Poshmark is one of the most popular apparel marketplaces online, with a whopping 80 million members in 2023. Whether you’re planning to build a retail empire or simply make some space in your closet, Poshmark can help you make it happen.

However, selling on the platform has implications for your taxes, and figuring them out can be tricky. Fortunately, you don’t have to do it alone. This guide to Poshmark taxes will help you understand your responsibilities and how to stay on top of them.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax advice.

To file your Poshmark taxes correctly, the first thing you should do is to determine which of the following describes your activities on the platform:

Selling personal items

Practicing a hobby for fun

Running a business for profit

The tax treatment of your Poshmark income and expenses will vary significantly depending on your answer. Let’s review what each of these categories means and how they affect your Poshmark taxes.

Poshmark is a great way to turn clutter into cash. If you’re just cleaning out your closet, taxes are likely simple. Selling personal items usually doesn’t trigger a tax bill unless you sell for more than you originally paid.

Say you recently moved from Boston to California and sell a jacket for $100 that originally cost you $150—no taxes owed. But if you sell it for $200, the $50 profit is taxable. If you owned it for over a year, capital gains tax applies (0%, 15%, or 20% based on your income). Otherwise, it’s taxed as ordinary income (10%-37% federally, plus state taxes).

Whether you have a gain or loss on the sale, you should still report these transactions on your tax return. We’ll talk more about that below.

If you end up selling items on Poshmark for less than they originally cost, it’s considered a non-deductible loss. In that case, you don’t typically owe any taxes on the proceeds from your sale.

Things get more complicated if you do more on Poshmark than rehome personal items you no longer want. In that case, the IRS recommends considering nine factors to determine whether your activities constitute a business or a hobby.

For example, those include:

How much time and effort you put into the activity

Whether you make money from the activity or operate at a loss

Whether you depend on income from the activity for your livelihood

These all boil down to whether or not you’re selling goods on Poshmark with the intent to generate a profit. If you are, then you’re generally considered a business owner. If not, then your activities are probably just a hobby.

When running a Poshmark business, any profit you have left after subtracting your tax-deductible expenses is taxable. It will generally be subject to ordinary income and self-employment taxes. The self-employment tax is a flat 15.3%.

If your activities are beyond the scope of selling personal items, but you don’t do them for profit, you fall into the hobby category. In that case, any income you earn will be taxable, and you won’t get to deduct any expenses you incur.

However, your earnings will only be subject to federal and state income taxes. Since you’re not a business owner, you won’t have to pay the self-employment tax on your earnings.

As a seller, you never have to pay sales tax. Only the customer is on the hook for it in the United States. You’re typically only responsible for collecting and sending the funds to the appropriate government agencies.

Fortunately, Poshmark handles this process automatically in most states. As a result, you typically shouldn’t have to worry about calculating, collecting, or remitting sales taxes as a seller.

However, that doesn’t mean you have no sales tax responsibilities, even if you live in a covered state. For example, you may still need to file a sales tax return. Consider hiring a Certified Public Accountant (CPA) to make sure you’re in compliance.

Now that you understand the different types of Poshmark activities you can engage in, let’s discuss the tax forms you should use to report them.

Fortunately, reporting the sale of a personal item is pretty easy, especially if you have a net loss. In that case, you only need to use Form 1040, Schedule 1.

Report the sale proceeds on Line 8z, Other Income, using the description "Personal Item Sold at a Loss." Next, report your costs (up to the proceeds amount) on Line 24z, Other Adjustments using the same description.

If you sold a personal item at a gain, you must report the details on Form 8949 and Form 1040, Schedule D. Refer to the instructions on each tax form for guidance.

If your Poshmark activities constitute a trade or business, you must generally report your net income or loss on Form 1040, Schedule 1, Line 3. You must also break down your income and expenses on Form 1040, Schedule C.

That assumes you file your Poshmark taxes as a sole proprietor. That's the default for self-employed people, including sellers doing business on the platform.

If you don't know your tax status, you’re probably still a sole proprietor. Changing to a corporation or limited liability company (LLC) requires filing paperwork and paying hundreds of dollars, so you’d remember doing it.

Finally, sellers whose Poshmark activities are just a hobby generally report their income on Form 1040, Schedule 1. In this case, you can use Line 8j, Activity Not Engaged in for Profit Income.

Since your activities don’t constitute a business, you don’t get to claim any expenses associated with your hobby. However, at least you don’t have to worry about keeping track of them.

Whatever category your Poshmark activities belong to, you must record your income and report it on the tax forms we discussed. Fortunately, the platform does most of the work for you.

You should be able to access your sales history from the Poshmark website or mobile app at any time. Just navigate to your account details and look for My Sales Report.

If you meet certain requirements, you should also receive a Form 1099-K. That’s a tax form that reports your annual gross income to you and the IRS, similar to the Form W-2 employees receive.

For tax year 2024, you must have at least $5,000 worth of sales to qualify. However, the IRS intends to lower the threshold to just $2,500 in sales for the 2025 tax year and eventually to $600.

By default, the platform will mail your Poshmark 1099 by January 31. You should receive it sometime in January or February. Alternatively, you can update your account settings and elect to receive a downloadable copy, which should come sooner.

Your sales history and 1099-K form can help you confirm your annual earnings. However, you should also keep your own records and double-check that you agree with Poshmark’s numbers to avoid any mistakes.

As mentioned above, you can likely “write off” tax-deductible expenses if you run a Poshmark business. That reduces your taxable earnings, indirectly lowering the income and self-employment taxes you owe.

However, only certain expenses qualify as tax-deductible. Generally, they must be “ordinary and necessary,” which is basically a reasonableness test. The costs should be typical for your industry and logical for your business model.

