Catching up on unfiled tax returns can be intimidating, but it’s always better to tackle them sooner rather than later. The complexity of the problem will only compound over time — as will any penalties and interest you might be subject to.

Let’s explore what happens if you have unfiled tax returns, what you should do to recover, and where to get help if you’re feeling overwhelmed.

If you fail to file your federal income tax returns on time, the Internal Revenue Service (IRS) follows a predictable series of steps. Here’s what you can expect to happen.

If you don’t submit your tax return by the due date—April 15 or October 15 with an extension—the IRS charges you two penalties based on the amount you owed on April 15, assuming you had a balance due:

Failure to File: This penalty equals 5% of your unpaid taxes for each month that your return is late, including partial months. After five months, the penalty caps out at 25% of the amount you owed.

Failure to Pay: This penalty is 0.5% of your unpaid taxes for each month or part of a month that your payment is late. After 50 months, it also caps out at 25% of the amount you owed.

When both penalties apply in the same month, the Failure to Pay penalty gets netted against the Failure to File penalty, directly reducing it from 5% to 4.5%. That results in a maximum combined penalty of 5% per month, or 47.5% over the maximum term.

For example, say you owed the IRS $5,000 on April 15, 2023, and filed your tax return seven months late, on November 15, 2023. Over the first five months, you’d accrue a combined penalty of 5% per month, totaling $1,250. For the last two months, you’d only accrue the Failure to Pay penalty, which would total $50.

The IRS also charges daily-compounded interest on your unpaid taxes, penalties, and interest charges until you pay your balance. For small business owners, the interest rate is generally the federal short-term rate plus 3%.

Fortunately, there is no penalty for filing taxes late if you are due for a refund. In that case, neither the Failure to File nor the Failure to Pay penalty would apply since both are dependent on you owing some amount on April 15.

Tip: If you can’t afford to pay your taxes, it’s still worth filing your return to avoid the Failure to File penalty, which is ten times higher than the Failure to Pay penalty.

If you’re owed a tax refund, failing to file your tax return delays your access to the funds. Also, if you don’t file within three years of the due date, you lose your right to the refund altogether. For example, if you’re owed a tax refund for the return due April 15, 2022, you have until April 15, 2025, to file your claim to it.

Having unfiled tax returns can also prevent you from getting refunds for other tax years. For example, if you file your 2023 return because you’re owed a refund but have an unfiled 2022 return, you may not get your 2023 refund.

If you don’t file your tax return, the IRS mails you notices asking you to correct the issue. Those eventually culminate in a Notice of Deficiency that includes a proposed tax assessment, or a proposed tax bill.

The assessment typically won’t account for the tax deductions, exemptions, and credits you’re eligible for, which the IRS hopes will encourage you to file your return.

If you still don’t respond, the IRS moves forward with an official Substitute for Return (SFR). The timeline varies, but you can expect them to reach this point between two and five years after your return’s due date.

If you still don’t file your return or pay your tax bill after the IRS files an SFR, the collection process begins. That can include wage garnishment, levies on your bank accounts, or a federal tax lien.

If you repeatedly neglect your tax returns, and the IRS determines that you’re willfully evading your taxes, you may be subject to criminal prosecution, which could result in additional fines and jail time.

The primary way your self-employment income gets reported to the Social Security Administration is through your annual tax returns. If you don’t file them, your earnings won’t contribute to your Social Security benefits, which will cost you in retirement.

Lenders often require you to provide previous tax returns when you apply for certain types of financing, including mortgages and business loans. If you haven’t filed yours, you may struggle to qualify for these types of credit accounts.

A statute of limitations is the maximum amount of time after an event that certain corrective actions can be taken. In addition to the statute of limitations on refunds discussed earlier, there are two types relevant to unfiled tax returns:

Assessment Statute Expiration Date (ASED): This is the day the IRS has until to assess–meaning establish or adjust–the amount of taxes you owe. If you file on time, it’s three years from the date your return was due, including extensions. If you file late, it’s three years after you submit your return.

Collection Statute Expiration Date (CSED): This is the date the IRS has until to collect taxes it’s assessed. It’s generally 10 years from the date of assessment, but you can have multiple CSEDs for one return. For example, you can have one for your original amount due and another for extra taxes discovered in an audit.

So what does that all mean for your unfiled tax returns? Typically, it means the IRS has unlimited time to determine how much you owe. Once it files a Substitute for Return and assesses a tax amount, the 10-year collection window starts.

Here are the steps you should take to resolve matters with the IRS if you have unfiled tax returns.

Catching up on unfiled tax returns can seem overwhelming if you don’t know where you stand. You might not know how much you owe, which notices have been sent your way, or what steps the IRS has taken to collect from you.

Taking stock of those things is the first step to getting back on track. Physical copies of IRS notices are easily lost, so start by visiting your IRS online account instead. You can find all your federal tax information there, including:

Digital copies of notices

Wage and income transcripts

Outstanding balances

Tax return filing statuses

It’s also beneficial to call the IRS, especially if you have multiple unfiled tax returns or are severely delinquent. Not only can you get personalized answers to your questions, but you can also request an abatement of your penalties and interest.

Tip: Some IRS representatives may be more or less helpful than others. If you’re not having success with one, consider hanging up and calling back.

Once you have the lay of the land, consider hiring a tax expert who can help you navigate the path back to compliance. A Certified Public Accountant (CPA) who specializes in tax matters can:

Provide insight from years of experience

Negotiate with the IRS on your behalf

Prepare and file your outstanding returns

The mental relief of having a trustworthy expert in your corner can also be invaluable, but do your due diligence before choosing one. Consider asking for referrals, reading online reviews, and taking a few free consultations to find a good fit.

If you can’t afford to pay for professional tax services, you may be eligible for free tax help through the Volunteer Income Tax Assistance (VITA) or the Tax Counseling for the Elderly (TCE) programs.

Whether or not you get a third party to help you, your next step is to start working through your unfiled returns.

Use the information you’ve gathered from your IRS account to report your income accurately, but don’t forget to check your own records, like bank and credit card statements, for any deductions and credits you can claim.

You can still prepare your returns with tax-filing software, but you’ll typically need to print out and mail a physical copy of the forms. The IRS only accepts e-filed tax returns until November.

Make sure you send your returns to the correct IRS location. You can check the addresses on the IRS notices you’ve received to determine where you should be sending each year’s tax return.

Tip: While the IRS would prefer that you catch up on all your unfiled tax returns, it may only take enforcement action on the last six years. Speak to an IRS representative to confirm your responsibilities.

Once you catch up on your unfiled tax returns, take steps to keep yourself in good standing with the IRS. Not only is it much easier than digging yourself out of trouble all over again, but the IRS is also less lenient with repeat offenders.

One of the best ways to avoid tax issues when you’re self-employed is to use Found. The platform includes features to simplify filing and automatically set aside a personalized percentage of each deposit to cover your tax bills — so you can be well-prepared for the next tax season. Found can also help you identify tax write-offs, ensuring that you don’t miss out on opportunities to save.

Open an account with Found today so you can stop worrying about taxes and focus on building your business.

There’s no penalty for filing taxes late if you are due a refund on the return’s original due date. However, you still must file your return to get your refund and avoid other complications, like reduced Social Security benefits and issues getting financing.

You must file your tax return within three years of its original due date to get a refund. For example, if your return was due April 15, 2022, you have until April 15, 2025, to file and get your money back.

You can go to jail for not filing taxes, but it’s generally reserved for those who willfully evade their responsibilities. That looks like intentionally hiding large amounts of income and repeatedly ignoring IRS resolution attempts.

There is no minimum amount you have to owe the IRS to go to jail. You could potentially owe the IRS huge sums of money and not go to jail as long as you’re working with them proactively to resolve the issue.

Check your IRS online account and speak with a representative to determine what’s required for you to get back in good standing. You may only need to file tax returns as far back as six years. Consider hiring a tax expert for help, like a CPA.

The information on this website is not intended to provide, and should not be relied on, for tax advice.

Related Guides

The Guide to Filing 2025 Self-Employment Taxes

Accounting and Taxes

Understanding the Schedule C Tax Form

Accounting and Taxes

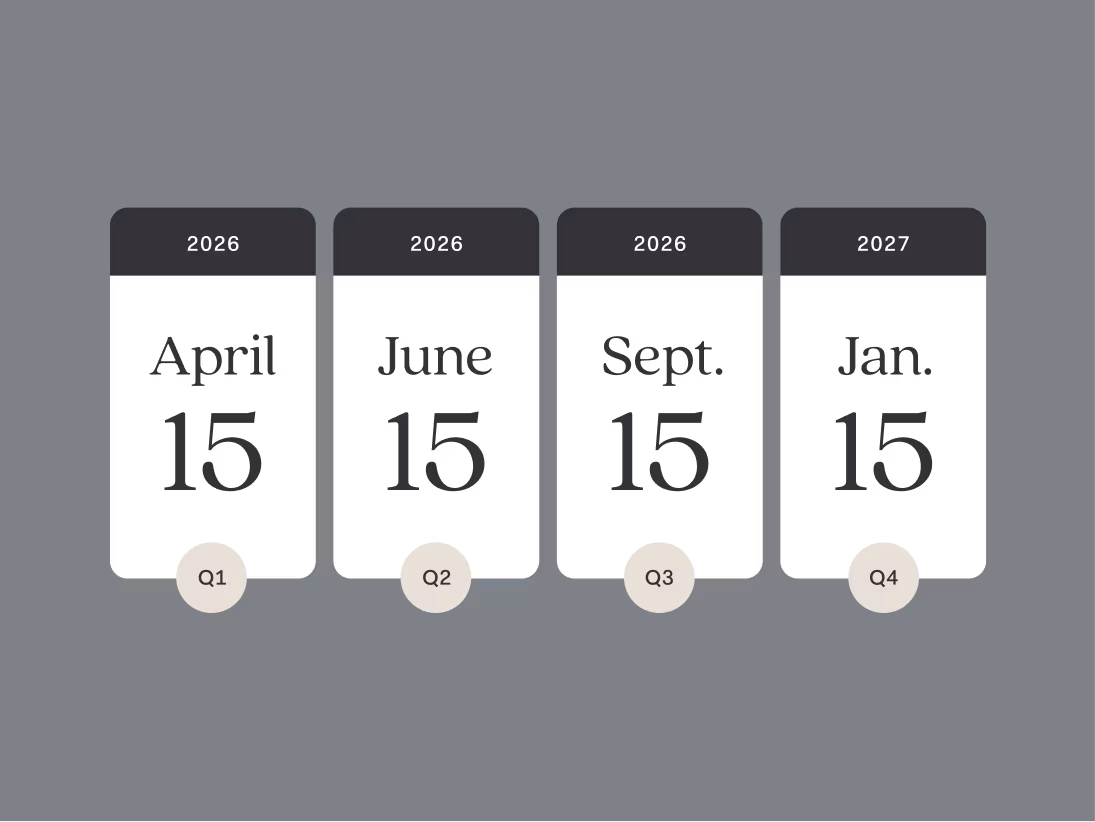

2026 Tax Deadlines for Small Business Owners

Accounting and Taxes