Self-employment is becoming increasingly attractive to Americans. In fact, more are self-employed now than at any time in the last 15 years. That's largely because gig apps like Amazon Flex make becoming your own boss incredibly convenient.

However, being the friendly neighborhood delivery driver also comes with greater tax responsibilities. Not only does filing your tax return become more complicated, but you’ll also have to do more preparatory work throughout the year.

Fortunately, you don’t have to learn how it works alone. Our guide to filing Amazon Flex taxes will help you understand your obligations and how to stay on top of them.

Amazon has many employees on the payroll, but Amazon Flex delivery partners aren’t among them. As a driver, you’re actually considered an independent contractor. This self-employed status significantly impacts your tax obligations in a few key ways:

Self-Employment Tax: Unlike employees who split this tax with employers, you're responsible for the entire 15.3% Medicare and Social Security tax burden on your net earnings.

Federal Income Tax: You'll pay standard progressive federal income tax rates on top of self-employment taxes, with higher earnings pushing portions of your income into higher tax brackets.

No Tax Withholding: Amazon doesn't withhold taxes from your payments, making you fully responsible for calculating and paying all taxes owed.

In addition to navigating another tax to navigate, Amazon Flex drivers also have extra administrative responsibilities, such as:

Tracking your business income and expenses

Making quarterly estimated tax payments

Filing additional self-employment tax forms

Let’s look at these responsibilities in more detail to help you understand what they entail and how to manage them.

Whatever your employment status, you’re responsible for claiming all the income you earn on your taxes. That can take some extra time if you’re an independent contractor with multiple income sources, but it shouldn’t be too difficult.

The platforms you work with usually keep track of your income for you, including Amazon Flex. You should be able to find your annual earnings in the mobile app under the Earnings section.

In addition, Amazon Flex may send you a Form 1099-NEC. That’s your equivalent of an employee’s Form W-2 and displays your gross annual income. You must have earned at least $600 from Amazon during the previous tax year to get one.

If you met that requirement in the previous year, you should be able to access a digital copy of the tax form on the Amazon portal by the following January 31.

Of course, you should also have your own records, such as your business bank account statements. They display all the deposits you received, and you should compare them to Amazon Flex’s numbers to make sure everything’s accurate.

The 1099-NEC reports income you earned as a non-employee. Unlike a W-2, it shows only gross earnings—no taxes withheld. The IRS receives a copy, too, so accuracy matters! Learn more →

Finding your gross income is the first step in calculating your taxable business earnings. The second is to identify your tax deductions. These are “ordinary and necessary” costs incurred in the course of business, which means they’re reasonable for your industry.

The Internal Revenue Service (IRS) lets you deduct them from your business income on your tax return. That decreases your taxable business earnings and indirectly lowers your tax bill.

Unfortunately, Amazon Flex won’t provide much documentation to help you track these costs. You’re solely responsible for recording them and claiming them on your taxes. If you don’t, you’ll lose the potential tax savings.

Use a separate business checking account like Found to track your business expenses. Not only will it simplify bookkeeping, but Found will automatically categorize your expenses and help you find write-offs. Found even has built-in mileage tracking software, which is critical for delivery drivers who often have many vehicle-related tax deductions.

Working for Amazon Flex requires you to pick up and deliver orders to Amazon customers using your own vehicle. Of course, owning and operating a car for business is expensive, so the IRS lets you deduct the associated costs.

For example, some of the most common tax-deductible vehicle expenses include:

Auto insurance

Auto lease payments

Depreciation

Auto loan interest

Gas or other fuel costs

Registration costs

Repairs and maintenance

However, the IRS only allows you to write off the portion of these expenses that’s associated with your business. If you use the same car for your personal and Amazon Flex trips, you’ll have to do some work to calculate your deduction.

The IRS allows the following two methods:

Actual expense method: This approach involves tracking your vehicle expenses and your personal and business mileage. To calculate your deduction, determine the percentage of your driving that's for business and multiply it by your total expenses.

Simplified method: This approach significantly reduces your bookkeeping responsibilities, as it only requires tracking your business miles. Just multiply them by the IRS standard rate to get your deduction. In 2024, the rate is 67 cents per mile.

Either method can lead to a higher deduction in different circumstances, so it’s best to calculate both in your first year. Just know that choosing one option can affect your ability to switch to the other one in the future.

If you opt for the actual expense method, you can’t switch to the simplified method until you get a new vehicle. It’s important to do the math the first year to choose the higher one! Learn more →

If you don't know which will save you the most in taxes over the long term, hire a Certified Public Accountant. They’ll be able to help you make the best decision for your situation.

They should also be able to help you identify tax deductions you can take other than your vehicle expenses. For example, that might include the business portion of your cell phone costs or supplies you use to transport goods you deliver.

Incidentally, it likely includes whatever fees you pay your CPA for their tax advice. You can write that off on your tax return under professional services.

In addition to having additional bookkeeping responsibilities, self-employed people don’t benefit from tax withholding. Instead, you must make manual tax payments throughout the year.

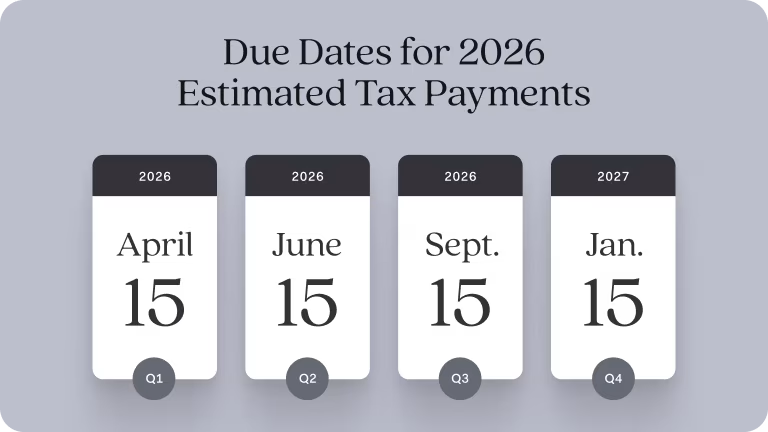

These are called quarterly estimated tax payments, but they’re not actually due every three months. Here are the real deadlines:

April 15

June 15

September 15

January 15 (of the following year)

You must set aside a portion of each payout you receive and aim to pay 25% of your projected tax bill on each of these days. You can submit your payments online via bank transfer using the IRS portal.

To avoid underpayment penalties, you must send in at least 90% of your current year’s tax bill or 100% of your previous year's tax bill. The IRS refers to these as your safe harbor thresholds.

Last but not least, self-employed people have some extra forms to complete when tax time comes around. They can vary depending on your legal entity structure, but most Amazon Flex drivers file as sole proprietors.

That’s the default status for all self-employed people, and there’s a significant amount of fees and paperwork involved in changing it. If you don’t recall going through that process, it’s safe to assume you’re a sole proprietor.

Given that, here are the primary additional tax forms you’ll need to complete:

Schedule 1: Use this form to report your net business earnings and any other income that isn’t wages.

Schedule C: Provide the details of your business income and deductible expenses on this form. It should detail how you got to the net business earnings shown on Schedule 1.

Schedule 2: Use this form to report the self-employment tax you owe for your net business earnings. You should also report the taxes you owe on any other income that isn’t wages here.

Schedule SE: This is the form where you demonstrate how you calculated the self-employment taxes shown on your Schedule 2.

These are supporting schedules for your Form 1040, which is what people commonly refer to as the individual tax return. Form 1040 summarizes your tax situation, while these documents explain how you arrived at the amounts you’re claiming.

After reporting the income and expenses you tracked all year on your return, you should be ready to file your Amazon Flex taxes. Assuming you paid enough estimated taxes to hit either IRS safe harbor, you should also be safe from underpayment penalties.

To avoid late filing penalties, which are even more expensive, you generally must submit your tax return by April 15. Alternatively, you can file an extension to get an extra six months, pushing your due date to October 15.

However, that doesn’t change the timeline for your estimated tax payments. You’ll always need to make them by their original due dates to avoid penalties, even if you haven’t filed your return for the previous year.

Generally, it’s best to follow the recommendation of the IRS and file your taxes electronically. It’s much faster, and the agency will confirm receipt immediately. Filing a paper return can lead to delays and lost documents, which are headaches best avoided.

Of course, the easiest option is to let your CPA handle the process. You’ll need to provide your bookkeeping records, but they can fill out and file the tax documents for you. It’s a great way to make your life easier if you can afford it.

Another great way to streamline the filing of your taxes is to use Found. It’s built from the ground up to make everything tax-related easier for the self-employed. It's also significantly cheaper than a CPA’s services.

Sign up for Found today and let its powerful features simplify your Amazon Flex taxes.

According to Amazon, when you drive for Amazon Flex, you are an independent contractor. As a result, you won’t receive a W-2 form like you would as a full-time employee. Instead, you'll get a 1099 form, assuming you earned at least $600 during the tax year.

If you earn $600 or more in a given year by delivering for Amazon Flex, the IRS requires the platform to send you a Form 1099-NEC. It displays your gross annual income for the year and can help you file your taxes.

You must log in to the Amazon tax portal to get your copy. It should be available to you by January 31 at the latest.

Amazon Flex doesn’t take out taxes from your earnings as a delivery partner. According to Amazon, you’re an independent contractor, not an employee, so you’re not subject to tax withholding. Instead, you must make quarterly estimated tax payments.

These are due April 15, June 15, September 15, and January 15. Aim to pay 25% of your tax bill for the year by each date.

Does Amazon Flex count as being employed by Amazon?

No, when you’re a Flex driver, you're not typically considered an Amazon employee. The IRS classifies you as an independent contractor, which means you'll get a 1099-NEC form (not a W-2) when you earn $600+ in a calendar year from Amazon. In the eyes of the IRS, you are essentially running your own delivery business while using Amazon's platform.

How much should you save for taxes on Amazon Flex?

Amazon Flex drivers should set aside 25-30% of gross earnings for taxes. This amount covers both your self-employment tax (15.3% for Social Security and Medicare) plus your federal income tax requirements. Your specific tax percentage may vary based on your filing status, additional income sources, state tax rates, and applicable deductions. Consider establishing a dedicated savings account specifically for tax funds and make quarterly estimated payments if you think you’ll owe more than $1,000 when filing your annual return.

Does Amazon Flex pay for gas?

No, Amazon Flex doesn't reimburse its drivers for any vehicle costs, including gas. As an independent contractor, you're responsible for all costs including fuel, maintenance, insurance, and depreciation for your vehicle. However, these expenses are likely tax-deductible business costs. You can either use the standard mileage deduction (67 cents per mile for 2024) or track actual vehicle expenses. Either way, you’ll want to keep all your receipts and use a mileage tracking app for proper documentation.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax advice.

Related Guides

A Guide to Small Business Quarterly Taxes

Accounting and TaxesThe Guide to Filing 2025 Self-Employment Taxes

Accounting and Taxes

1099-NEC Instructions Explained: What is Non-Employee Compensation?

Accounting and Taxes