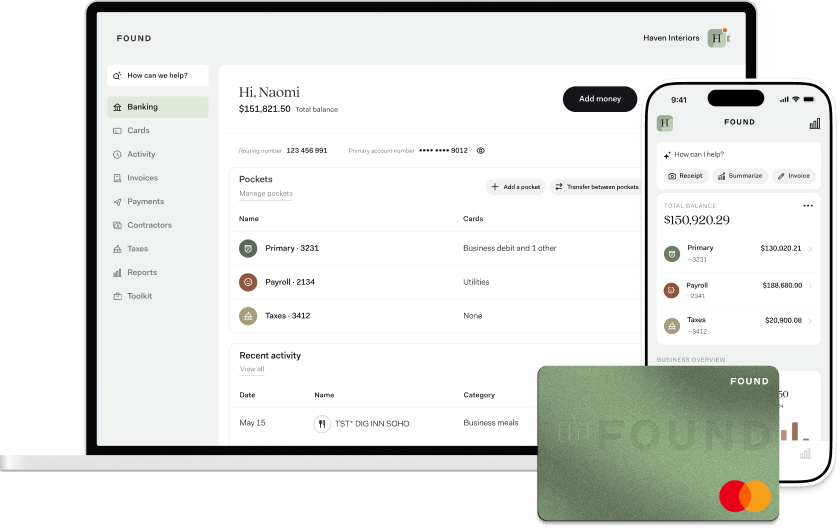

Upgrade your banking experience without slowing down

Bring your banking and back office into one platform in a few easy steps. Your future self will thank you.

Placeholder

Placeholder

Placeholder

Placeholder

Best Business Checking for Paying Contractors and Saving for Taxes

Placeholder

©2017-2026 and TM, NerdWallet, Inc. All Rights Reserved.

Best for Innovative Features

Placeholder

©2026 Forbes Advisor. All Rights Reserved.

The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

Best Business Checking for Paying Contractors and Saving for Taxes

Placeholder

©2017-2026 and TM, NerdWallet, Inc. All Rights Reserved.

Best for Innovative Features

Placeholder

©2026 Forbes Advisor. All Rights Reserved.

Sign up is fast and free

Get started in just a few simple steps

Placeholder

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

⁴Optional subscriptions to Found Plus for $19.99/month or $149.99/year or Found Pro for $80/month or $720/year. There are no monthly account maintenance fees, but other fees such as transactional fees for wires, instant transfers, and ATM apply. Read Found Fee Schedule.

Do more from your bank account

Automate your bookkeeping

Streamline your invoicing

Pay and manage contractors

Add team members and distribute cards

Simplify taxes

Manage cash flow

What makes us different?

Only the things that matter.

Compare features:

FOUND

OTHER BANKS

Physical debit card²

Placeholder

Placeholder

ATM network⁷

Placeholder

Placeholder

Cash and mobile check deposit⁵

Placeholder

Placeholder

Free ACH transfers

Placeholder

Placeholder

APY on checking account balance¹⁴

Placeholder

¹⁴Found Plus subscribers (for $19.99/month or $149.99/year) earn 1.5% APY on balances up to $20K. Found Pro subscribers (for $80/month or $720/year) earn 2.5% APY on all balances, with no cap.

Placeholder

¹⁴Found Plus subscribers (for $19.99/month or $149.99/year) earn 1.5% APY on balances up to $20K. Found Pro subscribers (for $80/month or $720/year) earn 2.5% APY on all balances, with no cap.

No required monthly fees⁴

Placeholder

⁴Optional subscriptions to Found Plus for $19.99/month or $149.99/year or Found Pro for $80/month or $720/year. There are no monthly account maintenance fees, but other fees such as transactional fees for wires, instant transfers, and ATM apply. Read Found Fee Schedule.

Placeholder

⁴Optional subscriptions to Found Plus for $19.99/month or $149.99/year or Found Pro for $80/month or $720/year. There are no monthly account maintenance fees, but other fees such as transactional fees for wires, instant transfers, and ATM apply. Read Found Fee Schedule.

No minimum account opening deposit

Placeholder

Placeholder

No required minimum account balance

Placeholder

Placeholder

Role-based permissions for co-owners, partners, employees, accountants and bookkeepers

Placeholder

Placeholder

Ability to issue physical and virtual debit cards to trusted business partners or employees

Placeholder

Placeholder

Sub-accounts with customizable savings goals

Placeholder

Placeholder

Contractor management tools

Placeholder

Placeholder

Built-in bookkeeping tools and receipt tracking

Placeholder

Placeholder

Financial reports (P&L, Balance Sheet, Schedule C)

Placeholder

Placeholder

Automatic tax savings

Placeholder

Placeholder

INCLUDED

NOT INCLUDED BY ALL

NOT INCLUDED

The information on this website is not intended to provide, and should not be relied on for, tax or legal advice.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

⁵Subject to eligibility requirements, applicable terms and conditions, and service fees. See Terms of Service and Lead Account Terms for more details.

