Working independently has never been so popular. According to a 2023 Upwork study, 39% of the American workforce (60 million Americans) performed freelance work in the past year, up from 36% in 2021.

Part of this is likely a result of the Great Resignation, where mass numbers of workers left their jobs following the start of the COVID pandemic. Another factor may be workers starting side hustles to bring in a little more money. Whatever the reason, it’s clear more people than ever are interested in working for themselves as 1099 contractors.

But is self-employment right for you? Your choice between W-2 and 1099 status changes everything. The paycheck you see isn't what you get. As a 1099 contractor, you'll charge more but cover your own taxes and benefits. As a W-2 employee, your salary is just one piece of your total compensation package.

Did you know? Your employment classification isn't just about taxes—it shapes your entire work experience, from schedule flexibility to workload to income potential.

When you accept a W-2 position, you're entering a structured relationship. The company doesn't just pay you—they create an ecosystem around your work life. They handle tax withholding, provide benefits, and set your schedule. This arrangement trades some freedom for stability and predictability.

Tax withholding: Your employer automatically takes taxes from each paycheck

Benefits package: Often includes health insurance, 401(k), paid time off, and other perks

Predictable income: Regular paychecks in set amounts

Set schedule: The company determines your work hours and location

That salary number in your offer letter? It's just the starting point. Smart job seekers look beyond the base pay to evaluate what employers are really investing in them. Your full compensation includes several hidden elements that add substantial value.

Your W-2 salary isn't your true compensation. Your total package includes:

Base salary

Employer-paid taxes (7.65% of your wages for FICA)

Health insurance premiums (averaging $7,931 annually per employee in 2023)

Retirement benefits

Paid time off value

Many W-2 employees often undervalue their benefits package. Your total compensation often exceeds your salary by 25-30%.

The 1099 path puts you in the driver's seat. You're not just a worker—you're a business of one. This arrangement gives you control over your work methods, clients, and schedule. The flip side? You handle everything your employer would normally manage, from taxes to benefits.

Self-employment taxes: You pay both employer and employee portions (15.3% total)

DIY benefits: You arrange your own health insurance and retirement

Flexible schedule: You control when and where you work

Business deductions: You can write off qualified business expenses

Smart contractors set their rates—sometimes hourly or sometimes project-based—by calculating what they're really spending to run their business. Your true income shrinks quickly when you account for what you're handling alone.

Your 1099 earnings need to cover:

Your take-home pay:

Self-employment taxes (the full 15.3% for Social Security and Medicare, since you’re responsible for both)

Health insurance premiums (this varies by person, depending on your state, income, and any pre-existing health conditions)

Retirement savings

Unpaid time between contracts

Understanding how the IRS views worker classification is essential. Misclassification can lead to significant tax penalties and back payments for businesses, and tax surprises for workers.

The IRS looks at three main areas to decide whether a worker is a 1099 contractor or W-2 employee: behavioral, financial, and relational.

Behavioral: This is the degree of control the company has over when and how the worker does their job. In other words, how much freedom do they have to work the way they want?

Financial: Financial considerations include how the worker is paid, whether your business covers expenses, and whether they provide their own tools and equipment.

Relational: You should consider the types of contracts or employment agreements in place with the worker, as well as whether they’ll continue to work for you once the current project is over.

The main thing to keep in mind is that there’s not a single equation that definitively says one worker is a contractor and another is an employee. Each situation is unique.

Misclassification isn't just a paperwork issue—it has serious financial consequences:

For businesses: Back taxes, penalties, and interest on unpaid employment taxes

For workers: Unexpected tax bills, loss of labor protections, missing out on benefits

If you’re really stuck, the IRS provides a worksheet you can use to help make a determination—Form SS-8. You can file this form and the IRS will review the situation and circumstances and make an official determination of the worker’s status. However, do note that it can take at least six months to get an answer. If you’d like an answer sooner, consulting a tax advisor is a great option.

Taxes might not be the most exciting topic, but they dramatically impact your bottom line, whether you’re a W-2 employee or a 1099 contractor. The W-2 and 1099 paths create entirely different tax situations, affecting your paperwork load, your take-home pay, and your obligations.

Your employer does much of the heavy lifting with taxes. They calculate, withhold, and submit payments on your behalf throughout the year. This simplifies your tax life considerably.

Taxes automatically withheld each paycheck

Employer pays half of Social Security and Medicare

Simple W-2 form at tax time

Limited deductions

As a contractor, you become your own payroll department. The government still wants its share, but now you're responsible for calculating, saving, and submitting those funds on a regular schedule.

You pay quarterly estimated taxes

You cover all Social Security and Medicare taxes (15.3%)

More complex tax filing with Schedule C

Business expense deductions available

Tax Tip: A good rule of thumb for 1099 contractors is to set aside 25-30% of income for paying quarterly tax payments.

Benefits represent a major value gap between employment types. W-2 employees often take these perks for granted until they price them independently as contractors. Understanding what benefits are worth helps you make accurate compensation comparisons.

Your employer typically provides a safety net of protections and perks that extend well beyond your salary. These benefits create financial security and work-life balance support.

Employer-provided health insurance

Paid vacation and sick leave

Company-sponsored retirement plans

Workers' compensation coverage

Unemployment eligibility

Legal protections

As a contractor, you create your own benefits structure. Because you’re building your own work life, the payoff doesn’t always translate dollar for dollar on a spreadsheet. While this gives you freedom to customize your options, it requires more planning and typically costs more than group rates available to employers.

Higher hourly/project rates

Freedom to choose your own benefits

Flexible work schedule

Ability to work with multiple clients

Control over retirement options

The value of these benefits matter differently to everyone. A parent might prize flexibility to attend school events, while someone else might value the ability to travel while working. Unlike W-2 perks, these advantages adapt to what matters most to you.

Did you know? Research from the Bureau of Labor Statistics shows that benefits cost employers an average of $14.68 per hour worked for each employee in 2024—representing nearly a third of total compensation costs for private industry workers.

Every employment arrangement involves tradeoffs. Understanding the advantages and limitations of each option helps you prioritize what matters most for your current life situation and career goals.

The W-2 path shines in areas of simplicity and security. Your employer handles many financial and administrative aspects, allowing you to focus primarily on your core work responsibilities.

No surprise tax bills

Benefits without shopping around

Company-provided equipment

Built-in work community

Clear advancement tracks

Regular, predictable paychecks

Structured career progression path

Company-provided training and development

Team environment with built-in collaboration

Structured feedback and performance reviews

Traditional employment's stability comes with certain constraints. You'll have less control over various aspects of your work life in exchange for the security benefits.

Less control over your schedule

Fewer tax deductions

Income ceiling based on role

Less work-life flexibility

Growth limited by company needs

Career advancement dependent on organizational structure

Limited ability to diversify skills across industries

Compensation increases typically follow set schedules

Less autonomy in work methods and processes

Contracting offers advantages for those who value independence and financial growth potential. You gain control over numerous aspects of your working life that employees typically cannot influence.

Potentially higher gross pay

Significant tax deductions

Freedom to pick projects

Work where and when you want

Build your own business

Income potential varies with your client base and effort

You direct your own career path and development

Self-directed skill acquisition and growth

Independent work environment

Client-based feedback system with diverse perspectives

The independence of contractor status comes with additional responsibilities and risks. You'll need to manage aspects of work life that employees can often take for granted.

Unpredictable cash flow

Full tax responsibility

No paid time off

Admin overhead

Need self-discipline

Complete responsibility for your success

Constantly selling yourself to maintain client base

Handling all aspects of business development

No external structure for accountability

Managing multiple client expectations simultaneously

Some people thrive with structure while others feel constrained by it. This fundamental difference affects job satisfaction regardless of compensation. Consider which elements matter most to you when choosing between these paths.

Something that often catches 1099 contractors by surprise is taxes: As a 1099 contractor, taxes become a year-round consideration rather than a once-a-year April event. Smart tax management can significantly increase your net income and help you avoid unpleasant surprises at filing time. Here are a few tips to get started:

Track business expenses: You’ll want to make sure you have a solid bookkeeping tool to help you track expenses.

Set up tax savings: Automatically set aside 25-30% of your income for quarterly estimated taxes

