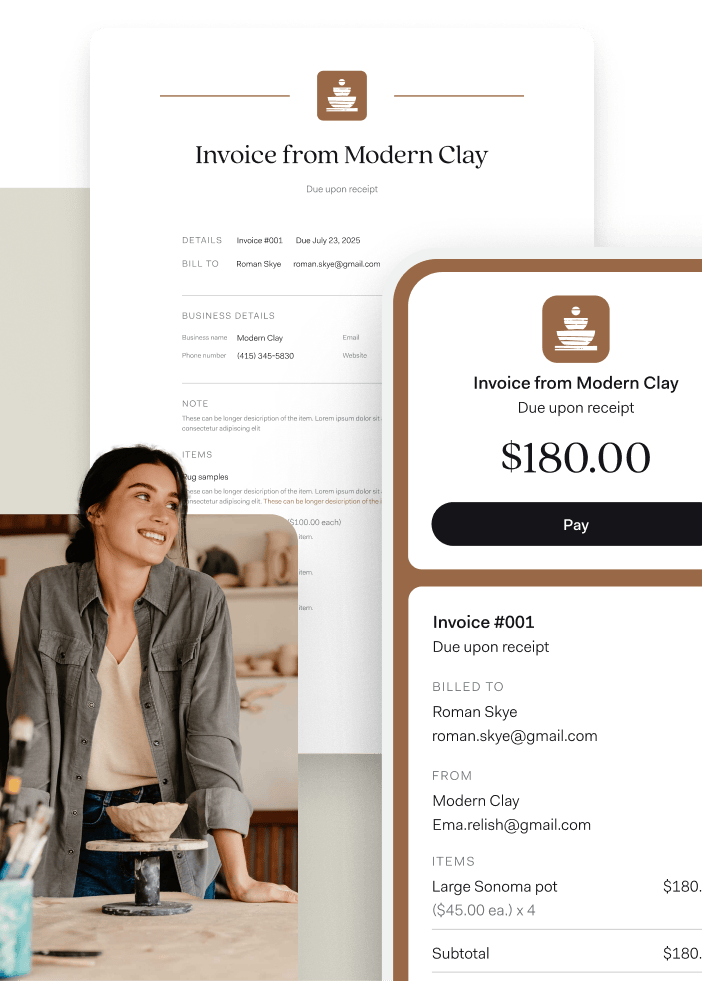

Invoicing that works as hard as you do

Tired of creating the same type of invoice multiple times? Save time and effort with invoice templates. For repeat customers, we’ll even auto-fill the details from your last invoice.

