Cash App was created in 2013 to help Square, its parent company, compete with apps like Venmo and Paypal. It’s now one of the most popular peer-to-peer payment platforms in the world, reaching a whopping 57 million users by the end of 2024.

Though originally designed to help friends and family send money back and forth, many people also use the platform to complete commercial transactions, especially since the official launch of Cash App for Business.

If you use the platform for personal or business reasons, this guide to Cash App taxes will help you understand what that means for your annual tax responsibilities.

There are two types of transactions on Cash App. First, there are personal ones, which the site was created to facilitate. They involve the transfer of money for non-commercial reasons, often between friends and family.

For example, that includes:

Sending your significant other money for groceries

Paying your friend back for a shared dinner they bought

Getting your roommate's payment for their half of the rent

When you receive money in these situations, the payments aren’t income or taxable. You don’t have to report them on your tax returns. The only exception is when you sell a personal item, like an old couch or phone, for more than it costs you.

In that case, your profit would be subject to capital gain taxes. However, that’s unusual since personal items tend to lose value over time.

In addition to personal payments, Cash App can support business transactions. That refers to any transfer of money in exchange for goods and services. Some potential examples include:

Paying for your food at a local fast-food restaurant

Charging someone for the cleaning services you provide them

Collecting payment from a customer for your homemade jewelry

When you’re the recipient in these transactions, any payments you get are considered income. You’re required to report the total to the Internal Revenue Service (IRS), which will generally be taxable.

Cash App’s terms of service forbid you from collecting business payments through personal accounts. To accept payment for goods or services, you’re supposed to sign up for a Cash App for Business account. If you collect business income through a personal account, whether on purpose or accidentally, report it on your taxes anyway.

When you collect payments for goods or services on Cash App, they’re subject to ordinary income taxes. That’s the tax that applies to virtually all earnings, including your paycheck. Federal brackets range from 10% to 37%, while state rates vary.

Assuming you’re a sole proprietor and your Cash App activities constitute a business, not a hobby, you'll also be subject to self-employment taxes. It’s a flat 15.3% tax containing the 12.4% Social Security and 2.9% Medicare taxes.

To report your Cash App business income, you need to keep track of the amounts you earn. Fortunately, Cash App does most of the work for you. Every January, it should send you a breakdown of all your transactions from the previous year as a CSV file.

If you don’t get one, you can download a copy through the mobile app. Go to Documents → Business Accounts Taxes → Desired Year → Transactions CSV. Alternatively, you can refer to your monthly account statements.

In addition, you should receive a Form 1099-K if you meet certain activity requirements on Cash App. It’s an official tax document that states your gross income for the year. Use it alongside your other tax documents and records to complete your tax return.

Did you know? If you use Found, you can consolidate your financials all in one place by importing your transactions via CSV.

Form 1099-K is the primary tool platforms like Cash App use to report taxable income to you (the taxpayer) and the IRS. The law requires that they send a copy to both parties when your activities exceed certain thresholds.

For tax year 2024, you’ll get one from Cash App if you earned at least $5,000 in business income on the platform.

Previously, the IRS wanted 2023 to be the first year it used a threshold of just $600. However, they phased the rollout after seeing pushback from taxpayers and tax experts. They plan to phase in the $600 threshold over the next couple of years.

For tax year 2025, you’ll receive a 1099-K form when you exceed $2,500 in gross business receipts on a platform. Then, the $600 threshold will take effect in 2026 and apply to all subsequent tax years.

To clarify, Cash App classifies transactions solely on the type of account used to process them. As a result, all activity in a Cash App for Business account goes toward your 1099-K threshold, but nothing in a personal account contributes.

If you qualify for a Form 1099-K, Cash App must send it to you by January 31. By default, it will give you an electronic copy, which you can download from the Documents tab in the mobile app or website.

Whenever you collect business income through Cash App, it's taxable. It doesn’t matter how little you earn or whether the platform sends you a Form 1099-K. You’re always required to report the amount on your return.

Generally, the only way to avoid Cash App taxes is to lower your taxable income by claiming tax deductions. Also known as “write-offs,” they’re business expenses that you can subtract from your business income, indirectly reducing the taxes you owe.

These expenses must be “ordinary and necessary” to be deductible, which is essentially the IRS reasonableness test. “Ordinary” means common for businesses like yours, and “necessary” means beneficial - not strictly essential.

Since you can use the platform to collect payment for any business model, there are no Cash App-specific write-offs outside its fees. That said, here are some typical deductions for freelancers in general:

Office supplies

Marketing expenses

Professional services

Office rent and utilities

Business portion of vehicle expenses

Business portion of phone and internet costs

Labor and materials necessary to make a product

If you need help determining what you can take as a tax deduction, consider hiring a Certified Public Accountant or other tax expert. They’ll be able to minimize your taxes while complying with tax laws, and any fees you pay them are also tax-deductible.

