All Posts

Read the latest small business insights from the Found team.

Found vs QuickBooks: Which Is Right for Your Small Business?

The Guide to Filing 2025 Self-Employment Taxes

3 Ways To Track Miles for Taxes

How to File DoorDash Taxes: Step-by-Step Guide for Dashers

W-9 Forms: An Essential Guide for Small Business Owners

A Step-by-Step Guide to Filling Out the Schedule SE Tax Form

Understanding the Schedule C Tax Form

How to Hire a CPA as a Small Business Owner

Introducing Found for Teams

Introducing Found Pro

How This Pet Services Founder Cut Payroll Time by Two-Thirds While Scaling to a Franchise

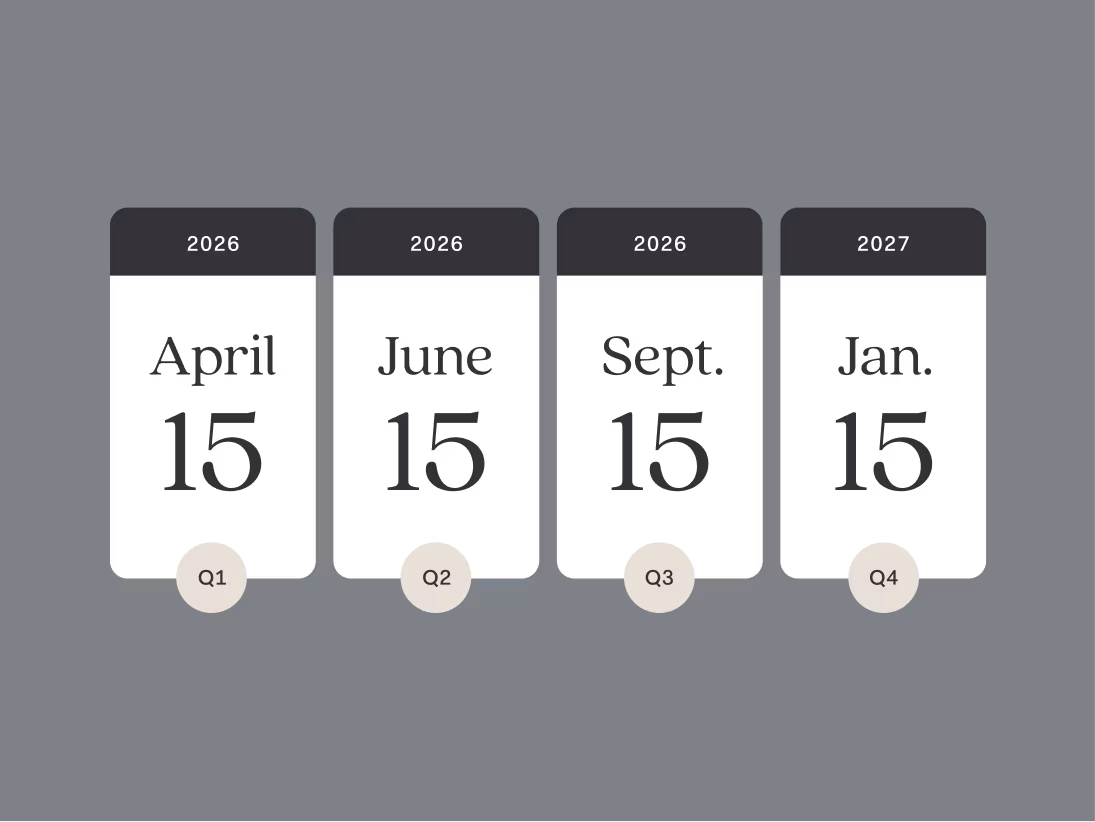

2026 Tax Deadlines for Small Business Owners

How Found Gave This Mental Health Practice Owner 20+ Hours Back Every Month

Found vs. Chase Business Banking: All-in-One Platform vs. Traditional Bank

Found vs. Wells Fargo Business Banking: All-in-One Platform or Traditional Bank

Found vs. Bank of America

How to Handle Late Payments from Clients: A Survival Guide for Small Business Owners

Business Banking for Therapists: What You Really Need to Know (2025 Guide)

Found vs. Traditional Banks

Found Partners with Lead Bank to Accelerate Growth for Small Business Owners

Found vs. Bluevine: Which Business Banking Platform Should You Pick?

Found vs. Novo: Which Offers Better Banking for Small Business?

Found vs. Lili: Which Offers Better Banking for Small Business?

Found vs. North One: Which Business Banking Platform Is Right for Your Small Business?

6 Reasons Found Simplifies 1099 Contractor Payments

6 Mistakes to Avoid When Hiring 1099 Contractors

Introducing Support for Multiple Businesses

Filing Taxes as a Creator: Your 2025 Guide

Filing Taxes as a Therapist: Your 2025 Guide

Why Small Business Owners Are Leaving Big Banks Behind

Small Business Owner's Guide to Automated Invoicing

The 2025 Tax Deduction Guide for Landscapers and Lawn Care Professionals

Introducing Tax Forms for S-Corps & C-Corps

Online vs. Traditional Banking: How to Choose the Right Small Business Bank Account

Introducing Connected Accounts Improvements

How to Choose a Business Structure

Introducing New and Improved Invoicing Tools

Top Tax Deductions for Beauty and Barber Business Owners

Business Banking for Photographers: What You Really Need to Know (2025 Guide)

How to File Taxes as a Photographer: The Complete 2025 Guide

Ultimate Guide for Small Business Expense Tracking & Reporting

The 2025 Tax Deduction Guide for Social Media Influencers and Creators

A Guide to Small Business Quarterly Taxes

A Small Business Owner’s Guide to Quarterly Taxes

Top 12 Tax Deductions for Writers

Common Therapist Tax Deductions to Shrink Your Tax Bill

Essential Tax Deductions for Photographer Business Owners

Form 1099-MISC: What Small Business Owners Need to Know

AI Productivity Hacks for Busy Small Business Owners

The Ultimate Guide to Small Business Invoicing: Get Paid Faster and More Reliably

Top 9 Tips to Recession-Proof Your Small Business

How to Budget as a Freelancer: A Step-by-Step Guide

5 Ways To Make Your Small Business Taxes Easier Next Year

How to Avoid PayPal 1099 Forms & PayPal Taxes

1099 vs W-2: What's the Best Option for Your Career & Taxes?

Cash App and Taxes: Your Complete 2025 Guide

Zelle Taxes: Does Zelle Report to the IRS?

How to File Your Poshmark Taxes

How To Calculate Taxable Income When You’re a Small Business Owner

Profit and Loss Statements for Small Business Owners

How to File Amazon Flex Taxes

How to Set Up a Small Business

Introducing Bulk Import Transactions via Spreadsheet

How to Read a K-1: For Partners, Shareholders, and Beneficiaries

The Ultimate Small Business and Freelancer Tax Prep Checklist for 2025

Introducing Invoice Estimates

Form 1099-K: A Guide for Small Business Owners

6 Tax Mistakes Small Business Owners Make

Introducing Batch Request W-9s from 1099 Contractors

17 Tax Deductions for Freelancers and Small Business Owners

Introducing New and Improved Income and Expense Tracking Tools

Introducing Multiple Debit Cards for Small Business Owners

Introducing Mailing Paper Checks

Introducing E-Filing for 1099-NEC Forms

The Ultimate End-of-Year Business Checklist

Tax Changes for 2024: A Guide for Small Business Owners

8 Common Myths About the Schedule C Form

Unfiled Tax Returns: What to Do and Where to Get Help

Hiring a Bookkeeper vs. a CPA: The Difference Between Bookkeeping and Accounting

1099-NEC Instructions Explained: What is Non-Employee Compensation?