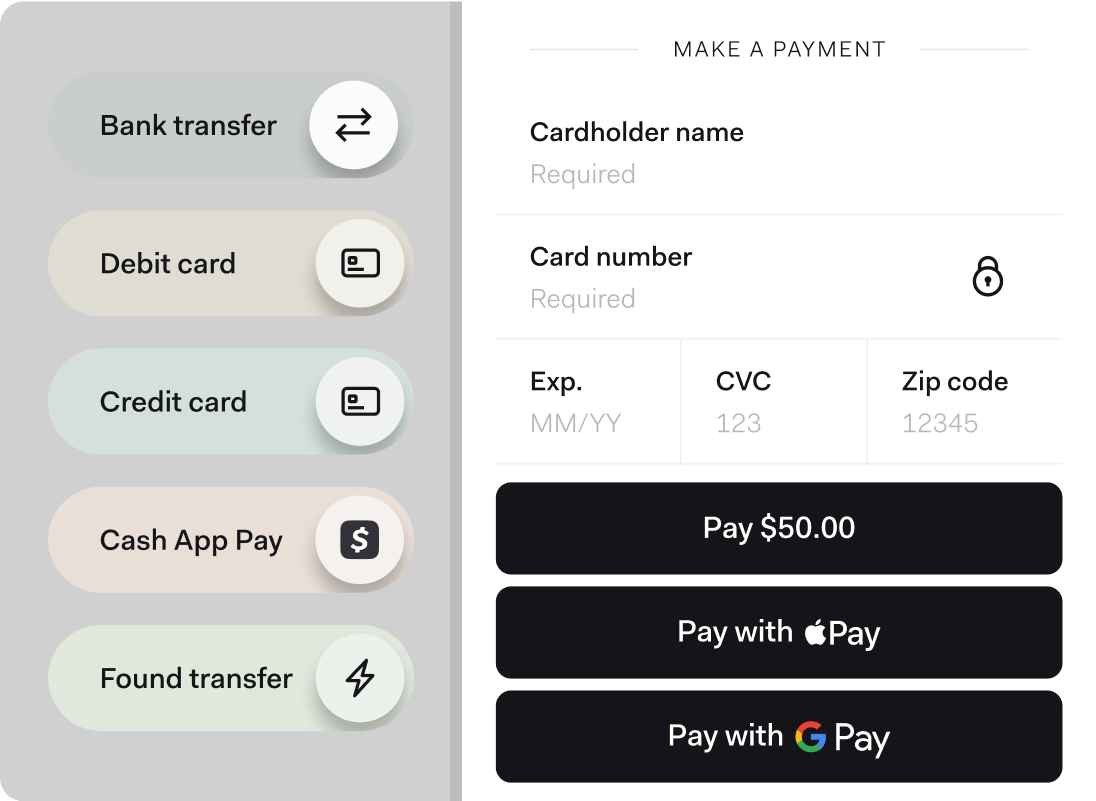

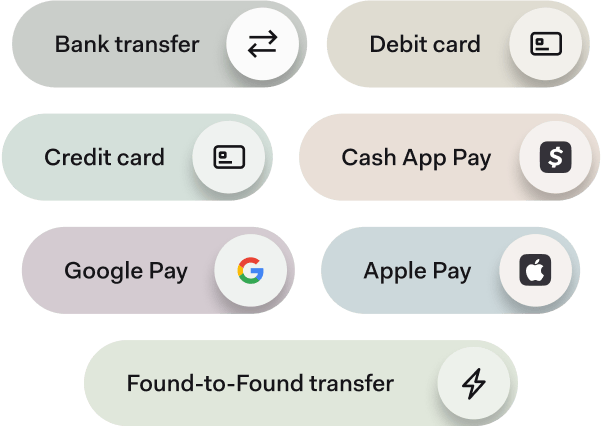

Offer flexible payment methods

Clients can use a wide range of seamless payment options—including direct deposit, credit and debit card payments, and instant transfers between Found accounts.

Keep your books up to date

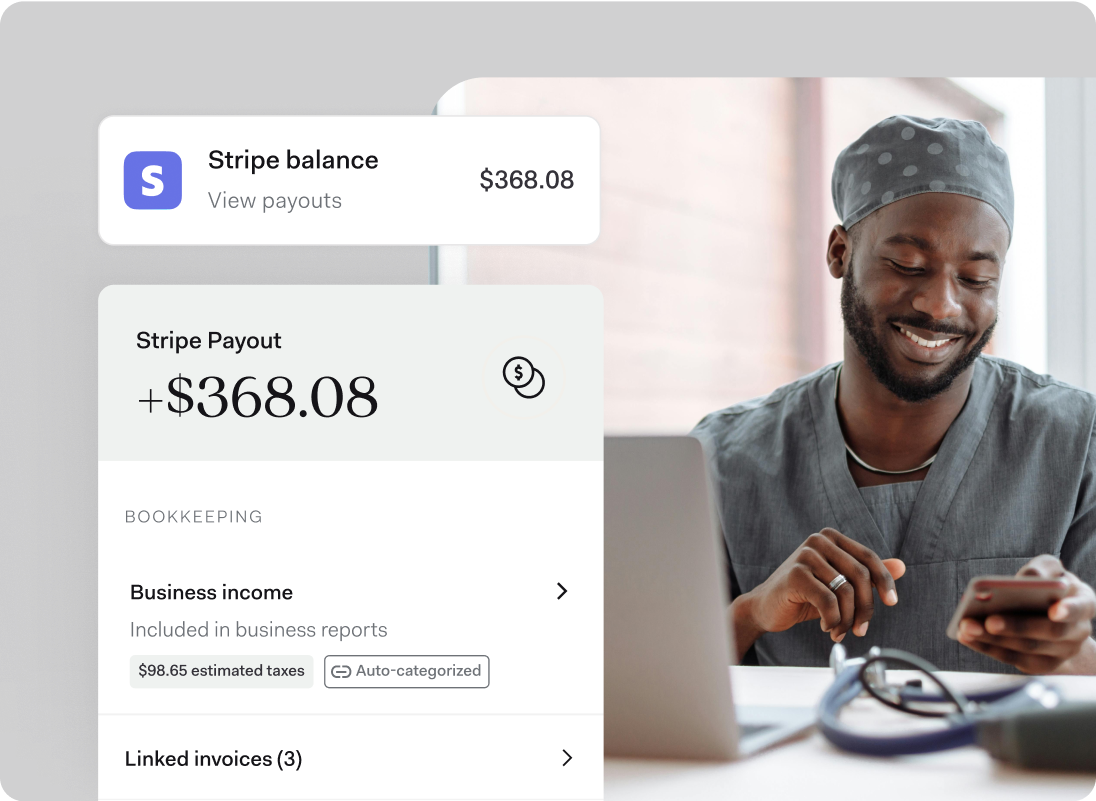

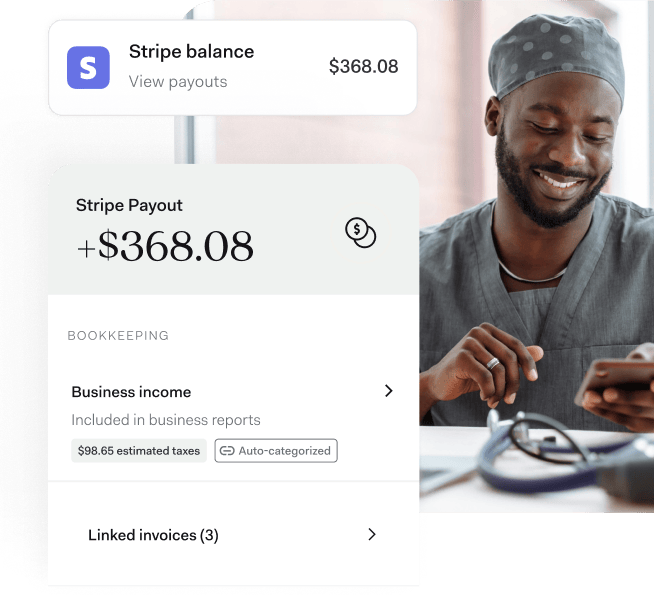

When you connect Found to Stripe, payments are automatically linked to your invoice, speeding up reconciliation and keeping your books organized.