For example, some common Poshmark tax deductions include:

Poshmark fees and commissions

Packing and shipping expenses

Payments to suppliers for materials

Labor costs to make products ready for sale

Inventory management and storage costs

Marketing costs (like professional product pictures)

Rent for an office space or the home office deduction

Business portion of internet and phone costs

Business portion of travel and vehicle expenses

If you’d like help figuring out which expenses you can deduct, that’s another good reason to hire a CPA. Fortunately, any fees you pay them are also considered tax-deductible professional service costs.

If you sell on Poshmark for profit, you’re generally considered self-employed. As a result, you owe income and self-employment taxes, but Poshmark won’t withhold them from your earnings like an employer would for their employee.

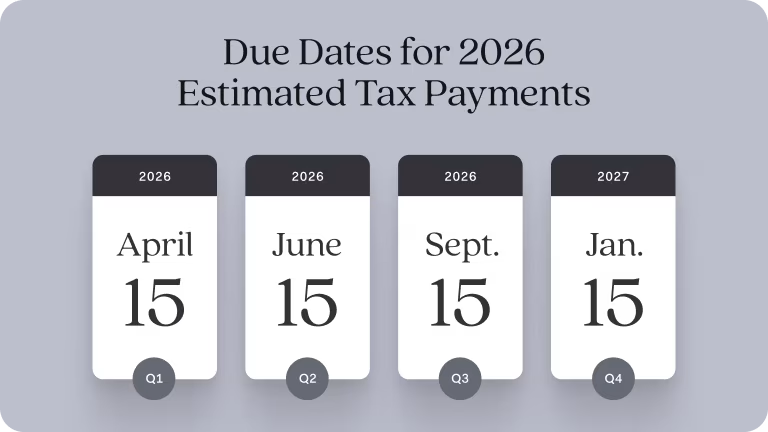

Instead, you must make quarterly estimated tax payments throughout the year. Aim to pay 25% of your projected tax bill via the IRS portal by the following dates:

April 15

June 15

September 15

January 15 (of the next year)

If you're not sure what you'll owe in taxes, use your best estimate. You won't incur any penalties if you pay at least 90% of the taxes you owe for the current year or 100% of the taxes you owed in the previous year.

We’ve covered how to classify your Poshmark activities, keep accurate records of them, and report them on the proper tax forms. You should have everything you need to file your Poshmark taxes!

If you made your estimated tax payments, you should also be safe from underpayment penalties. To avoid late filing penalties, which tend to cost even more, file your tax return or an extension by April 15.

Typically an extension can be filed to allow an additional six months to file tax returns, but you don’t get an extension to pay. Penalties and interest begin accruing as of the original filing date. In addition, payment plans are available if you file on time but don’t have all of the funds available to pay the amount due. Learn more →

You should be able to e-file your Poshmark taxes yourself without too much trouble, but you can also hire a CPA. They’ll take the information you’ve tracked all year and finalize everything for you. And remember, any fee you pay them is likely tax-deductible.

Sign up for Found today and let its powerful features simplify your Poshmark taxes.

Generally, you have to pay taxes on the income you earn through Poshmark unless you’re selling personal items at a loss. However, the amount of income that’s taxable and which taxes the amount is subject to depends on the circumstances.

If your activities qualify as a trade or business, you can subtract tax-deductible expenses from your gross income to reduce the taxable amount. However, you’ll owe income and self-employment taxes.

If you only sell things on Poshmark as a hobby, you don’t get to claim any write-offs. However, the amount you earn is only subject to income taxes. You don’t have to pay self-employment taxes.

Finally, those who sell personal goods at a gain must pay taxes on the difference between their proceeds and what they paid for the item. However, the amount is only subject to capital gains taxes.

The IRS requires that Poshmark send 1099-K forms to sellers who meet certain reporting thresholds. For tax year 2023, that includes those with at least $20,000 in gross income and 200 or more transactions on the platform.

Sellers who live in states with lower qualifying thresholds will also receive a 1099 if they meet the local requirements. In both cases, a copy of your Poshmark 1099 will also go to the IRS.

Usually, yes. Clothing you buy specifically to resell counts as inventory, and you can deduct these costs when the items sell. Keep all your receipts and track each item's purchase price. Remember, you can't deduct personal clothing you later decide to sell - only items bought with resale intent. Your inventory deductions directly reduce your taxable income, keeping more money in your pocket.

Keep all financial records for your Poshmark business for at least 3 years. Essential documents include:

Sales reports (monthly and annual)

Poshmark fee statements

Inventory purchase receipts

Shipping costs and supplies

Business travel mileage

Home office expenses

Using a separate business bank account helps prevent personal and business expense confusion and makes tax time easier. Complete records serve two purposes: they protect you during IRS audits and help identify your most profitable items to boost future earnings.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax advice.

Related Guides

The Guide to Filing 2025 Self-Employment Taxes

Accounting and Taxes

1099-NEC Instructions Explained: What is Non-Employee Compensation?

Accounting and Taxes

A Guide to Small Business Quarterly Taxes

Accounting and Taxes

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. FDIC insurance only covers the failure of an FDIC-insured depository institution.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

¹⁷Cash Back Terms and Conditions apply.

The information on this website is not intended to provide, and should not be relied on for, tax or legal advice.

Found partners with various providers to enable you to compare offers from participating institutions, such as lending, filing service, and insurance providers. Found is not a lender, a filing service, nor an insurance provider.

This website contains advertisement of Found and third party products and services.

According to NerdWallet, Found is the Best Business Checking for Paying Contractors and Saving for Taxes. (Source)

Terms of Service ・ Privacy Policy ・ Accessibility statement ・ © 2026 Found