If you use Zelle to collect business payments from customers, you may wonder if Zelle reports them to the IRS. Headlines about the new $600 tax rule and reduced 1099-K thresholds have muddied the waters, making the question harder to answer.

Let’s clarify Zelle’s current tax reporting policies to make sure you understand how they work, what they mean for your annual tax responsibilities, and how to file your Zelle taxes correctly.

Unlike Venmo and other popular payment processors, Zelle doesn’t report your activities to the IRS. No matter how much business income you collect via the platform, it will never issue a 1099-K form for you.

So what does that mean? Let’s back up for a second and provide some context.

Third-party payment processors, aka payment networks, are digital platforms that help businesses and individuals transfer money back and forth. Some of the most well-known examples include PayPal, CashApp, and Stripe.

Businesses often use these platforms to collect customer payments for goods and services. Individuals typically use them to complete personal transactions with friends and family, such as splitting a dinner tab or sending a birthday gift.

Personal transactions don’t impact your taxes, but customer payments for goods or services constitute business income. Business income is always taxable, so you have to report it on your annual tax return.

Unsurprisingly, enforcing that requirement with nothing but the honor system isn’t very effective. In fact, according to the most recent IRS estimates, businesses underreported their gross income by a whopping $182 billion in 2021.

To encourage business owners to report earnings accurately, the IRS requires third-party payment processors to report significant taxpayer income. When your activities on such a platform exceed certain thresholds, it does so via Form 1099-K.

That requirement applies to Venmo, PayPal, Stripe, Square, and many more payment processors. However, Zelle is exempt due to a critical difference in how it facilitates payment transfers, which we’ll explore more in the next section.

1099-K reporting requirements only apply to third-party payment processors. Since that includes platforms like Venmo and PayPal, it’s easy to assume Zelle counts too, but that’s not actually the case.

Unlike other payment networks, Zelle never takes possession of its users' funds. Instead, it allows you to send money directly from your business bank account to your intended recipient’s account. The process is almost instantaneous.

In contrast, processors like CashApp and Stripe have built-in digital wallets that let you store funds on the platform. When you use them to collect customer payments, they take possession of your funds as an intermediary, however briefly.

As a result, collecting payments via third-party payment processors involves an additional step. Typically, you have to manually withdraw your funds from the platform and transfer them to your bank account.

Because it isn’t a third-party payment network, Zelle isn’t subject to tax reporting requirements and doesn’t have to issue 1099-K forms.

Form 1099-K is the tax form that third-party payment processors use to report your gross income. If you meet certain activity requirements on their platforms, they’ll send you and the IRS a copy.

In Box 1a, you’ll see the income you collected through the platform before accounting for anything else, including the platform’s fees and any refunds you issued.

Here’s what the form looks like:

As a taxpayer, you’re supposed to use your 1099-K forms to make sure you claim the correct amount of income on your tax return. Similarly, the IRS will compare your tax return to its copy of the 1099-K form to check your return’s accuracy.

If there’s a discrepancy between the two, it’ll know to investigate. Of course, the IRS is most concerned with you underreporting your business earnings, so the system is primarily to help the agency get its tax money.

For tax years 2023 and before, you should have gotten a 1099-K if you had at least $20,000 in gross annual income and completed more than 200 transactions on a third-party payment network.

However, the IRS recently decided those thresholds were too high. It eliminated the minimum transaction volume requirement and reduced the gross income threshold to $5,000 for tax year 2024. And starting in tax year 2025, the threshold will be just $600.

Since Zelle doesn’t report to the IRS, you might think you can avoid paying taxes on your business income by using the platform to collect customer payments.

Unfortunately, that’s not the case.

Whether you receive a 1099-K or not, you’re required to report all of your business income on your tax return. Purposely neglecting to claim your earnings can have significant consequences.

If the IRS discovers you're underreporting, you’ll have to pay what you owe plus penalties and interest charges. In the most severe cases, you can also be charged with tax evasion, a crime potentially punishable with jail time.

Personal Zelle payments from acquaintances, friends, and family are not taxable, but business payments from customers in exchange for goods or services constitute taxable business income.

Assuming you’re a sole proprietor, the default business structure for independent contractors, you’ll typically have to pay the following taxes on your net income:

Ordinary income taxes: This tax applies to almost every type of income and has a progressive tax rate that increases the more money you make. For example, in 2024, your first $11,600 is taxed at 10%, and the next $35,550 is taxed at 12%.

Self-employment taxes: This flat 15.3% tax is a combination of the 12.4% Social Security and 2.9% Medicare taxes that apply to W-2 wages. However, while employees and employers split them, with each party paying 7.65%, self-employed people have to cover everything.

Depending on where you live, you may be subject to additional state or local income taxes, but those vary significantly by location.

Zelle doesn’t report to the IRS, but that doesn’t excuse you from any of your tax responsibilities. Let’s explore the steps you should be taking to file your Zelle taxes as a self-employed person without a 1099-K.

If you collect business income during a tax year, you’re responsible for reporting the amount accurately on your tax return. With a typical third-party payment processor, you’d have a lot of help, but you’ll get much less assistance from Zelle.

