Placeholder

Placeholder

Placeholder

Placeholder

POWERFUL BOOKKEEPING TOOLS

Smart bookkeeping, built into your banking platform

Placeholder

Our platform makes it easy to stay on top of your taxes all year round—with features that help you maximize write-offs, see your tax estimate, and set money aside.

No hidden fees

No minimum balance

Easy sign up, no credit checks

Unlimited transactions

Placeholder

Placeholder

Placeholder

More than 3 million expenses categorized—and counting

Bookkeeping made simple.

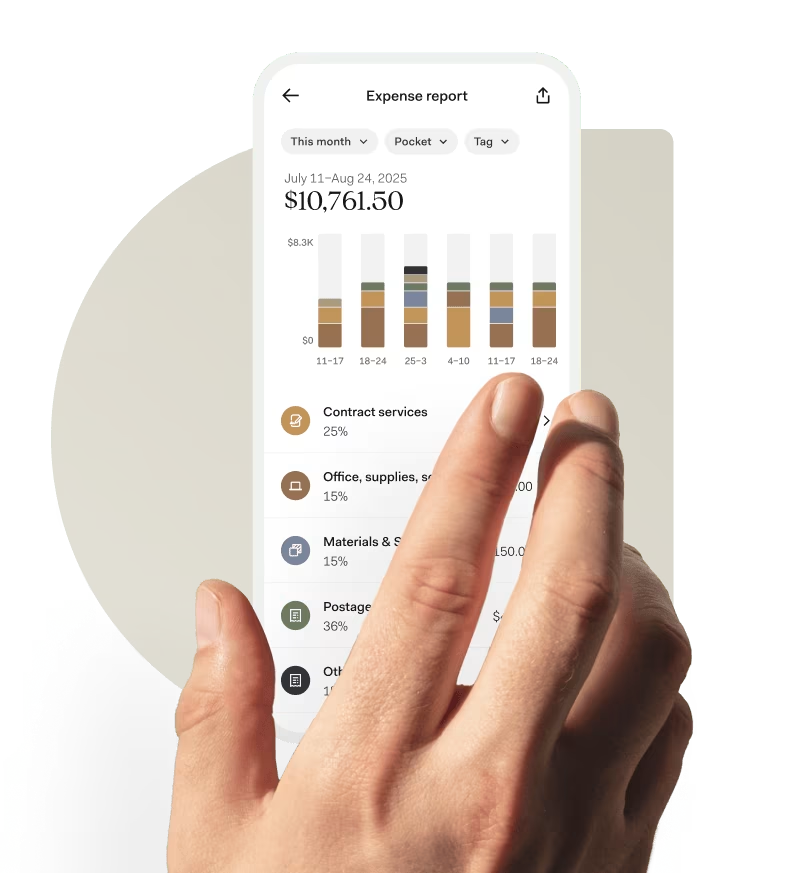

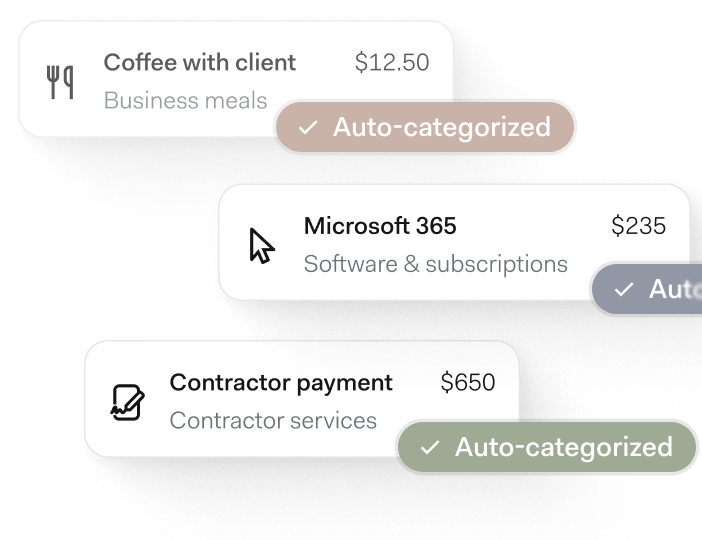

Your expenses accounted for

Found automatically tracks and categorizes your expenses when you make them. We’ll even help you identify write-off opportunities.

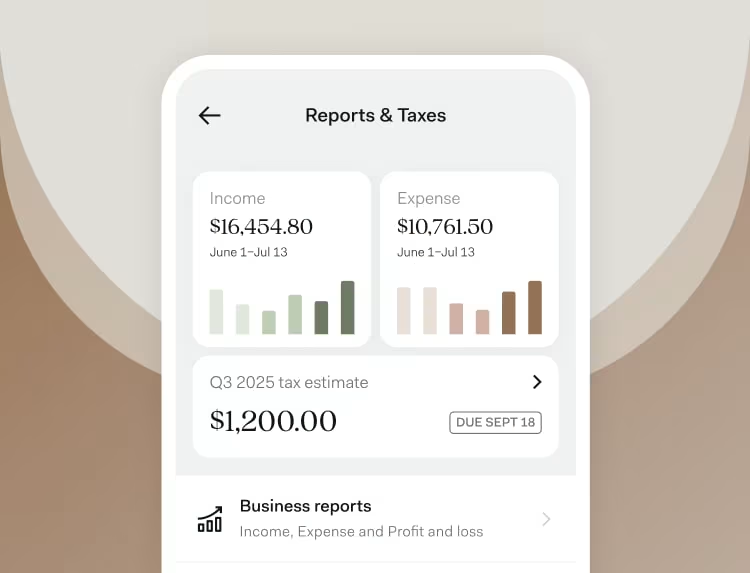

Stay ahead of tax season

As you earn and spend, we’ll update your tax estimate, so you can prepare for tax season long before it rolls around.

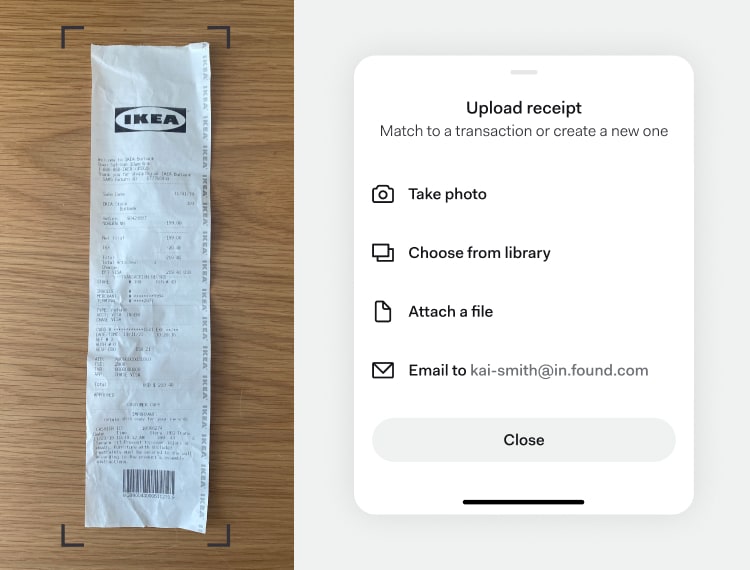

Save time, not receipts

Snap a photo of your receipt or email it to Found and we’ll automatically pull the details into an expense item for you.

FOUND PLUS

Upgrade for premium bookkeeping tools

Take the stress out of growing your business with advanced bookkeeping and tax tools³ — plus 1.5% APY on balances up to $20K.

Speed up your expense tracking

Skip the manual expense categorization with unlimited category rules.

Import activity from other accounts

Consolidate transactions from your bank account, credit card, and apps.

Customize your books

Organize and track expenses the way you want with custom categories and tags.

³Found's core features are free. Found also offers two optional paid products, Found Plus for $19.99/month or $149.99/year and Found Pro for $80/month or $720/year.

Get real-time reporting

With just a few taps, you can dive into auto-generated income, expense, and profit and loss reports to better understand your business.

Manage your cash flow with Pockets

Use Pockets for all your budgeting and cash flow needs. Automatically allocate funds for payrolls, supplies, emergencies — whatever you choose.

Collaborate with your accountant

Have an accountant or bookkeeper? Save time by collaborating with them directly in your account.

See why over 500K business owners have chosen Found

Frequently Asked Questions

Sign up in as little as 5 minutes.

Easy sign up

No credit check

No minimum balance

No maintenance fees

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC.