When you’re a small business owner, you have a million balls to juggle. That includes accounting and, by extension, taxes. One of the most important tax forms you’ll deal with is Schedule SE. Let’s walk through this crucial form and learn what’s involved in filing one.

The Schedule SE tax form calculates how much self-employment tax you need to pay. It’s technically a part of Form 1040, the main form used to file an individual income tax return.

Schedule SE isn’t actually where you report your self-employment tax—you do that on the Schedule 2 form, which is another part of Form 1040. Instead, Schedule SE provides the calculations to determine what you owe, and it must be attached to your 1040 when you file.

Here’s what the Schedule SE tax form looks like:

Anyone who made over $400 in self-employment income in 2025 must fill out a Schedule SE and pay self-employment tax on that income. This is true regardless of whether you earn your full living from self-employment or work for yourself as a side hustle. This includes:

Sole proprietors

Independent contractors

Freelancers

Consultants

Any other self-employed individuals

The only exception to these rules is for individuals who earned income as church employees—they’re required to file a Schedule SE if they make $108.28 or more.

Self-employment tax is a combination of Social Security and Medicare taxes. It’s similar to the FICA taxes that W2 employees pay, but unlike these taxes, self-employment tax also includes the employer portion.

For this reason, it may be higher than you’re used to paying into Social Security and Medicare. However, the upshot is that the employer's half is considered a deductible expense.

The self-employment tax rate is 15.3% of your self-employed income. This amount is comprised of 12.4% for Social Security and 2.9% for Medicare. A few other things to know about self-employment tax:

The Social Security component (12.4%) only applies to the first $176,100 in 2025 and the first $184,500 for the 2026 tax year.

There's no limit to the Medicare component, and you must pay the 2.9% Medicare part of the SE tax on all your net earnings.

Generally, the amount subject to self-employment tax is 92.35% of your net earnings from self-employment. Why not 100% of your net earnings? Tax code allows for a deduction of half of your self-employment tax when you calculate your adjusted gross income (AGI), effectively reducing the amount of self-employment tax you owe. That’s why you see this number on line 4a.

Here’s a simplified example: let’s say you made $50,000 in self-employed income in 2025 (congratulations!). You would need to pay 15.3% of that in self-employment tax, so we get this equation:

50,000 x 15.3% = 7,650

That means your self-employment tax for 2025 is $7,650, half of which ($3,825) is a deductible expense.

Schedule SE is important because it walks you through calculating and reporting your self-employment tax for the year. This is mandatory for anyone earning over $400 in self-employed income, and failing to pay it can result in significant penalties (and potentially federal charges!).

Schedule SE has two parts. The first part focuses on calculating your self-employment tax, while the second part focuses on so-called “optional methods” that can help if your self-employment income is either very small or a net loss.

These lines are specific to farmers—if that’s you, you’ll put your farming profit or loss and any social security retirement or disability benefits in the appropriate lines. If you’re not a farmer, you can simply leave these blank.

On these lines, you’ll enter your total self-employment income from various sources. You can find this on line 31 of your Schedule C form. You’ll then multiply this number by 92.35% to get the total earnings that are subject to self-employment tax. Remember how the tax code allows for a deduction of half of your self-employment tax when you calculate your AGI? That’s where this 92.35% number comes from on line 4a.

Enter the result from line 4c on Line 6.

This line contains the maximum amount you can pay Social Security tax on. This amount typically increases each year—currently $176,100. This may already be filled in for you.

On these lines, record any earnings from jobs you already paid Social Security tax on. The most common example here is the salary you earn as a W-2 employee, which you can find on the W-2 form you receive from your employer. If you are strictly self-employed, you’ll leave these lines blank.

On these lines, you calculate how much Social Security tax you owe the IRS.

This line calculates the Medicare tax you owe.

Line 12 combines the totals from lines 10 and 11 to determine the total amount of self-employment tax you owe.

Finally, line 13 is where you’ll calculate the amount of self-employment tax you can claim as a deduction. This is 50% of the total from line 12.

Part II of Schedule SE contains optional calculations that can help give you credit toward social security coverage if you have very little earnings (or took a loss) from self-employment income. These optional methods apply if you have net profits of less than $7,493. There’s a section for farm income and one for non-farm income.

Tip: If you’re considering using one of these methods, we recommend consulting a tax professional, as they may increase your self-employment tax. Learn how to hire a CPA.

You can deduct 50% of your self-employment taxes as a business expense. This is because, as a self-employed person, you’re paying both the employee and employer portion of the tax, and the IRS considers the employer portion a deductible expense. You calculate this deduction on Schedule SE at line 13.

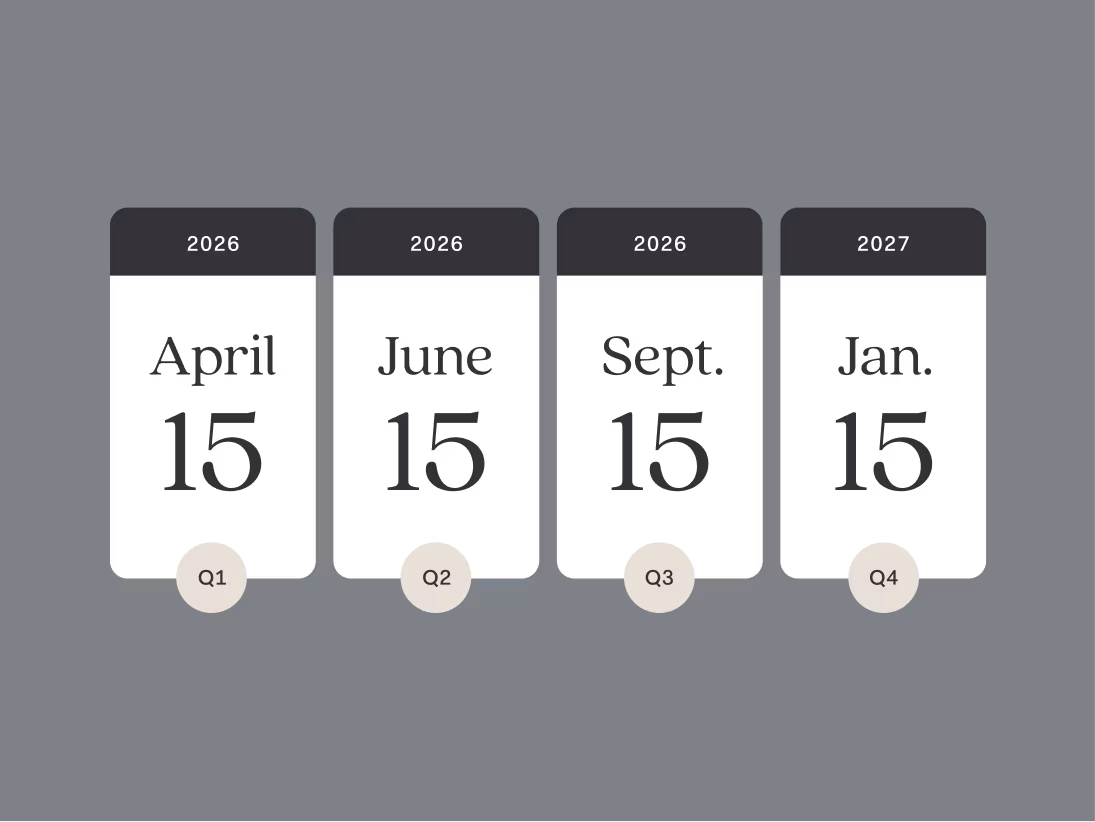

Schedule SE must be attached to your Form 1040 when you file income taxes. As such, it’s due at the same time—April 15, unless it falls on a weekend or holiday.

Tip: 2025 taxes are due by April 15, 2026.

Self-employment income is all money you earned as an independent contractor, freelancer, or otherwise self-employed individual. In many cases, you’ll receive a Form 1099-NEC from clients you worked with that will show your income for that company.

However, you won’t receive a 1099 from every client, and they aren’t guaranteed to be accurate. For these reasons, the best way to keep track of your self-employed income is to maintain accurate records in accounting software throughout the year.

If you have net earnings of $400 or more from self-employment, you’re required to pay self-employment tax on it. This can be from any source that isn’t a W-2 position, including freelancing, contracting, consulting, and other self-employed gigs.

Schedule SE—and other tax forms like the Schedule C—can be overwhelming, particularly if you’re unfamiliar with them. They don’t have to be, though. With a little help, you can make tax time a breeze.

You can really take the guesswork out of taxes with Found. Our tax tools help you run your business with newfound clarity and ease. No more toggling between costly apps.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax or legal advice.

Related Guides

How To Calculate Taxable Income When You’re a Small Business Owner

Accounting and Taxes

Understanding the Schedule C Tax Form

Accounting and Taxes

2026 Tax Deadlines for Small Business Owners

Accounting and Taxes