Not only does the platform not send 1099-K forms, but it doesn’t provide many intuitive ways to organize your transaction history either. As a result, it’s especially important that you have your own bookkeeping systems in place when using Zelle to collect payments.

That primarily means having a separate business bank account you use to deposit your business revenue. That way, you can calculate your gross income by adding the deposits in your monthly bank statements.

Since you don’t have to pay any payment processing fees when collecting money through Zelle, that total should equal your gross business income.

The best way to pay less in Zelle taxes is to claim tax deductions. Also known as write-offs, they’re expenses the IRS lets you subtract from your business income, lowering your net earnings and indirectly reducing the taxes you owe.

To be tax-deductible, business expenses must be “ordinary and necessary.” That basically means they should be normal for businesses in your industry and clearly beneficial to your operation.

For example, some common tax deductions for freelancers include:

Office supplies

Office rent and utilities

Professional service fees

Direct labor and raw materials

Business travel costs

Business vehicle expenses

Interest on business financing

Make sure you keep track of business expenses like these throughout the year so you can claim them on your tax return. Once again, the best way to stay organized is to pay for all these costs with a separate account, such as a business credit card.

As your business becomes more complicated, it can be worth hiring a bookkeeper to maintain your financial records for you. Fortunately, any fees you pay them are tax-deductible professional services

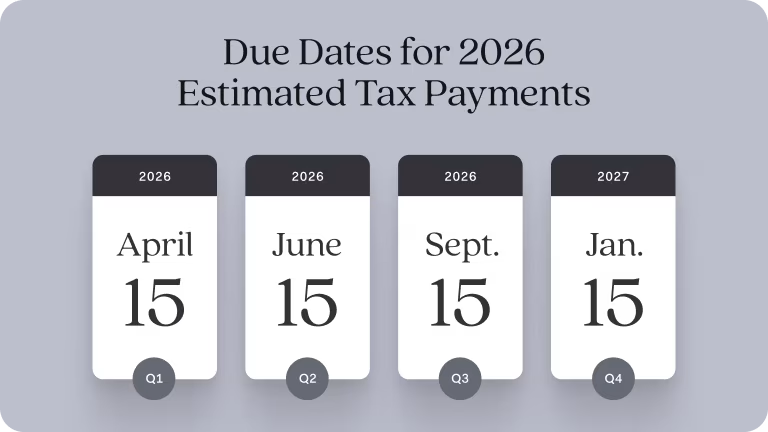

Because self-employed people don’t have bosses to withhold taxes from their earnings, they have to make estimated tax payments instead. They’re due roughly every quarter and go toward your income and self-employment taxes.

Aim to pay 25% of what you expect to owe for the year on or before each of the following due dates:

April 15

June 15

September 15

January 15 (of the following year)

It can be tricky to predict your future taxes but don’t worry. You’ll be safe from penalties as long as your tax payments cover 90% of the taxes you owe or 100% of the taxes you owed in the previous year.

Finally, you need to file a tax return for yourself and your business by April 15. You can file an extension to push the due date back six months, making the deadline October 15, but that won’t give you more time to pay - only to file your return.

Whenever you file, assuming you’re a sole proprietor, use Schedule C to report your business income and claim your tax deductions. E-file it alongside its supporting schedules (Schedules 1, 2, and SE) and Form 1040, the individual tax return.

Alternatively, you can hire a Certified Public Accountant to complete the process. They’ll be able to handle the most time-consuming aspects and minimize the taxes you owe. Plus, like a bookkeeper, any fees you pay them are likely tax deductible.

Using Zelle With Found

Zelle can be a fantastic way to collect payments from customers. Not only does the platform not charge any fees, but transfers are almost instantaneous. Unfortunately, it makes for an incomplete billing and bookkeeping system by itself.

To make up for what Zelle lacks, you need a separate business bank account, and one of the best options is to use Found. Our platform has unique, powerful features designed to make life as a self-employed person easy.

For example, Found gives you the ability to:

Create and customize unlimited professional invoices

Automatically track your business income and tax deductions

Transfer financial data directly to your tax forms, including auto-generating a Schedule C if you’re a sole proprietor

Sign up for Found today to streamline your financial functions so you can focus on growing your business.

Zelle doesn’t report to the IRS for business or personal use of its platform. Technically, it doesn’t count as a third-party payment network, so the usual reporting requirements don’t apply to it.

In addition, personal transactions on a third-party payment network are never taxable. Platforms like Stripe, CashApp, and Venmo won’t report them either.

Because it’s exempt from IRS reporting requirements, Zelle won’t send you a 1099-K form. If you need to know how much business income you collected on the platform, review its unofficial records of your transaction history.

Alternatively, you can look at your business bank account statements. Since Zelle doesn’t charge platform fees, your deposits should equal your gross business income.

Even though Zelle doesn’t report to the IRS, you still have to pay taxes on the business income you collect through the platform. Assuming you’re a sole proprietor, you'll typically be subject to ordinary income and self-employment taxes.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax advice.

Related Guides

Form 1099-K: A Guide for Small Business Owners

Accounting and TaxesIntroducing Pockets: The Smarter Way to Manage Your Freelance Finances

Business Banking

6 Tax Mistakes Small Business Owners Make

Accounting and Taxes