The Great Resignation led to a surge of people striking out on their own as freelancers, contractors, and small business owners. As part of this new generation of self-employed workers, you can likely take advantage of one of the most significant tax write-offs available: the home office tax deduction.

In a year when so many people work from home, the home office deduction will inevitably be on the minds of self-employed people. Luckily, if you’re self-employed and using a portion of your home for work, there’s a very good chance that you’re eligible to deduct a portion of your home expenses as a business expense by taking advantage of this deduction.

Below, we’ll go through the eligibility requirements for this deduction, how to calculate your deduction, and some tips and tricks to remember when preparing to claim this deduction on your tax return.

When you’re self-employed, you can (and you should) deduct your business-related expenses on your tax return. Why? Deducting these business expenses allow you to lower your business profit, the amount of business income you’re taxed on. The more you deduct, the lower your business profit and your tax bill.

If you’re self-employed and use a portion of your home to conduct business, you can likely deduct a portion of the cost of maintaining your home. What does this mean? A percentage of your home expenses—such as rent or mortgage payments, utilities, maintenance, and homeowner’s insurance—could be deductible on your Schedule C tax form as a business expense.

Any home can qualify you for this deduction; in this case, "home" can apply to houses, apartments, condos, mobile homes, and even houseboats. If the location provides "basic living accommodations," it likely counts! This could be a spare bedroom, a corner of the living room, the basement - you name it! A separate building on your property, like a garage or studio, could qualify for this deduction, assuming you use it for business purposes.

The key is that you use the space regularly for work and don't use it for other purposes like hanging out with your family. It doesn't need to have walls or a door closing it off. You should be good to go if you can show that you treat it as your primary work area.

When claiming the home office tax deduction, the IRS allows you to deduct both "direct" and "indirect" expenses. What's the difference?

Indirect home expenses are costs for the entire home, not just the office space. You can likely deduct a percentage of the following indirect expenses:

Rent/Mortgage Interest: If you rent your home, you can deduct a percentage of your rent based on the square footage of your office space compared to the total square footage of your home. If you own your home, you can deduct a percentage of your mortgage interest and property taxes.

Utilities: You can deduct a percentage of utilities like electricity, gas, trash pickup, etc.

Home Insurance: A percentage of your home or renter's insurance can be deducted.

Repairs and Maintenance: Expenses for office space are deductible for painting, repairs, and maintenance.

Depreciation: You can depreciate the value of your office over time. Computers, equipment, and furniture used for your business may qualify.

It's important to remember that you can only deduct the total cost of most of these items if they are purchases specifically for the office, like the direct home office expenses below. To determine the deductible percentage using the Regular Method, you calculate the square footage of the home office space divided by the total square footage of your home. You can also use the Simplified Method. Keep reading for more details on each method.

These expenses are specifically for the home office space itself. Typically, you can deduct the entire cost of the following direct expenses:

Painting or renovations done to the office area

Office furniture purchases

New computer and equipment for the office

Repairs done specifically to the office space

Direct expenses are often fully deductible, while indirect expenses must be prorated based on the space. If you need help determining direct vs. indirect expenses, consider hiring a CPA to help.

If you're a self-employed individual who wants to claim the home office tax deduction, it's essential to understand the eligibility requirements. This deduction can help you save on your self-employment taxes, but you do need to meet specific criteria to qualify:

To claim the home office deduction, you must be self-employed. This deduction isn't available for traditional W-2 employees, even if your employer offers remote work. In the past, W-2 employees working from home could deduct home office expenses, but the Tax Cuts and Jobs Act of 2017 removed this option.

You can only deduct the expenses of a property you own or rent. You can't claim this deduction if you're living with a friend or family member but aren't responsible for the property's upkeep and costs.

If you conduct business in multiple locations, that's okay. However, to qualify for the home office deduction, your home office must be your primary place of business. For example, if you primarily operate a food truck but occasionally use your spare bedroom for work, the spare bedroom won't count as your "principal place of business."

This final requirement is non-negotiable to the IRS—for a home office to qualify you for the deduction, your home office must meet two crucial criteria:

Regular Use: Your home office space should be used for work regularly, meaning it should serve as your workspace for a significant portion of the year.

Exclusive Use: Your home office must be used exclusively for work-related purposes. This means the designated area in your home should be used for work and nothing else. If you use it for personal activities or other non-business purposes, it won't meet the IRS's "exclusive use" requirement.

If you use a spare bedroom both as an office and a playroom for your kids, it doesn't satisfy the "exclusive use" requirement.

Source: IRS Publication 587

Determining the amount you can deduct for your home office tax deduction involves two distinct methods: the "Regular Method" and the "Simplified Method." Let's explore each option:

The Regular Method lets you deduct a percentage of your home expenses based on the size of your office space. Here's how it works:

Measure the total square footage of your home office space. Your dedicated home office is 200 square feet.

Calculate the total square footage of your entire home. For example, your home is 1,000 square feet total.

Divide the home office square footage by the total home square footage. In this case, the percentage of your home used as a home office would be 20%.

What does that mean? You’d then deduct 20% of your indirect home expenses—which means 20% of your utilities, mortgage payments, insurance, etc. This deduction can really add up.

There's one catch to the home office deduction: Your deduction can't exceed your business' gross income. You're in the clear if your gross income exceeds your home office expenses. You can deduct all of your allowable home office expenses.

What if your total home office expenses exceed your annual gross business income? You must limit your deduction. Here’s how the IRS asks you to calculate your allowable deduction:

Calculate your gross annual business income. This is the maximum you can deduct.

Subtract expenses you could deduct without a home office, like mortgage interest.

Subtract any direct home office expenses. Remember, these are the expenses that aren't related to the general upkeep of your entire home but rather the costs that relate only to your home office (such as a separate phone line, office supplies, etc.)

The remainder is the limit for your home office deduction. This prevents your deduction from exceeding gross income, per IRS rules.

This deduction method is a bit, well, simpler. Here's how it works:

Measure the total square footage of your home office space. Let's say it's that same 200-square-foot spare bedroom from before.

Take that square footage and multiply it by $5. That's your deduction. In this case, $5 x 200 square feet equals a $1,000 deduction.

The Simplified Method takes out all the complicated calculating and allocating that the Regular Method requires. It’s worth nothing the IRS does have a cap for the Simplified Method. The maximum size for this option is 300 square feet and a maximum deduction of $1,500. If your home office is 300 square feet or less, consider using the Simplified Method.

Now that you know the difference between the Regular and Simplified Method, you're probably wondering which you should choose. The Regular Method often takes more work but could result in a larger deduction. Meanwhile, the Simplified Method, while simpler, may mean a smaller deduction. Here are some tips for how to decide:

Calculate both methods for your first year to see which gives you a more significant tax break.

Consider if the extra time for the Regular Method is worth the potential extra savings. The Simplified Method is much quicker.

Think about your home office space: If your home office is a large percentage of your home, the Regular Method will likely be better. The Simplified Method might make more sense if it's just a small office space.

Go with the method that maximizes your deduction while balancing your time. You can always switch methods year-to-year as your situation changes.

If you still have questions about which method makes the most sense, consider asking a Certified Public Accountant to walk you through the pros and cons of each.

If you use the Regular Method by deducting a portion of all of your home expenses, you'll want to keep the same kinds of records for your home office expenses as you do for any other business expenses, noting the date, amount, merchant, and business purpose of any expense will help you keep an accurate tally of your deduction, and will help protect you during an audit.

The home office deduction offers significant tax savings for the self-employed. Still, knowing the eligibility rules and choosing the best calculation method for your office set-up is essential. Using a service like Found to track expenses can make tax time a breeze, especially to help track your business expenses.

If you use Found as your business bank account, you can track your home expenses in your Found account so that your tax bill is consistently up-to-date. Sign up today.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax advice.

Related Guides

A Small Business Owner’s Guide to Quarterly Taxes

Accounting and TaxesThe Guide to Filing 2025 Self-Employment Taxes

Accounting and Taxes

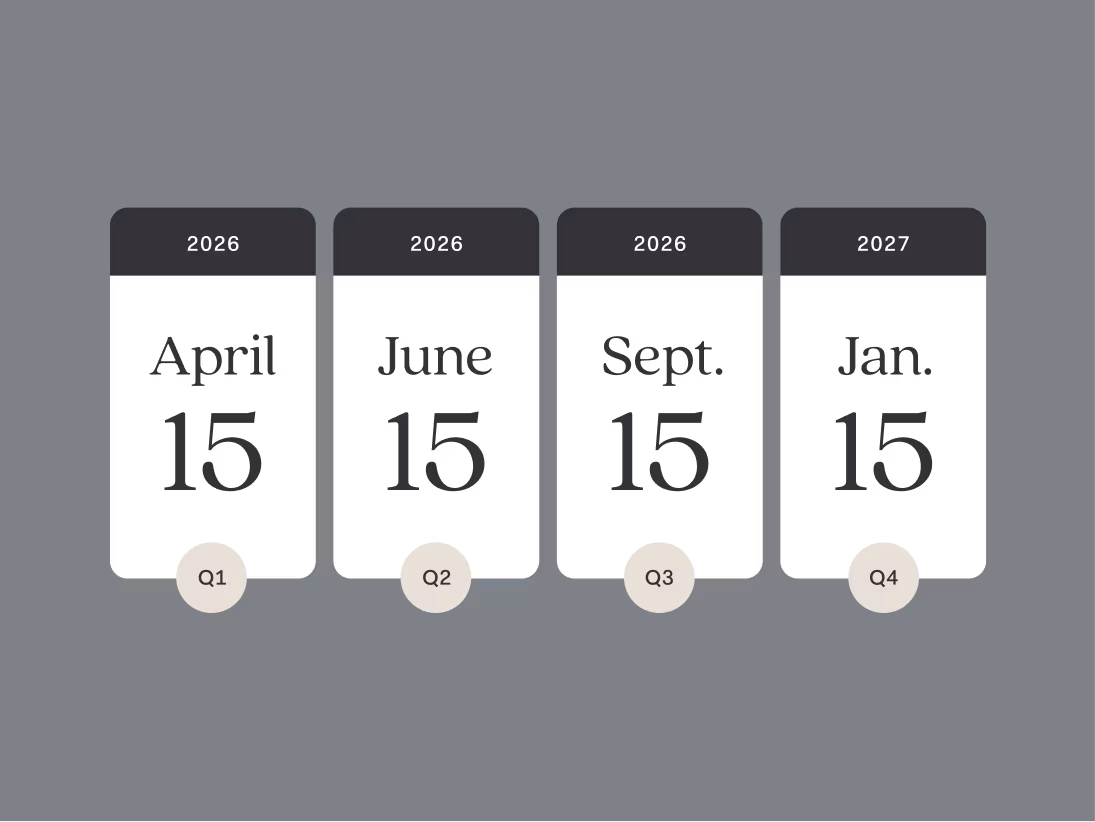

2026 Tax Deadlines for Small Business Owners

Accounting and Taxes