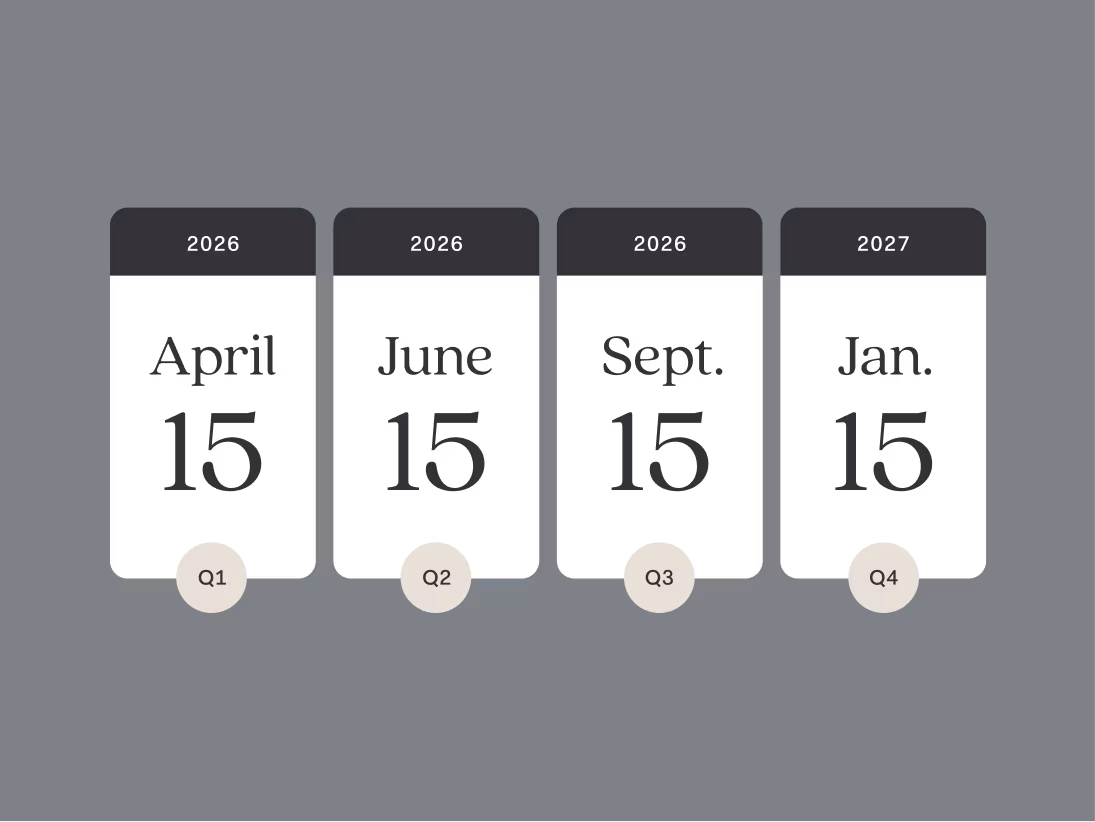

Pay quarterly taxes: Mark the tax deadlines for quarterly estimated taxes in your calendar.

Consider your business structure: An LLC with S-Corp status could help you save on self-employment taxes in some cases. Do your research.

Most 1099 contractors leave money on the table by missing deductions. Common write-offs include home office, internet, phone, insurance, and mileage. Learn more →

Your employment classification should align with your life priorities, financial goals, and work style preferences. There's no universally correct answer—just the right fit for your specific situation.

Your ideal classification depends on your:

Financial situation

Risk comfort level

Need for flexibility

Career goals

Administrative tolerance

Many successful professionals mix both classifications at different career stages. Some maintain part-time W-2 work while building a contracting business.

The bottom line: Understanding the tax, benefit, and career implications helps you make an informed choice that supports your goals.

Did you know? You don’t have to choose W-2 or 1099 work. According to a Bankrate survey, 36% of U.S. adults earn extra money through a side hustle outside of their main source of income.

The W-2 vs. 1099 decision shapes how you work and earn money, and having the right tools can make it easier. Stop juggling separate apps for taxes, banking, and bookkeeping. Your Found account gives you full-featured business banking that meets your business needs, plus:

Automatic expense tracking that finds tax write-offs

Built-in tax savings to avoid quarterly surprises

Free, professional invoicing with multiple payment options

Contractor management tools to help you simplify your growing business

Ditch the spreadsheets, forgotten receipts, and tax-time panic. Found handles the financial headaches so you can get back to the work you actually enjoy.

People considering their employment classification options typically share similar concerns. These answers address the most frequent questions about W-2 and 1099 arrangements.

Yes, you can simultaneously work as a W-2 employee at one company while performing 1099 contract work for other clients. This arrangement is legal and increasingly common in today's gig economy. You must maintain separate records for each income source and report both on your tax return. The W-2 job will withhold taxes automatically, while you'll need to make quarterly estimated tax payments on your 1099 income.

1099 contractors should set aside 25-30% of gross income for taxes. This covers self-employment tax (15.3% for Social Security and Medicare) plus federal income tax. Your exact percentage depends on your income level, tax bracket, state tax rates, and available deductions.

If you're a self-employed contractor, you may be at a higher risk of an IRS audit compared to traditional W-2 employees. According to Investopedia, the IRS audits less than 1% of individual tax returns each year, but certain red flags, such as being self-employed and claiming questionable business expenses, can increase the likelihood of an audit.

When comparing take-home pay between W-2 and 1099 status, you must look beyond hourly rates. W-2 employees receive benefits worth 25-30% of their salary, while 1099 contractors pay 15.3% in self-employment taxes but can claim business deductions. Calculate your specific situation by comparing total W-2 compensation (salary + benefits) against 1099 income after self-employment taxes and with eligible business deductions applied. The higher-paying option depends on your tax situation, available deductions, and benefits needs.

No, employers cannot simply choose worker classification based on preference. The IRS determines proper classification using specific criteria related to behavioral control, financial control, and relationship type. Misclassifying employees as contractors to avoid taxes and benefits can result in significant penalties for the employer, and the classification must reflect the actual working relationship.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax advice.

Related Guides

17 Tax Deductions for Freelancers and Small Business Owners

Accounting and TaxesThe Guide to Filing 2025 Self-Employment Taxes

Accounting and Taxes

2026 Tax Deadlines for Small Business Owners

Accounting and Taxes