When you sign up for a personal Cash App account, you agree to use it only for non-commercial purposes. If the platform’s algorithm determines you’re breaking that rule, Cash App could lock your account, blocking access to any money within it.

As a result, you should always open a Cash App for Business account if you want to collect payment for goods or services on the platform, despite the fees. In addition to preventing compliance issues, doing so should simplify your bookkeeping.

Having separate personal and business Cash App accounts saves you from sorting through your activities to determine what’s what. Incidentally, you should have a separate business bank account for the same reason.

Collecting business income on Cash App makes you self-employed, so you don’t have a boss to withhold taxes from your earnings. As a result, you must make quarterly tax payments if you expect to owe at least $1,000 in taxes for the year.

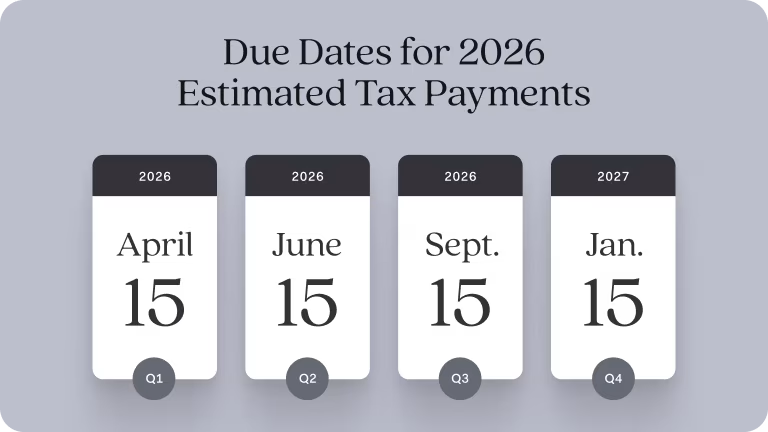

To avoid late payment penalties, pay 25% of the amount you expect to owe by the following deadlines:

April 15

June 15

September 15

January 15 of the following year

Fortunately, the IRS knows it can be tricky to estimate your taxes accurately. It won’t charge you underpayment penalties as long as your payments equal 90% of the taxes you owe for the current year or 100% of what you owed the previous year.

As a sole proprietor, the default legal structure for self-employed people, you typically report your business income and expenses on Schedule C. You’ll need to fill out a few supporting forms too, like Schedules 1, 2, and SE.

Once they’re complete, file them electronically alongside Form 1040, the IRS term for the individual tax return. To avoid late filing penalties, which are the steepest of all, submit your return by April 15.

Alternatively, you can file an extension for an extra six months, pushing the filing due date to October 15. However, that doesn’t give you additional time to pay your taxes for the current or subsequent tax years.

If you’re afraid of messing up your Cash App taxes or simply prefer not to do the work yourself, it’s often a good idea to let a CPA handle the filing process for you. They’ll be able to minimize your taxes without breaking any laws, and their fees are deductible.

Cash App for Business can be a convenient way to collect payments for your goods and services, especially if you’re familiar with the platform and use it personally. However, it doesn’t have the most robust supporting systems.

One of the best ways to make up for what it lacks is to combine your Cash App account with Found, a business bank account specifically designed for the self-employed. It has a host of automation features that can streamline processes like:

Tracking your business income and categorizing deductions

Setting aside money for estimated tax payments

Creating and customizing unlimited professional invoices

Fortunately, you can get started for free! Sign up for Found today and let our platform take care of the busy work so you can focus on growing your business.

The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

Cash App must report your income to the IRS if your activities on the platform exceed a certain threshold. For tax year 2024, that meant having at least $5,000 in gross business income.

The only requirement in 2025 will be to have $2,500 in business income. For 2026 and subsequent tax years, it will drop to just $600 in business income.

Payments you collect on Cash App only count as income if you received them in exchange for goods or services. In contrast, personal payments between friends and family don’t count, and you don’t have to report them on your taxes.

Some examples of non-taxable personal transactions would be collecting your roommate’s half of the rent or getting reimbursed for buying them dinner.

Generally, Cash App doesn’t send 1099 forms for personal accounts. You’re required to use personal accounts for non-commercial purposes only, so it assumes that any payments you receive are for personal reasons, not goods or services.

That said, Cash App algorithm reviews your activities automatically and may flag transactions that look like business dealings. It may lock your account if it catches you trying to avoid the platform’s fees.

Business income you collect through Cash App is subject to federal and state taxes, but the platform doesn’t take the taxes from you. Instead, you’re responsible for making quarterly estimated tax payments to cover the amount you owe.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax advice.

Related Guides

6 Tax Mistakes Small Business Owners Make

Accounting and Taxes

Form 1099-K: A Guide for Small Business Owners

Accounting and Taxes

How to File Your Venmo Taxes

Accounting and Taxes