LLC with S-Corp Status: Could It Help You Save On Taxes?

Follow the Money: Where Small Businesses Spend and Why it Matters

Best Photography Business Structure: LLC or Sole Proprietorship?

What is a Chart of Accounts?

How to Pay Freelancers: Payment Methods, Tax Forms, and Best Practices

A Step-by-Step Guide to Hiring 1099 Contractors For Your Small Business

Mastering Money Management: A Guide for Small Business Owners

What is a W-2 Employee?

Stripe 1099-K: Does Stripe Report to the IRS?

Introducing Pockets: The Smarter Way to Manage Your Freelance Finances

The $600 Tax Rule: What Small Businesses Need to Know for 2024 (and Beyond)

How to File Your Venmo Taxes

3 Ways to File Self-Employment Taxes

Turo Tax Guide: How to File Your Turo Taxes

8 Changes Small Business Owners Need to Know When Filing 2023 Taxes

Filing Uber Taxes

Through the Lens: How a Photographer Uses Pockets to Budget for the Off-Season

How to File Your Shipt Taxes

A Small Business Owner's Guide to Health Insurance

How to Write Off a Car For Business

Profitable by Design: How an Agency Owner Used Pockets to Grow

Building Your Dream Team: A Q&A with Nicole McCance

The Home Office Tax Deduction for Small Business Owners

6 Ways To Speed Up Your Contractor Onboarding Process

Small Business Emergency Funds for Freelancers and Solopreneurs

How to File Airbnb Taxes

Small Business Banking 101: What You Need to Know

Budgeting with Irregular Income: 10 Tips for 1099 Contractors

5 Features You'll Want in Your 1099 Payroll Software

What is Small Business Insurance and Do You Need it?

Filing Instacart Taxes

Quiet Hiring: What To Know About The 2023 Employment Trend

EIN vs. SSN: Decoding Tax IDs for Small Business Owners

Are You Making These 8 Venmo Tax Mistakes?

5 Ways to Grow Your Business Online

Sole Proprietorship vs LLC: Which Business Structure Is Right For You

7 Ways to Keep Your Small Business Finances Secure

What to Know About Potential Changes to the Independent Contractor Classification

Self-Employment Survival Tips: Advice for Aspiring Entrepreneurs

Found’s 2023 Self-Employment Survey

Brush Up on Deductions: Common Tax Deductions for Artists

Work Out Your Deductions: Tax Write-Offs for Personal Trainers

How to Navigate Tax Season When You’re a Small Business Owner

What to Know about Retirement Plans When You Own a Small Business

2023 Tax Deadlines Small Business Owners Should Know

Your Venmo Tax Questions Answered: What To Know About The New 1099-K Form

7 Signs It's Time To Quit Your Job

The Venmo Tax: What You Should Know About the New 1099-K Form In Your Mailbox Next Year

Best Finance Tools for Small Business Owners

How to Set Small Business Goals

Keeping Business in Harmony: Sadie Hoyt’s Entrepreneurial Journey

5 Tips to Make the Jump to Self-Employment During a Recession

How to Start a Freelance Business in 7 Simple Steps

7 Ways Freelancers Can Benefit From a Business Bank Account

5 Changes Small Business Owners Need to Know When Filing 2022 Taxes

In It For The Long Haul: Garrett Henderson’s Business Journey

Employment Trends: The Great Resignation and the Move to Self-Employment

Taking Her Shot: How Amber Garrett Built Her Photography Business

The Complete Guide to Expense Reporting for Beauty and Barbering Businesses

Bookkeeping for Small Business: Everything You Need to Know

Kick the 2022 Tax Season Off Right

How to Fill Your Bookkeeping Gaps

You Got a PPP Loan. Now What?

Sign up in as little as 5 minutes.

Easy sign up

No credit check

No minimum balance

No maintenance fees