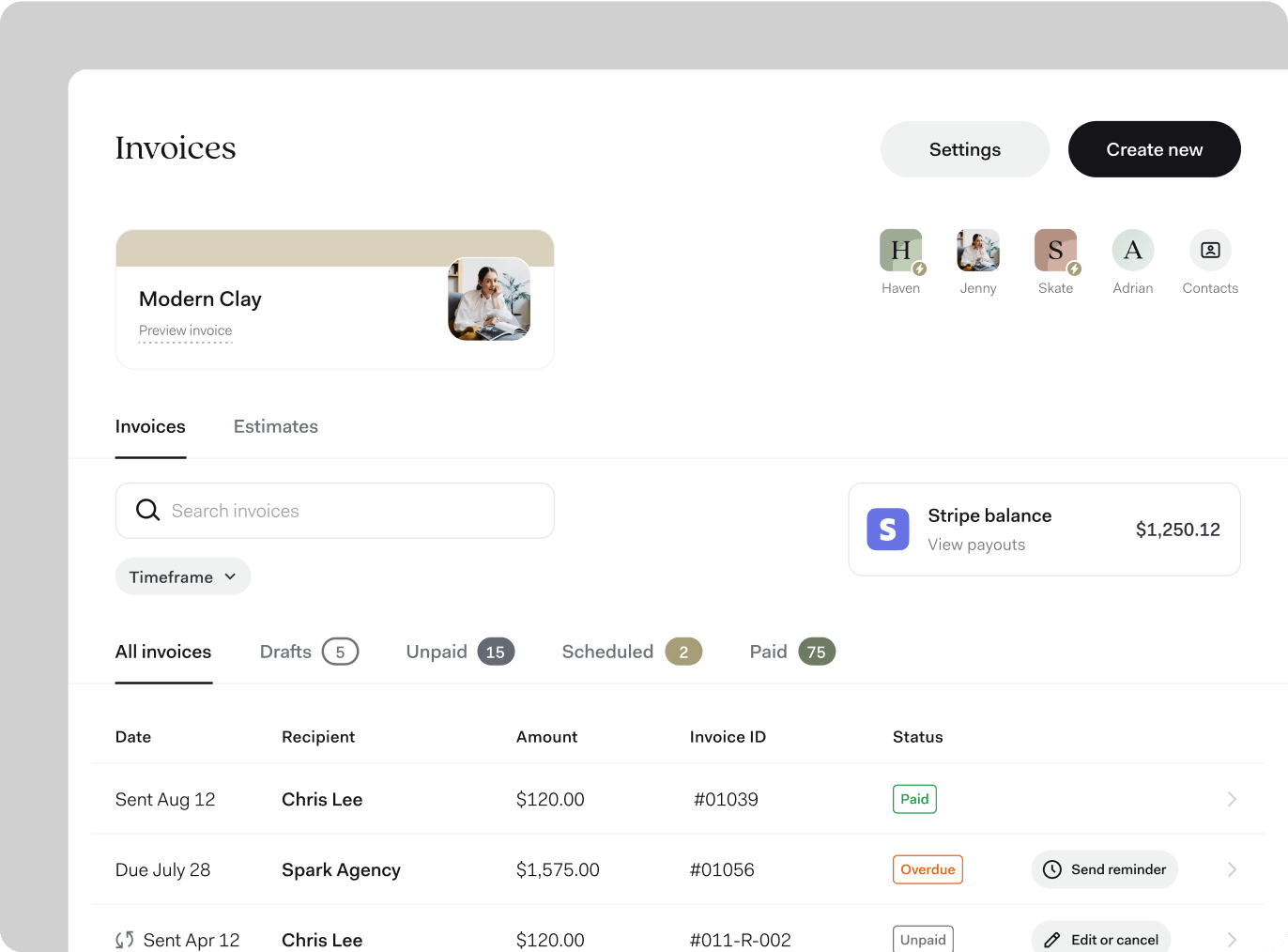

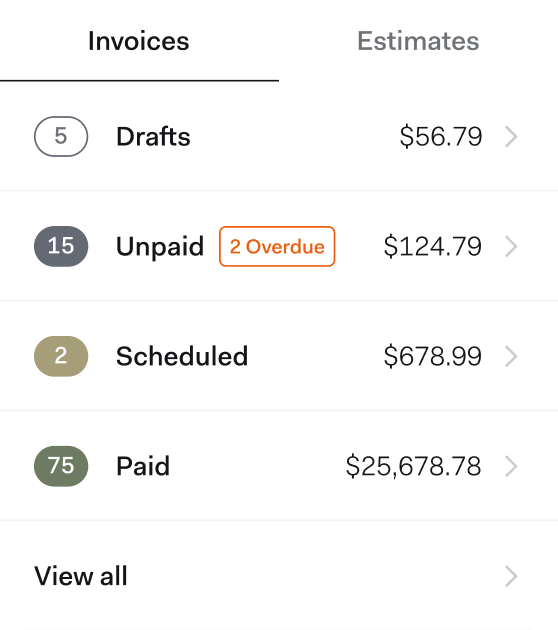

Manage your income in one place

Keep tabs on your invoices, see what’s paid and what’s pending, and set automatic reminders for clients.

Keep tabs on your invoices, see what’s paid and what’s pending, and set automatic reminders for clients.

Try Found’s free, online invoice generator

Found’s invoice generator allows you to create and send beautifully-designed invoices—no account needed.

Try Found’s free, online invoice generator

Found’s invoice generator allows you to create and send beautifully-designed invoices—no account needed.

Frequently Asked Questions

Sign up in as little as 5 minutes

Easy sign up

No credit check

No minimum balance

No maintenance fees

your business finances

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. FDIC insurance only covers the failure of an FDIC-insured depository institution.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc.

⁴Optional subscriptions to Found Plus for $19.99/month or $149.99/year or Found Pro for $80/month or $720/year. There are no monthly account maintenance fees, but other fees such as transactional fees for wires, instant transfers, and ATM apply. Read Found Fee Schedule.

¹⁷Cash Back Terms and Conditions apply.

The information on this website is not intended to provide, and should not be relied on for, tax or legal advice.

Found partners with various providers to enable you to compare offers from participating institutions, such as lending, filing service, and insurance providers. Found is not a lender, a filing service, nor an insurance provider.

This website contains advertisement of Found and third party products and services.

According to NerdWallet, Found is the Best Business Checking for Paying Contractors and Saving for Taxes. (Source)

Terms of Service ・ Privacy Policy ・ Accessibility statement ・ © 2026 Found

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC.