Despite not supporting personal transactions like Venmo or PayPal, Stripe is one of the most popular payment platforms in the world. It helped businesses process over $800 billion in payments during 2022 and may have cracked $1 trillion in 2023.

If you use Stripe to collect payments from your customers, here’s what you should know about the platform’s reporting policies, including when Stripe reports to the IRS and what that means for your annual tax responsibilities.

Stripe is what the IRS refers to as a third-party payment processor, or payment network. As a result, it's required to report your gross income to the IRS if your activities on its platform are significant enough.

In other words, yes, Stripe does report to the IRS. If you use the platform to collect payment for your goods or services, the agency will typically know how much you earned during each tax year.

If you report a lower amount on your tax return, it will mail you a letter and investigate the discrepancy. Typically, you’ll have to pay the difference plus penalties and interest, though purposeful tax evasion has more dire consequences.

All that said, it shouldn't matter too much whether Stripe reports to the IRS or not. Even when it doesn't, you're still legally required to list all the income you earn on your tax return and pay taxes on the amount.

Form 1099-K is the official tax document third-party payment processors like Stripe use to report your income. If you have enough activity on a platform, it’ll send completed copies of the document to you and the IRS.

Here’s what the form looks like:

As a taxpayer, you can use Stripe’s 1099-K to help determine the amount of gross income you collected via the platform each year. The document displays what Stripe thinks you earned in Box 1a.

Ideally, you should compare that amount to your own records and confirm that it matches your expectations before reporting it on your tax return. Similarly, the IRS will compare your tax return to its copy of the 1099-K to make sure your return is accurate.

If you get a 1099-K from Stripe, you’re self-employed in some capacity, and the payments you collect through the platform are generally considered business income.

Assuming you file your taxes as a sole proprietor, the default business structure for self-employed people, you’ll owe ordinary income and self-employment taxes on your business’s net earnings.

The ordinary income tax is one we’re all familiar with. It applies to almost all sources of income, including W-2 wages, and the tax rate increases as you earn more money. For example, your first $10,000 gets taxed at 10%, and the next $33,725 gets taxed at 12%.

Meanwhile, the self-employment tax is a flat 15.3%. It’s actually a combination of the same Social Security and Medicare taxes that apply to W-2 wages. Employees split those taxes with their employers, with each party paying 7.65%, but self-employed people are their own employers.

Stripe sends 1099-K forms when your activities on the platform exceed certain IRS thresholds. For tax year 2023 and those before, you’d get a 1099-K if you earned more than $20,000 and completed at least 200 transactions on a payment platform.

However, those thresholds are now changing.

You’ve probably seen discussions about a new “Venmo tax” over the last few years, with many popular publications claiming that people who use these platforms will soon be subject to increased taxes.

Fortunately, that’s not really the case. These publications are actually referring to a reduction in the 1099-K reporting thresholds for platforms like Stripe.

The old rules were pretty forgiving. Many small businesses either generate less than $20,000 in annual revenue or have fewer than 200 transactions each tax year, letting them avoid getting a 1099-K.

Theoretically, those taxpayers could fly under the IRS radar. It would be illegal for them not to report all their income on their tax returns, but the IRS would have a tough time catching them without a 1099-K.

To encourage taxpayers to report their earnings honestly, the IRS introduced new rules in the American Rescue Plan Act of 2021. It lowered the reporting threshold to just $600 in gross income and eliminated the transaction volume requirement.

The change was originally set to take effect in 2022, causing the issuance of an extra 30 million 1099-K forms per year. However, taxpayers, tax experts, and payment processors protested, arguing that it was too much of a change too quickly.

Eventually, the IRS relented. First, it delayed the implementation of the threshold change to 2023, then announced a second delay toward the end of 2023 that made both 2023 and 2024 transitionary periods.

For tax year 2023, the original thresholds stayed in effect, but for the 2024 tax year, you’ll get a 1099-K if you have $5,000 or more in gross receipts. In 2025 and all subsequent tax years, the $600 threshold will apply.

If you get a 1099-K from Stripe that shows a gross receipts amount below the federal threshold, it may not be a mistake. You might just live in a state or territory with a lower 1099-K threshold.

As of 2023, here are the places where the local reporting thresholds differ from the federal ones:

It used to be standard for organizations to mail you paper copies of your 1099 forms, but that’s not so common anymore, especially with digital payment platforms like Stripe. Instead, you’ll typically get access to an electronic copy.

If you meet the activity requirements, Stripe will email you to let you know you have a tax document available by January 31. Afterward, you should be able to download a copy of your 1099-K from the Documents section of the dashboard.

If you get a 1099-K from Stripe, the IRS will get a copy too. As a result, it’ll know you have business income to report, making it extra important that you fulfill your tax responsibilities. Here’s what you should do to stay on the agency’s good side.

If you disagree with the amount you see in Box 1a of your 1099-K, don’t ignore the mistake. It may be tempting to simply report the correct amount on your tax return, but that will usually lead to more work for you down the road.

After all, the IRS gets a copy of the form too, and it’s going to compare it to your tax return. If it notices a discrepancy between the two, it’ll mail you a letter and force you to go through a time-consuming process to explain everything.

To preempt the issue, fix the problem at the source. You can request that Stripe correct any errors and send an updated 1099-K to you and the IRS via the same section of the Stripe dashboard you used to download the original.

After confirming that your 1099-K matches your records, report the amount on your tax return. Sole proprietors should list it on Line 1 of Schedule C, with all adjustments and expenses coming after.

Remember, your Stripe 1099-K displays your gross business income for the year. That means it shows your earnings before accounting for anything else, including the fees the platform charged you and any refunds you issued.

Fortunately, you don’t have to pay taxes on all the income shown on your 1099-K. You can reduce the amount that’s subject to taxes by claiming tax deductions, aka write-offs. Those are “ordinary and necessary” business expenses you paid during the tax year.

“Ordinary” basically means common for your industry, while “necessary” translates to beneficial - not absolutely required. In other words, a reasonable person should be able to see that your tax deductions are relevant and helpful expenses for your operation.

Since you can use Stripe to collect payments for virtually any business, the only tax write-off every Stripe user can claim is the platform’s fees.

Because Stripe automatically deducts them from your earnings, you won’t find the amount in your bank statements, but you can create a balance history report for the tax year to confirm the total.

Otherwise, here are some examples of common tax deductions for freelancers:

Office supplies

Marketing costs

Professional and legal services

Raw materials for products sold

Contract labor expenses

Wages paid to employees

Business travel costs

Business vehicle expenses

Insurance premiums

Interest on business financing

Office rent and utilities

Ultimately, the expenses you can deduct depend primarily on the nature of your business. If you want help maximizing your tax deductions, consider hiring a Certified Public Accountant (CPA) for guidance.

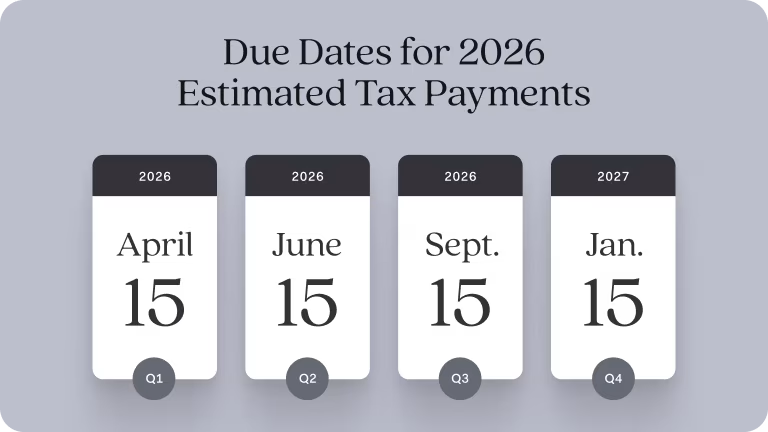

Because self-employed people don’t have bosses to withhold taxes from their earnings, they have to make estimated tax payments throughout each tax year instead. They’re due approximately every quarter.

When you get a 1099-K for the first time, you’ll have to make estimated tax payments for your business going forward if you weren’t already. Aim to pay 25% of the income and self-employment taxes you expect to owe for the year by the following due dates:

April 15

June 15

September 15

January 15 (of the following year)

To avoid penalties, your total estimated tax payments must cover at least 90% of your current year’s taxes. Alternatively, you can pay 100% of the taxes you owed in the previous year, which is helpful if you’re not confident in your revenue projections.

Lastly, you need to file a tax return for you and your business by April 15 (October 15 with an extension). Fortunately, sole proprietorships aren’t separate from their owners, so there usually isn’t too much extra paperwork for the typical independent contractor.

In addition to Form 1040 (the official IRS term for an individual tax return), you'll need to complete Schedule C and its supporting documents. That usually includes Schedule 1, Schedule 2, and Schedule SE.

If you’re going to do everything yourself, it’s best to use tax software to fill out and submit an electronic copy of your return. It costs money, but it’s much faster and safer than mailing a paper copy. Those can easily get lost, causing delays or penalties.

If you’re uncomfortable with DIY tax work because your return is too complicated or you’re unfamiliar with the rules, it’s often worth paying a CPA to handle the process.

They’ll be able to take all of the hardest parts off your hands while minimizing your taxes. In addition, whatever fees you pay for their services are tax deductible.

Stripe is a convenient way to collect customer payments and very well-suited to keeping track of your earnings. However, it can't help you record your business expenses.

For a complete bookkeeping system, you should combine Stripe with a business bank account like Found! Its powerful features are designed to make your life as a self-employed person easier.

For example, Found can automate processes like:

Tracking your business income and categorizing deductions

Setting aside money for estimated tax payments

Filling out your business tax forms, including Schedule C

Sign up for Found today and let it take care of the busy work so you can focus on growing your business.

Stripe does send 1099-K forms when your activities on the platform exceed certain thresholds. If you meet the requirements in a given tax year, you and the IRS will both get a copy of the document by January 31 of the following year.

For tax year 2024, the threshold is $5,000 in gross receipts, but it will drop to just $600 in 2025. The $600 tax rule will also apply to future tax years.

Fortunately, the IRS considers payment processing fees ordinary and necessary expenses for every business. As a result, Stripe fees are typically tax deductible. You can claim them on Schedule C to reduce your net earnings and pay less taxes.

Just be sure you report the gross income from your Stripe 1099-K on your tax return to avoid double dipping. The amounts that hit your business bank account already have the platform’s fees subtracted.

If you sign up for Stripe Tax, the platform can automatically calculate and collect sales taxes from customers on your behalf. However, it can’t remit the funds to the proper agencies or file a sales tax return for you.

As a result, Stripe Tax can’t eliminate your sales tax responsibilities entirely. To avoid expensive compliance issues, it’s usually worth hiring a CPA to help with the rest of your sales tax duties.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax advice.

Related Guides

6 Tax Mistakes Small Business Owners Make

Accounting and Taxes

Form 1099-K: A Guide for Small Business Owners

Accounting and TaxesIntroducing Pockets: The Smarter Way to Manage Your Freelance Finances

Business Banking