⁷Found does not charge ATM fees, but some ATM providers may add their own fee.

Bank comparisons are based on the top 10 retail banks by assets from Federal Reserve data (September 2025), excluding investment banks (Goldman Sachs), primarily online banks (Capital One), and custody banks (Bank of New York Mellon). Pricing and features reflect entry-level checking accounts for ZIP code 10001 (New York, NY), representing standard rates in a major metropolitan area. Fees and features may vary by location and are subject to change. Visit each bank's website for current pricing. Data compiled January 2026.

No required monthly fees: Traditional bank policies vary. Among the banks surveyed, monthly maintenance fees range from $10 to $16 for entry-level business checking accounts. Most banks offer fee waivers contingent upon meeting specific requirements, such as maintaining minimum average monthly balances (typically $500–$5,000), meeting monthly debit card spending thresholds, or enrolling in premium membership programs. U.S. Bank and Truist offer entry-level business checking accounts with no monthly maintenance fee. Fee structures and waiver conditions are subject to change; consult each bank directly for current terms.

No minimum account opening deposit: Traditional bank policies vary. Among the banks surveyed, minimum opening deposit requirements range from $1 to $100 for entry-level business checking accounts. Chase Bank does not require a minimum opening deposit for its Business Complete Banking account. Deposit requirements are subject to change; consult each bank directly for current terms.

No required minimum account balance: Traditional bank policies vary. While the banks surveyed do not impose ongoing minimum balance requirements that result in account closure, several tie balance thresholds to monthly fee waivers. Maintaining balances below these thresholds may result in monthly maintenance fees. Balance requirements and fee waiver conditions are subject to change; consult each bank directly for current terms.

Role-based permissions for co-owners, partners, employees, accountants, and bookkeepers: Traditional bank policies vary. Among the banks surveyed, several offer user management features that allow account holders to grant varying levels of access—including view-only permissions—to accountants, bookkeepers, and other authorized users. However, the availability, functionality, and cost of these features differ significantly by institution. Some banks include basic user management at no additional cost, while others require premium account tiers or paid add-on services for advanced permission controls. Consult each bank directly for current feature availability and pricing.

Over 750K small business owners have chosen Found

SEE WHY

4.8

App Store

over 29K ratings

4.7

Google Play

over 17K reviews

4.5

TrustPilot

over 1K reviews

"What used to take hours now takes me 45 minutes. I've kind of mastered it, so it's very quick. I can even do it from my phone.”

Review by Carolina C.

TAILS N TRAILS

“It has been so helpful with keeping track of all the aspects of my business and it feels nice to have everything in one place. I would give Found a 10 out of 10.”

Review by Dominique J.

INFINITE GROWTH COUNSELING & COACHING, LLC

“I love how it takes taxes out immediately so I don't have to think about it. I'm a social worker, not a business major. So it takes all the guess work out of it.”

Review by Heather K.

LICENSED CLINICAL SOCIAL WORKER | HEADWAY

Ready to switch? We’ve made it easy

Learn how you can quickly get started with Found from an existing bank account.

Sign up in as little as 5 minutes.

Easy sign up

No credit check

No minimum balance

No maintenance fees

your business finances

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. FDIC insurance only covers the failure of an FDIC-insured depository institution.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

⁴Optional subscriptions to Found Plus for $19.99/month or $149.99/year or Found Pro for $80/month or $720/year. There are no monthly account maintenance fees, but other fees such as transactional fees for wires, instant transfers, and ATM apply. Read Found Fee Schedule.

⁵Subject to eligibility requirements, applicable terms and conditions, and service fees. See Terms of Service and Lead Account Terms for more details.

⁷Found does not charge ATM fees, but some ATM providers may add their own fee.

¹⁴Found Plus subscribers (for $19.99/month or $149.99/year) earn 1.5% APY on balances up to $20K. Found Pro subscribers (for $80/month or $720/year) earn 2.5% APY on all balances, with no cap.

¹⁷Cash Back Terms and Conditions apply.

The information on this website is not intended to provide, and should not be relied on for, tax or legal advice.

Found partners with various providers to enable you to compare offers from participating institutions, such as lending, filing service, and insurance providers. Found is not a lender, a filing service, nor an insurance provider.

This website contains advertisement of Found and third party products and services.

According to NerdWallet, Found is the Best Business Checking for Paying Contractors and Saving for Taxes. (Source)

Terms of Service ・ Privacy Policy ・ Accessibility statement ・ © 2026 Found

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC.