Placeholder

Placeholder

Placeholder

Placeholder

FULL-FEATURED BANKING

Peace of mind that lasts beyond tax season

Placeholder

Our platform makes it easy to stay on top of your taxes all year round—with features that help you maximize write-offs, see your tax estimate, and set money aside.

No hidden fees

No minimum balance

Easy sign up, no credit checks

Unlimited transactions

Placeholder

The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

“Best for tax planning, bookkeeping and invoicing tools”

October 2025

©2017-2025 and TM, NerdWallet, Inc. All Rights Reserved.

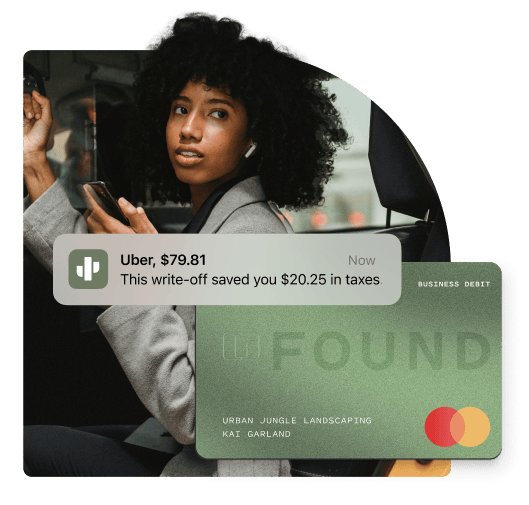

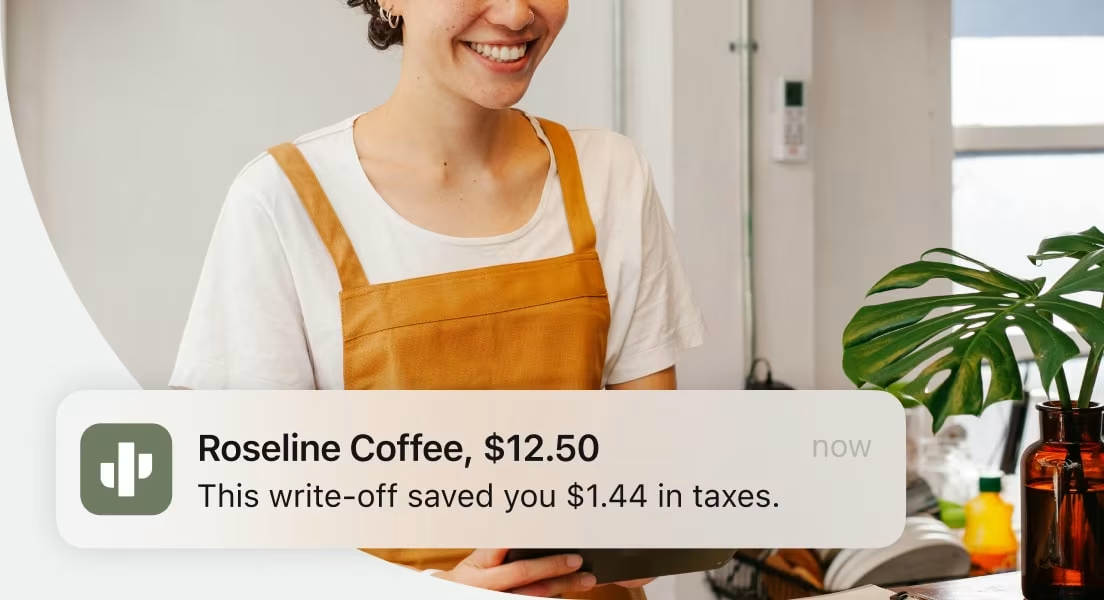

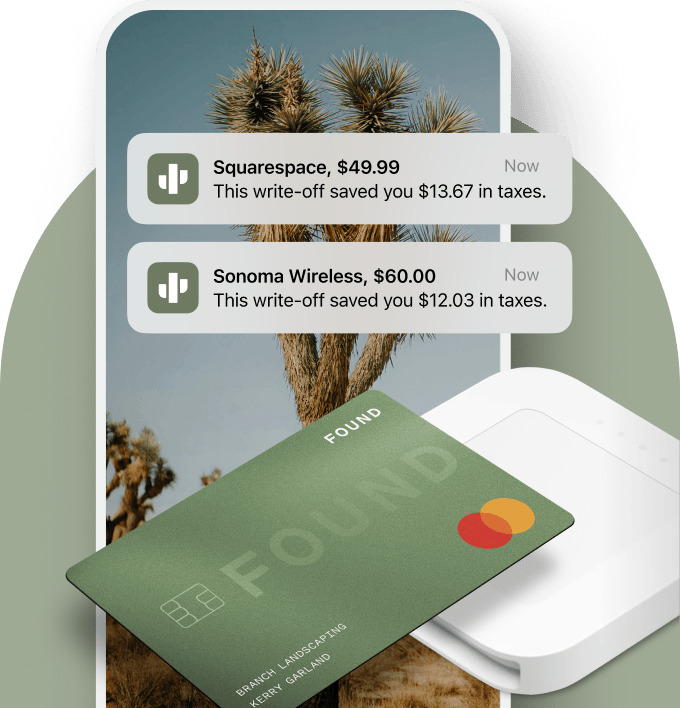

You spend—we find write-offs

Found automatically looks for tax write-offs when you make a purchase.

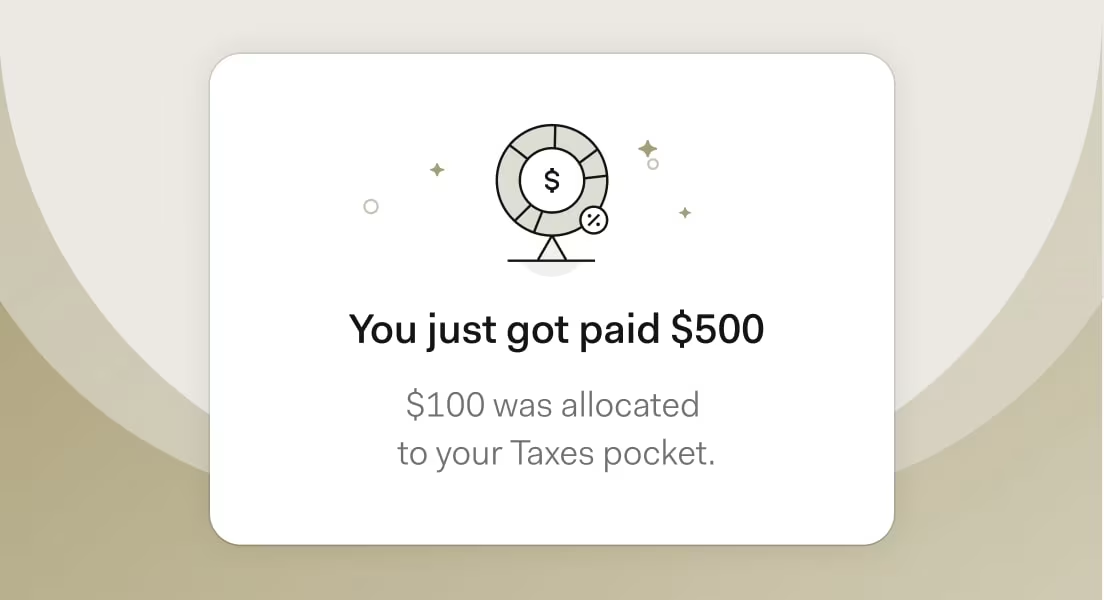

You earn—we set money aside

When you get paid, we’ll set aside money to cover your estimated taxes.

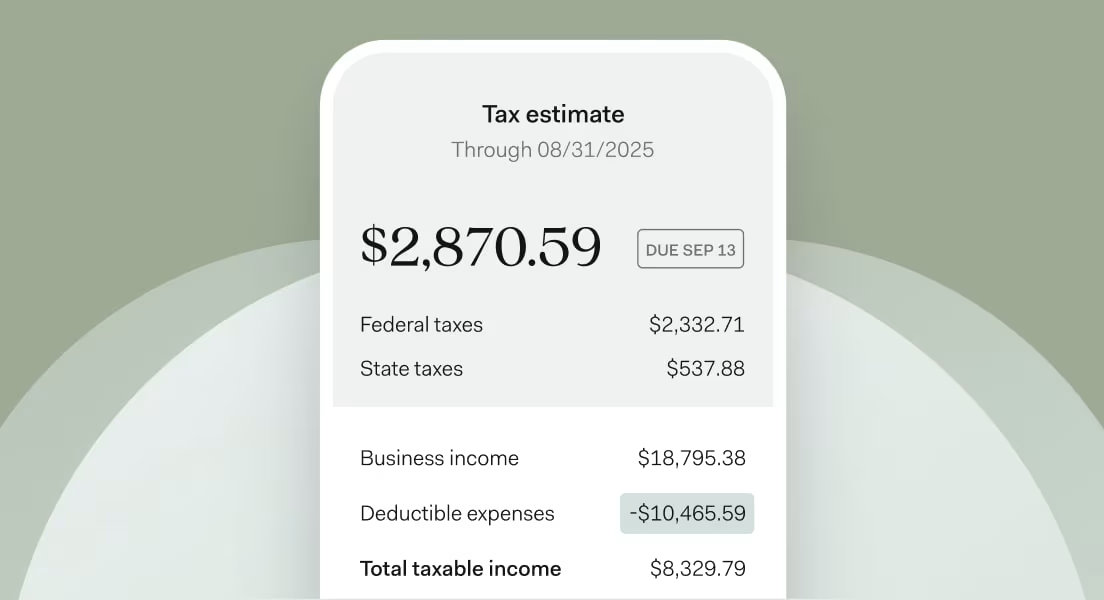

Get real-time tax estimates

See your tax estimate update as you earn and spend.

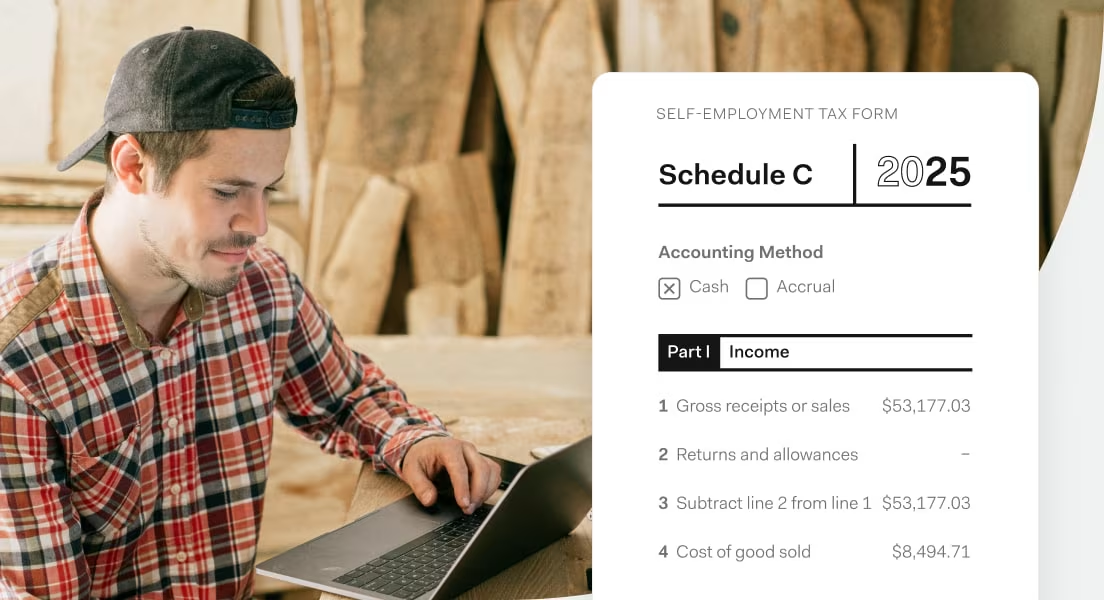

Auto-generate tax forms

We’ll generate your 1099-NECs, Schedule C, and 1120/1120-S.

Placeholder

Take the guesswork out of tax season

What’s my estimated tax payment going to be this quarter? Am I maxing out my write-offs? We help you answer those questions whenever you get paid or make a purchase. Here’s how it works:

1

You get paid or make a purchase...

2

We identify tax write-offs...

3

Update your tax estimate...

4

And automatically set money aside.

FOUND PLUS

Upgrade for premium tax tools and more

Take the stress out of growing your business with advanced bookkeeping and tax tools³ — plus 1.5% APY on balances up to $20K.

In-app tax payments

Schedule C filers can pay their quarterly federal taxes right from the app.

Customize your books

Create unlimited custom rules, categories, and tags for your expenses.

Priority customer support

Create unlimited custom rules, categories, and tags for your expenses.

³Found's core features are free. Found also offers two optional paid products, Found Plus for $19.99/month or $149.99/year and Found Pro for $80/month or $720/year.

The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

$2,670

The average amount Found users save on self-employment taxes with Found's in-app expense-tracking and write-off tools†

$2,670

The average amount Found users save on self-employment taxes with Found's in-app expense-tracking and write-off tools†

†Average tax savings is based on data from Found users who have been active customers for more than two years, calculated over their total two-year period of using Found's in-app expense tracking and write-off tools. Individual results may vary.

The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

†Average tax savings is based on data from Found users who have been active customers for more than two years, calculated over their total two-year period of using Found's in-app expense tracking and write-off tools. Individual results may vary.

See what Found customers have to say.

Frequently Asked Questions

Sign up in as little as 5 minutes.

Easy sign up

No credit check

No minimum balance

No maintenance fees

your business finances

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. FDIC insurance only covers the failure of an FDIC-insured depository institution.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

³Found's core features are free. Found also offers two optional paid products, Found Plus for $19.99/month or $149.99/year and Found Pro for $80/month or $720/year.

¹⁷Cash Back Terms and Conditions apply.

The information on this website is not intended to provide, and should not be relied on for, tax or legal advice.

Found partners with various providers to enable you to compare offers from participating institutions, such as lending, filing service, and insurance providers. Found is not a lender, a filing service, nor an insurance provider.

This website contains advertisement of Found and third party products and services.

According to NerdWallet, Found is the Best Business Checking for Paying Contractors and Saving for Taxes. (Source)

Terms of Service ・ Privacy Policy ・ Accessibility statement ・ © 2026 Found

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC.