Small business quarterly taxes are a common challenge for the self-employed. In 2023, the IRS collected $7 billion in penalties from small business owners who missed or underpaid their quarterly taxes. That's 14 million business owners who got hit with avoidable fees.*

You don't have to be one of them.

When you’re a W-2 employee and work for someone else, your employer takes taxes out of every paycheck and sends them to the IRS. Easy. When you work for yourself, that job falls to you.

Quarterly taxes are your way of paying the government throughout the year instead of getting slammed with a massive bill in April. Think of them as your self-imposed payroll deduction.

The rules are straightforward, but the scenarios can get tricky. Here's how to know if quarterly taxes might apply to you:

You're on the hook if:

Your side hustle or business will generate more than about $3,000 in profit

You're freelancing, consulting, or running any kind of solo operation

You get 1099s instead of W-2s

You might catch a break if:

You also have a day job with tax withholding

Your spouse's job withholds enough to cover both of you

Your business barely breaks even

Scenario 1: Your business only made enough profit to trigger $600 in taxes—you likely wouldn't be required to pay quarterly; you could pay the entire $600 when you file your tax return.

Scenario 2: You made $15,000 from a part-time W-2 job and $10,000 from freelance writing, owing $5,000 total in taxes. If $4,100 was withheld from your W-2 paychecks, you'd only owe an additional $900 on your own. Since this is below $1,000, you likely wouldn't need to pay quarterly.

Stop overthinking this. Here's your basic formula:

Estimate your total business income for the year

Subtract your business expenses

Calculate your income tax on what's left

Add 15.3% for self-employment tax (Social Security and Medicare)

Divide by four

Let's walk through a real example. Say you run a freelance marketing business:

Your business brings in $60,000 for the year, but you spend $15,000 on expenses (computer, software, home office, etc.). That leaves you with $45,000 in taxable income.

On that $45,000, you'll owe:

$5,000 in regular income tax

$6,358 in self-employment tax (Social Security + Medicare)

$11,358 total for the year

Divide that by four quarters: $2,840 per payment.

So instead of scrambling to find $11,358 in April, you make four manageable payments of $2,840 throughout the year.

Note: This example assumes you're single and filing as a sole proprietor—your actual numbers will vary based on your filing status, deductions, and tax bracket.

Math not your strong suit? That’s okay. You don't need to crunch these numbers by hand. Here are a few tools you can use:

Found App: When you use Found as your business bank account, you’ll see an updated tax estimate each time money moves in and out of your account. No guessing, no spreadsheets.

IRS Tax Withholding Estimator: A Free government tool that walks you through the calculation step-by-step. You'll need last year's tax return and a realistic income estimate, but it spits out exactly how much you should pay each quarter to avoid penalties.

Form 1040-ES: The old-school paper method will take you a bit longer, but if you prefer the paper method, you can use this form.

Don’t make the mistake of waiting until tax season to think about quarterly payments. By then, you may be staring at a massive bill that could have been spread across four manageable chunks.

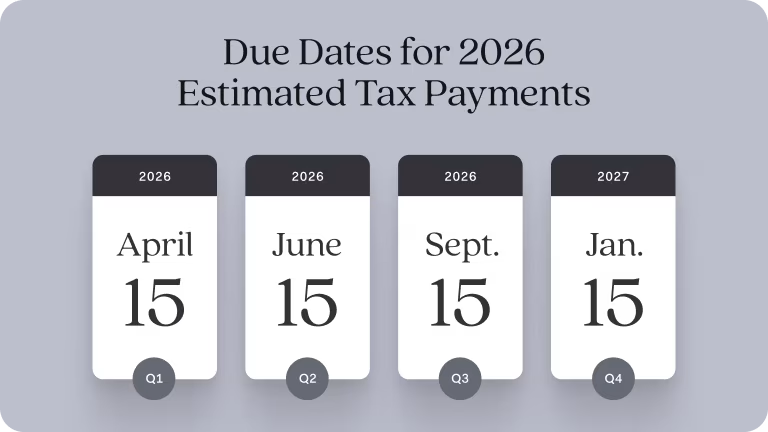

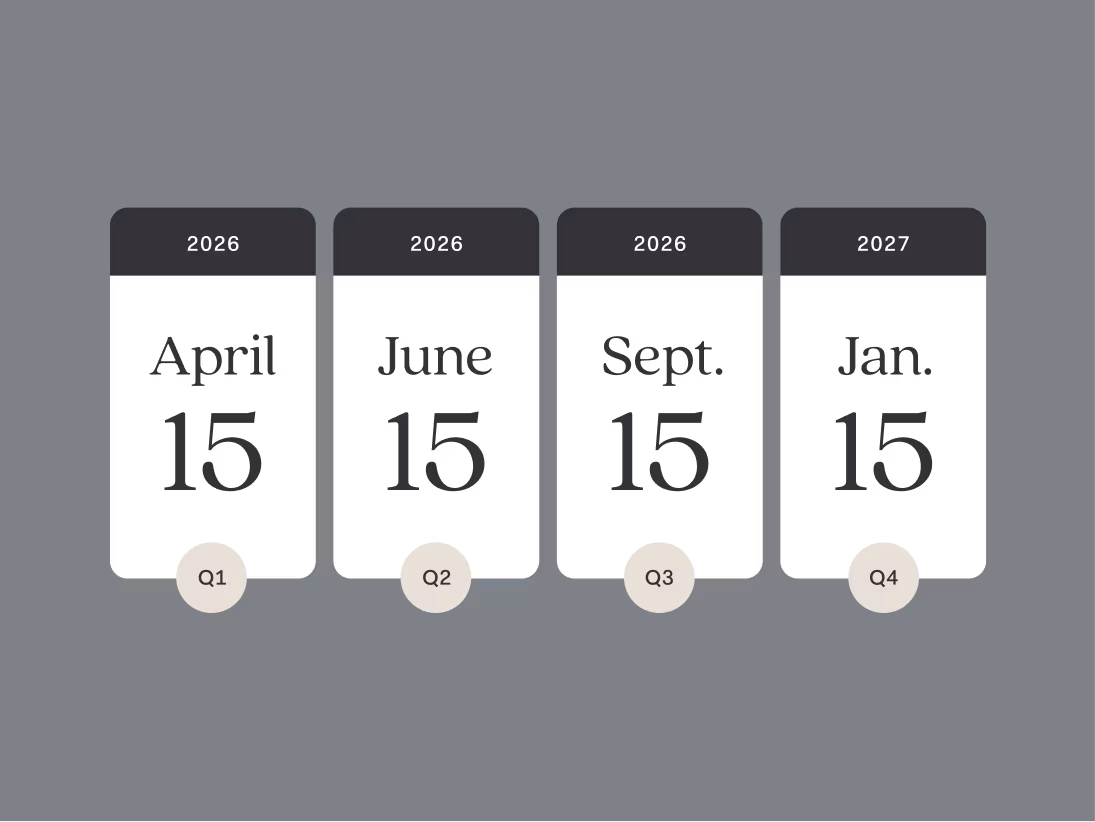

You’re required to make quarterly tax payments four times per year, but not exactly every three months. Here are the actual due dates:

April 15: Covers January through March

June 15: Covers April and May

September 15: Covers June through August

January 15: Covers September through December

If these dates fall on a weekend or a holiday, the due date is the next business day. It’s a good idea to mark those tax deadlines in your calendar to avoid missing a payment or forgetting to save for one.

While you can still technically pay your small business quarterly taxes by mail, the IRS is doing its best to go paperless. Electronic methods are much more efficient anyway and significantly reduce processing times.

Here are some of the best electronic options for paying your estimates:

Found app: If you’re a Found Plus or Found Pro subscriber and file a Schedule C, you can make in-app quarterly federal tax payments.⁴

IRS Direct Pay: Direct Pay is a secure service on the IRS website. It allows you to pay directly from your bank account without any fees. You simply enter your tax information, verify your identity, and authorize the transaction.

IRS2Go mobile app: If you have IRS2Go on your mobile device, you can make estimated quarterly tax payments that way too. You can use your bank account or pay with a credit card or debit card. Just be mindful of the 2% processing fee.

Electronic Federal Tax Payment System (EFTPS): This government-run system offers high security for your tax payments. You have to enroll in EFTPS, after which you can schedule and make payments online or by phone.

You can still mail a check, but you should expect longer processing times and no immediate confirmation, which can be scary when you’ve just written a large check.

You’re not limited to one estimated payment per quarter. You can make as many payments as you need to pay in the necessary amounts before the due date.

Nervous about nailing the math? Here’s some good news: You don't have to have a perfect estimate. The IRS gives you wiggle room with "safe harbor" protection.

In other words, you don’t have to pay exactly what you owe to satisfy the IRS. You just need to pass one of the following tests:

Pay 90% of what you actually owe this year

Pay 100% of what you owed last year

Let's say you owed $8,000 last year. Pay at least $8,000 in quarterly payments this year, and you're safe, even if you end up owing $10,000. You'll pay the difference at tax time, but no penalties.

Since you can find your previous year’s tax liability on your tax return, you can always use it as your benchmark to avoid penalties. If you’re still worried, consider hiring a Certified Public Accountant to calculate your estimated taxes and help you make your quarterly payments.

The magic number: 30%

Every time money hits your business account, move 30% to a separate tax account. This covers federal income tax, self-employment tax, and state taxes (if applicable).

