PayPal is one of the pioneers of its industry and is largely responsible for popularizing the concept of digital payment platforms. It’s now one of the largest networks of its kind, with 434 million active accounts in 2024.

Most are personal accounts used for transferring money between friends and family, which shouldn't affect your taxes. However, business accounts used for commercial transactions will, especially if you get a 1099-K form.

If you have an account on the platform, here’s what you should know about PayPal taxes and Form 1099-K, including how they both work, how to avoid them, and how to manage them when you can’t.

Whether you have to pay taxes on funds you collect through PayPal depends on the transaction type, of which there are two. First, there are personal ones, which involve the non-commercial transfer of funds between people who know each other.

Understanding when PayPal transactions are taxable can save you significant headaches come tax season. Let's break down what you usually need to report and what you don't. PayPal transactions typically fall into two categories that determine their tax status:

These are non-commercial transfers between people who know each other. Money received from friends and family as gifts or repayments for personal expenses should not be reported on a Form 1099-K.

For example:

Splitting the check when your friend covers dinner

Collecting your roommate's share of monthly utilities

Receiving birthday money from relatives

You don't usually need to report these payments to the IRS since they aren't income.

These involve money being exchanged for goods or services. Whether or not you receive a Form 1099-K, you typically must still report any income on your tax return. This includes payments for goods you sell or services you provide. Irs

Examples include:

Getting paid for your freelance work

Selling handmade items through your online shop

Receiving payment for tutoring sessions

When you’re the recipient in these transactions, you've typically earned business income. No matter how small the amount, you’re required to report it on your tax return and will probably owe taxes as a result.

If you collect business income through PayPal, you generally qualify as self-employed, even if you have another job. If you file your taxes as a sole proprietor, the default business structure for independent contractors, you’ll most likely be subject to federal income and self-employment taxes.

The income tax is progressive, which means the tax rate on each dollar you earn increases as you make more money. In 2025, the brackets range from 10% all the way up to 37%. Most states have an income tax too, but rates vary significantly.

In contrast, the self-employment tax is a flat 15.3%, and there's no state equivalent. It’s the combination of the 12.4% Social Security and 2.9% Medicare taxes that employees and their employees split. Unfortunately, self-employed people have to cover it alone.

To report PayPal income on your taxes accurately, you’ll need to keep careful track of your activities on the platform. Fortunately, PayPal should help by providing various documents you can use to check your earnings.

First, you can review your transaction history in your account’s activity feed, but that’s often hard to sort through. The second and more efficient option is to create custom reports that filter and organize your transactions into digestible statements.

However, as helpful as those can be, they’re not official. To confirm your PayPal income, you’ll often need a Form 1099-K. That's the document payment platforms use to report your gross income to you and the IRS.

If you have enough activity to be eligible for a 1099-K form, you should be able to download a digital copy from the Statements and Taxes tab in your account by January 31. PayPal is required to make it available to you by then.

You should receive a PayPal 1099-K form for 2024 if you had at least $5,000 in gross income on the platform during the tax year. However, the rules are going to be different going forward.

The IRS has been trying to reduce the requirement to just $600 in gross receipts for a while now, but the change has been delayed several times due to pushback from taxpayers and tax experts.

The latest IRS plan is to phase the rollout of the new reporting threshold. For the 2025 tax year, the reporting threshold drops to $2,500. Full implementation of the $600 reporting threshold will take effect in 2026 and apply to future tax years. That should give individuals, payment processes, and the IRS time to adjust.

To clarify, only business income counts toward the receipts total, not personal payments. For PayPal, that typically includes the activity in a business account and anything in your personal account tagged as “payment for an item or service.”

Getting an incorrect or unnecessary 1099 form can be a real headache, and unfortunately, it can happen surprisingly easily. The most common issues you’ll run into are double reporting and personal payments marked as income.

Let’s look at both of those and discuss how to deal with them.

In this case, double reporting refers to income being reported to the IRS twice on separate 1099 forms. It often happens when you have a client who files a 1099-NEC for payments they sent you via a payment network like PayPal. They’re not supposed to.

For example, say you get a 1099-K from PayPal for $25,000 and a 1099-NEC for $10,000 from a client who paid you through PayPal. That would lead the IRS to believe you had $35,000 in earnings when you only had $25,000.

You can often prevent this by letting your clients know they don’t need to issue a 1099-NEC for your PayPal earnings. Or, if you’re too late, you can ask them to file an updated 1099-NEC to correct their mistake.

If all else fails, don’t worry. Go ahead and report the correct amount on your taxes. Usually, that’ll be the one on your 1099-K. If the IRS takes issue with it, just be prepared to provide accounting documents that validate your position.

Payment networks have systems in place to prevent personal and business transactions from being mistaken for each other, but they’re not perfect. Sometimes, you may receive a PayPal 1099-K that includes personal payments in the amount.

As a result, you shouldn’t trust these forms without verifying their accuracy. Always compare them to your own bookkeeping records before reporting the amounts displayed on your tax return.

If you disagree with your PayPal 1099 because it includes personal payments or for any other reason, request an update online. You can initiate the process from the same page you used to download the tax document.

Remember, this is necessary because the IRS uses the 1099-K to determine how much income you should be reporting on your taxes. If your return doesn’t match, it’ll usually investigate the difference, which is tiresome and takes a lot of time to resolve.

Avoiding PayPal taxes (not evading them) is a perfectly legitimate goal. However, you probably won’t be able to avoid them entirely if you collect a meaningful amount of business income through the platform.

Whether or not you receive a Form 1099-K, you're required to report all of your income on your taxes. It’s illegal and unwise to try sneaking any earnings past the IRS, even if it’s only a relatively small amount.

As a result, the only practical way to avoid PayPal taxes is to claim tax deductions on your return. Those are business expenses that you can subtract from your income, indirectly reducing the taxes you owe.

To be deductible, expenses must be “ordinary and necessary,” which is essentially a test of reasonableness. “Ordinary” refers to expenses that are common among businesses like yours, and “necessary” means beneficial, not absolutely required.

For example, some common deductions for freelancers include:

Phone and internet expenses

Office supplies and software

The home office deduction

Contractor labor and raw materials

Professional and legal services

Travel for business purposes

Business portions of vehicle expenses

Business insurance premiums

Interest on business financing

Marketing and advertising

Of course, whether you can deduct these depends on your business, but there’s one expense you can always claim - your PayPal fees. The platform takes a small percentage and a smaller fixed fee from every business payment, which is deductible.

If you’d like help determining which other tax deductions you’re eligible for, it’s a good idea to hire a Certified Public Accountant (CPA). They can help you avoid your PayPal taxes as much as possible without going so far that you get on the bad side of the IRS.

If you’re an individual who collects business income through PayPal and expects to owe at least $1,000 in taxes per year, you should make quarterly estimated tax payments. They’re the equivalent of tax withholding for employees.

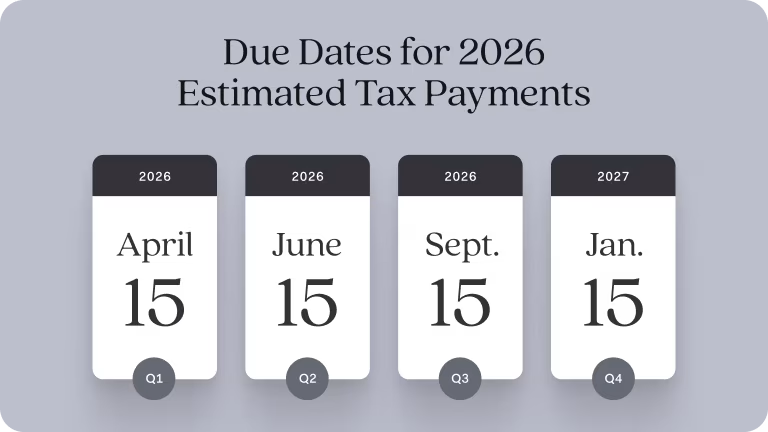

To avoid penalties, you must pay 25% of the amount you expect to owe in taxes on or before each of the following dates:

April 15

June 15

September 15

January 15 (of the following year)

If you aren’t confident in your tax estimates for the year, don’t worry. You won’t face any penalties as long as your total payments equal 90% of the amount you owe for the current year or 100% of what you owed the previous year.

Assuming you file as a sole proprietor, you should report your PayPal business income and expenses on Schedule C alongside its supporting tax forms, including Schedules 1, 2, and SE.

To avoid penalties, file them with Form 1040, the IRS term for the individual tax return, by April 15. Alternatively, you can file an extension to push the deadline back to October 15, but that won’t give you any extra time to pay the taxes you owe.

In practice, it’s often worth hiring a CPA to handle the filing process for you, especially as your business becomes more profitable and sophisticated. They can also help you avoid PayPal taxes without breaking the rules, and their fees are likely tax-deductible.

PayPal is a great way to collect payment for your products or services, but it’s usually not enough to keep your business finances organized. For a complete bookkeeping system, you also need a business bank account.

One of the best options is to open one with Found! We’ve designed our bank account specifically for the self-employed, and it comes with many powerful features that can automate processes like:

Tracking your business income and categorizing deductions

Setting aside money for estimated tax payments

Filling out your business tax forms, such as Schedule C or 1099-NEC forms

Best of all, you can sign up for free! Sign up for Found today and let our software streamline the taxes and paperwork so you can focus on growing your business.

The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

PayPal may report transactions in personal accounts tagged as “payment for an item or service” but not those marked as “friends and family.” If you get a 1099-K that includes those payments, ask PayPal to fix the mistake to avoid issues with the IRS.

You can do so directly from the Statements and Taxes tab in your account where you downloaded your PayPal 1099-K.

For tax year 2024, PayPal sent 1099-K forms to users who had at least $5,000 in business income on the platform. They should be accessible online as of January 31.

For tax year 2025, the gross business income threshold is $2,500. In 2026, the income threshold will drop again, this time down to just $600.

Typically, making business income on PayPal will cause you to pay ordinary income and self-employment taxes, no matter how small the amount. The IRS requires you to report and pay taxes on every dollar you earn.

You can avoid PayPal 1099-K forms by keeping your gross income below the reporting threshold ($5,000 in 2024), but that doesn’t excuse you from claiming the earnings or paying taxes on them.

As long as you’re using PayPal to collect business income, the fees you pay the platform for the privilege may be tax deductible. It doesn't matter whether you use a personal or business PayPal account.

As a result, it’s not worth trying to evade PayPal fees by tagging business transactions as friends and family payments. Besides, it’s against PayPal’s policy, and you'll usually lose your account privileges when they catch you.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax advice.

Related Guides

6 Tax Mistakes Small Business Owners Make

Accounting and Taxes

How to File Your Venmo Taxes

Accounting and Taxes

Form 1099-K: A Guide for Small Business Owners

Accounting and Taxes