Accounting and Taxes

Take the guesswork out of self-employed taxes and bookkeeping with these strategies.

The Guide to Filing 2025 Self-Employment Taxes

3 Ways To Track Miles for Taxes

How to File DoorDash Taxes: Step-by-Step Guide for Dashers

W-9 Forms: An Essential Guide for Small Business Owners

A Step-by-Step Guide to Filling Out the Schedule SE Tax Form

Understanding the Schedule C Tax Form

How to Hire a CPA as a Small Business Owner

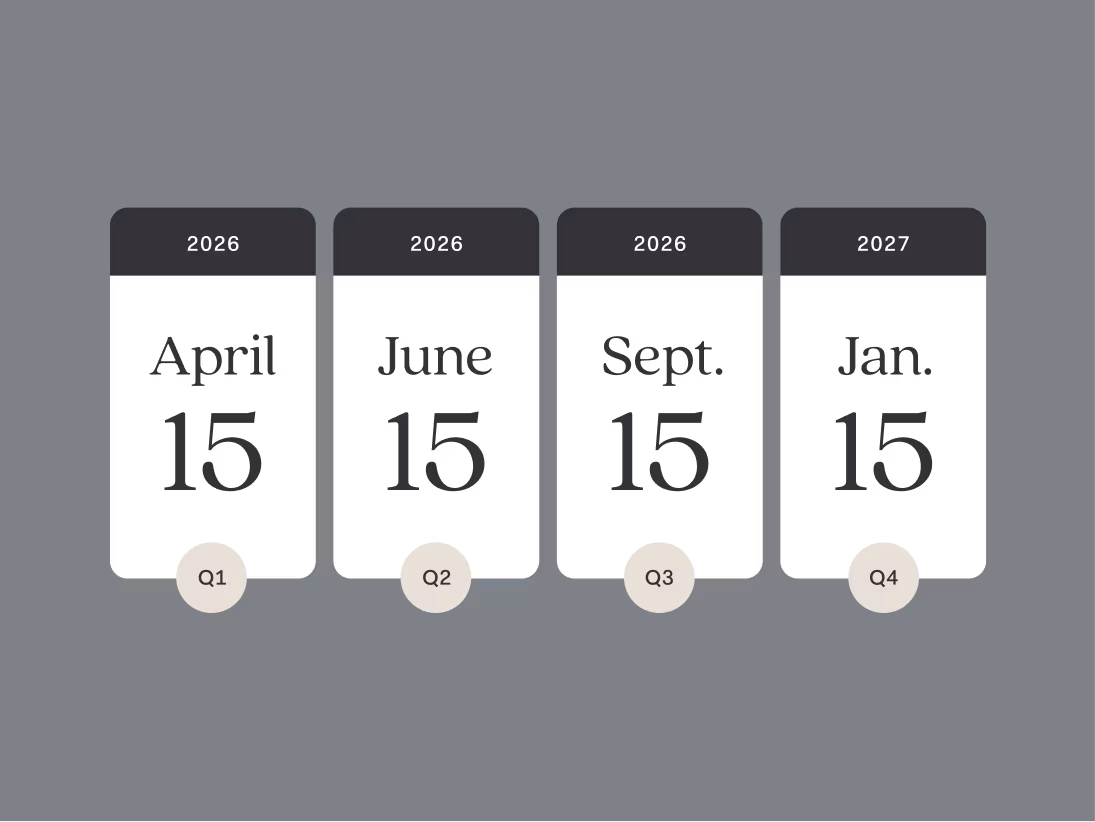

2026 Tax Deadlines for Small Business Owners

Found vs QuickBooks: Which Is Right for Small Business?

Filing Taxes as a Creator: Your 2025 Guide

Filing Taxes as a Therapist: Your 2025 Guide

The 2025 Tax Deduction Guide for Landscapers and Lawn Care Professionals

Top Tax Deductions for Beauty and Barber Business Owners

How to File Taxes as a Photographer: The Complete 2025 Guide

Ultimate Guide for Small Business Expense Tracking & Reporting

The 2025 Tax Deduction Guide for Social Media Influencers and Creators

A Guide to Small Business Quarterly Taxes

A Small Business Owner’s Guide to Quarterly Taxes

Top 12 Tax Deductions for Writers

Common Therapist Tax Deductions to Shrink Your Tax Bill

Essential Tax Deductions for Photographer Business Owners

Form 1099-MISC: What Small Business Owners Need to Know

5 Ways To Make Your Small Business Taxes Easier Next Year

How to Avoid PayPal 1099 Forms & PayPal Taxes

Cash App and Taxes: Your Complete 2025 Guide

Zelle Taxes: Does Zelle Report to the IRS?

How to File Your Poshmark Taxes

How To Calculate Taxable Income When You’re a Small Business Owner

How to File Amazon Flex Taxes

How to Read a K-1: For Partners, Shareholders, and Beneficiaries

The Ultimate Small Business and Freelancer Tax Prep Checklist for 2025

Form 1099-K: A Guide for Small Business Owners

6 Tax Mistakes Small Business Owners Make

17 Tax Deductions for Freelancers and Small Business Owners

The Ultimate End-of-Year Business Checklist

Tax Changes for 2024: A Guide for Small Business Owners

8 Common Myths About the Schedule C Form

Unfiled Tax Returns: What to Do and Where to Get Help

Hiring a Bookkeeper vs. a CPA: The Difference Between Bookkeeping and Accounting

1099-NEC Instructions Explained: What is Non-Employee Compensation?

LLC with S-Corp Status: Could It Help You Save On Taxes?

What is a Chart of Accounts?

Stripe 1099-K: Does Stripe Report to the IRS?

The $600 Tax Rule: What Small Businesses Need to Know for 2024 (and Beyond)

How to File Your Venmo Taxes

3 Ways to File Self-Employment Taxes

Turo Tax Guide: How to File Your Turo Taxes

8 Changes Small Business Owners Need to Know When Filing 2023 Taxes

Filing Uber Taxes

How to File Your Shipt Taxes

How to Write Off a Car For Business

The Home Office Tax Deduction for Small Business Owners

How to File Airbnb Taxes

Filing Instacart Taxes

Are You Making These 8 Venmo Tax Mistakes?

Brush Up on Deductions: Common Tax Deductions for Artists

Work Out Your Deductions: Tax Write-Offs for Personal Trainers

How to Navigate Tax Season When You’re a Small Business Owner

2023 Tax Deadlines Small Business Owners Should Know

Your Venmo Tax Questions Answered: What To Know About The New 1099-K Form

The Venmo Tax: What You Should Know About the New 1099-K Form In Your Mailbox Next Year

5 Changes Small Business Owners Need to Know When Filing 2022 Taxes

The Complete Guide to Expense Reporting for Beauty and Barbering Businesses

Bookkeeping for Small Business: Everything You Need to Know

Kick the 2022 Tax Season Off Right

How to Fill Your Bookkeeping Gaps

Sign up in as little as 5 minutes.

Easy sign up

No credit check

No minimum balance

No maintenance fees

your business finances

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. FDIC insurance only covers the failure of an FDIC-insured depository institution.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

¹⁷Cash Back Terms and Conditions apply.

The information on this website is not intended to provide, and should not be relied on for, tax or legal advice.

Found partners with various providers to enable you to compare offers from participating institutions, such as lending, filing service, and insurance providers. Found is not a lender, a filing service, nor an insurance provider.

This website contains advertisement of Found and third party products and services.

According to NerdWallet, Found is the Best Business Checking for Paying Contractors and Saving for Taxes. (Source)

Terms of Service ・ Privacy Policy ・ Accessibility statement ・ © 2026 Found