Here's why 30% works: As a self-employed person, you're paying the full 15.3% for Social Security and Medicare (versus 7.65% as an employee), plus federal income tax rates that can range from 10-37%, plus potential state taxes. When you add it all up, 30% typically gives you the buffer you need.

Set up a separate savings account for taxes only, then transfer 30% of every payment immediately when it hits your business account. Don't wait until the end of the week or month—do it the same day so you don’t even miss it.

Found's auto-save feature sets aside money for taxes every time you get paid. With every new income or expense, Found updates your tax estimate in real time. That way, you'll know what to expect when your quarterly estimated payments are due and you’ll have the money to make the payment. A true win-win!

Miss a payment? The penalty clock starts ticking immediately, and the IRS may charge you a penalty. It’s based on the amount you underpaid and the period of the underpayment (how many days it lasted and when it occurred).

But remember those safe harbor rules. Even if you miss early payments, you can still avoid penalties by hitting your annual target.

Take a deep breath. Before you panic, it’s time to figure out why you missed the payment. Your next steps depend on the reason.

If you didn't know your payment was due:

Make your missed payment immediately to minimize penalties

Set up calendar reminders for all remaining quarterly dates

Consider signing up for Found Plus for Found Pro⁴ to streamline future federal tax payments

If you didn't have the money:

This is a cash flow red flag that needs immediate attention. Here’s what to do:

Review your business expenses and pricing to ensure you're profitable enough to cover taxes

Set up automatic transfers to save 30% of every payment before you spend it

Consider making partial payments rather than skipping entirely—something is better than nothing

Don't skip future payments to "catch up"—make your remaining payments on time and consider increasing them to hit safe harbor. If your cash flow is consistently tight, you may need to consider raising your rates or cutting expenses. Missing one payment isn't the end of the world, but missing multiple payments because you're not saving properly signals bigger business problems that need fixing.

Your federal quarterly payments are just half the story. Most states want their cut too, and they don't always have the same rules. Here are a few ways state tax payments can get tricky:

Payment thresholds vary wildly—some states want money even when the federal government doesn't

Due dates might not match federal deadlines

Penalty structures can be harsher than federal consequences

Some states offer monthly payment options instead of quarterly

Some states link their requirements to your federal obligations. Owe federal taxes? You probably owe state taxes, too. But other states set their own minimum thresholds, often lower than the federal $1,000 mark. Most states follow federal due dates, but exceptions exist, so pay attention to due dates, too.

When you calculate federal estimated payments, pull up your state requirements at the same time. State penalty notices arrive faster than you'd expect, and you often have fewer options to negotiate payment terms than you do with federal taxes.

Quarterly taxes aren't punishment for being self-employed—they're your way of avoiding nasty surprises and making tax season way less scary. Making quarterly payments means you won't get hit with a massive bill in April, and paying in smaller chunks throughout the year is so much easier to handle.

Found’s all-in-one business banking solution can streamline this process for you. As soon as you create your account, you'll see a dedicated "pocket" just for quarterly estimated taxes. The app automatically sets aside a percentage of your income with every payment you receive, updating your tax estimate in real time.

No more guessing what you owe or staying up late with a calculator. Found's tools automate your tax savings, so you can focus on growing your business instead of worrying about deadlines.

If you anticipate owing more than $1,000 in taxes for the year and your tax isn't being withheld by an employer, it's time to look at quarterly taxes. This includes business entities like sole proprietors, partners, and S corporation shareholders. Remember, staying ahead of your tax obligations helps avoid unexpected year-end tax bills and penalties.

If you expect to owe at least $1,000 to the IRS, you generally have to pay quarterly taxes, even in your first year of self-employment. Doing so is beneficial anyway to help prevent you from facing an unaffordably large tax bill at the end of the year.

To avoid underpayment penalties, make sure your combined withholdings and estimated taxes cover at least 90% of your current year’s tax liability or 100% of the previous year’s.

If you pay estimated taxes late, you may trigger a penalty that accrues daily at an IRS-determined rate until you pay off your balance. It’s best to make on-time payments to avoid any penalties.

The safe harbor estimated tax rules state that you’re safe from underpayment penalties if your estimated payments and tax withholding equal at least one of the following:

90% of the taxes you owe for the current year

100% of the taxes you owed the previous year

However, that doesn’t necessarily mean you’re safe from late payment penalties. For example, if you owe $10,000 and pay $9,000 just before the third estimated tax payment, you reach the underpayment safe harbor, but you may still owe penalties for missing the first two estimated payments.

The information on this website is not intended to provide, and should not be relied on, for tax advice.

Related Guides

2026 Tax Deadlines for Small Business Owners

Accounting and Taxes

How To Calculate Taxable Income When You’re a Small Business Owner

Accounting and Taxes

6 Tax Mistakes Small Business Owners Make

Accounting and Taxes