As a DoorDash driver, you're typically classified as an independent contractor—which means you'll file taxes as a sole proprietor using Schedule C, pay self-employment tax (15.3%) on top of regular income tax, make quarterly estimated tax payments, and track deductible expenses like mileage to reduce what you owe.

That's more complicated than a traditional W-2 job, and DoorDash won't withhold taxes or tell you how to handle any of it. But it's manageable once you understand the basics. This guide walks you through each step so you can stay compliant and keep more of what you earn.

As a DoorDash driver, you’re considered an independent contractor. That makes you self-employed, not a W-2 employee. DoorDash won’t send you a W-2 form or withhold taxes on your behalf.

As a result, your net business earnings for the year (business income minus tax-deductible business expenses) are generally subject to ordinary income taxes and self-employment taxes.

Ordinary income taxes are progressive, which means the more money you make, the higher the tax rate on the most recent dollar you earned. The federal tax brackets range from 10% to 37% in 2026.

Self-employment taxes refer to Social Security and Medicare taxes. Employees share these taxes with their employers, with each party paying 7.65%. Self-employed people pay it alone, so their effective tax rate is 15.3%.

In addition, you have increased tax obligations throughout each calendar year and at tax time, including:

Completing additional self-employment tax forms, such as a Schedule C

Tracking your business income and expenses

Making quarterly estimated tax payments

Let’s look at each of these responsibilities in more detail to help you understand what they mean and how to stay on top of them.

Self-employed people are sole proprietors by default, including DoorDash drivers. That’s probably what you’ll file your taxes as since you must pay hundreds of dollars and do a lot of paperwork to become something else.

Assuming you’re filing as a sole proprietor, you’ll be responsible for completing the following additional tax forms and submitting them alongside your tax return:

Schedule 1: This is the form where you report your net business earnings and any other income that isn’t wages.

Schedule C: On this form, you must provide the details of your business income and expenses. It shows how you got to the net business earnings on Schedule 1.

Schedule 2: This is the form where you report the self-employment tax amount you owe for your net business earnings. You must also report taxes on any other income you have that isn’t wages.

Schedule SE: This is where you show how you calculated the amount of self-employment taxes on your Schedule 2.

These forms are all supporting schedules that tell federal and state tax agencies how you arrived at the numbers on your Form 1040. That’s the official name for the document we refer to as your “tax return.”

All individuals in the United States with enough taxable income must file one, regardless of their employment situation. It summarizes your tax situation and displays personal information like your Social Security Number and address.

To complete your DoorDash taxes, you must track your total earnings each year. Generally, Dashers have the following three sources of income:

Base pay

Promotions

Customer tips

However, you don't need to distinguish between these sources on your tax return. They all fall into the same category for tax purposes: business income.

And conveniently, DoorDash keeps records of the amounts for you. You can find them by going into the Dasher app and selecting Earnings. You should also receive a copy of Form 1099-NEC confirming your total for the year.

To receive an electronic copy, you must create a Stripe Express account. If you haven’t already, DoorDash should send an email by December 31 of the tax year to help you initiate the process, assuming you earned more than $600 over the last 12 months.

If you complete the steps necessary to receive an electronic copy, you should get it by January 31 after the tax year. If not, you’ll receive a paper copy, but that could take up to ten business days more.

A “tax deduction,” also referred to as a “write-off” or “business expense,” is a cost you incur in the normal course of business. It must be “ordinary and necessary,” which basically means someone reasonable should see that it furthers your business goals.

As a self-employed person, you can claim these deductions on your tax return and subtract them from your business income. That reduces your net business earnings, lowering the amount you pay taxes on.

Let’s look at some common examples of potential tax deductions for Dashers.

As a DoorDash driver, most of your tax deductions will probably be vehicle-related expenses. It costs a lot of money to use and maintain a car, and since driving is usually necessary for deliveries, the associated bills are generally tax-deductible.

Here are some examples of vehicle expenses you can usually write off:

Gas and fuel costs

Parking fees and tolls

Auto insurance

Registration charges

Repairs and maintenance

Asset depreciation

Lease payments

Interest portion of auto loan payments

However, because you probably don’t use your vehicle exclusively for business, you probably can’t deduct the entire amounts. Only the business-related portion of your vehicle costs are tax-deductible. There are two methods of calculating that.

Actual expense method: This requires tracking all your vehicle expenses and your personal and business mileage. Calculate the percentage of miles you drove for business, multiply it by your vehicle costs, and deduct the result.

Simplified method: This requires that you track your business mileage. Just multiply the number by the standard rate (72.5 cents in 2026).

Both options are viable, so it’s a good idea to calculate both and take the higher one.

If you opt for the actual expense method, you can’t switch to the simplified method until you get a new vehicle. It’s important to do the math the first year to choose the higher one! Learn more →

Besides vehicle costs, you can also deduct the other miscellaneous expenses you incur while Dashing. For example, that includes the business portion of your phone bills since you need the device to access the DoorDash mobile app.

It might also include the costs of accessories you use to store and transport deliveries, such as coolers and freezer bags. If you’re unsure whether something is a valid deduction, consult a tax expert, such as a Certified Public Accountant (CPA).

Incidentally, any fee you pay for professional tax help is likely a write-off, so don’t hesitate to take advantage of it!

Because Dashers are self-employed, you’re not subject to tax withholding and must make estimated tax payments instead. The only exception is if you expect to owe less than $1,000 in ordinary income and self-employment taxes for the year.

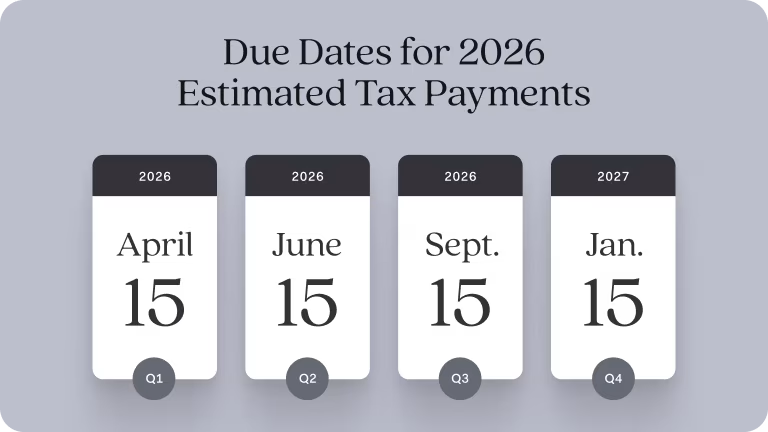

Assuming you don’t qualify for that exemption, you should estimate the amount of taxes you expect to owe at the end of the year and make a payment for 25% of it on the following days:

April 15

June 15

September 15

January 15 (of the next year)

Fortunately, you don’t actually have to predict your net business earnings perfectly. You won’t incur any penalties as long as you pay 100% of the taxes you paid in the previous year or 90% of the taxes you owe in the current year.

With records of your business income, tax deductions, and estimated tax payments, you should be well-equipped to file your DoorDash taxes. That should be all you need to fill out your Form 1040 and the accompanying schedules.

Once you’ve completed your tax return, you must file it by April 15 to avoid penalties. If you file an extension, your due date to file becomes October 15, but you still have to pay all the taxes you owe by April 15.

It’s usually best to file returns electronically. That way, you can be sure it gets delivered, and the process will move much faster. You’ll get any tax refund you’re owed significantly sooner than you would if you sent a paper copy.

If all of this tax stuff still sounds like too much work, don’t worry. You can streamline a lot of the most tedious aspects using Found! It’s a business checking account designed to simplify the paperwork-related parts of self-employment, including taxes.

For example, Found can give Schedule C filers a live estimate of their future tax bill and set aside a portion of your income to help you save for your estimated tax payments. It can also help you track your tax deductions, helping you save money come tax time. Sign up for Found today!

No. DoorDash doesn't withhold taxes because typically drivers are classified as independent contractors, not employees. Instead, you're most likely responsible for making quarterly estimated tax payments to cover both ordinary income tax and self-employment tax.

The IRS will charge you penalties and interest on unpaid taxes, and those charges continue to accrue until you pay. Because DoorDash sends a copy of your 1099-NEC directly to the IRS, they already know how much income you earned—so unpaid taxes will eventually result in a letter demanding payment.

It depends on your circumstances. DoorDash earnings are subject to 7.65% more in Social Security and Medicare taxes than W-2 wages, which makes gig work less tax-efficient on paper. Whether it's worth it comes down to whether you could earn more after taxes through other opportunities—and how much you value the flexibility.

Most Dashers earn $10 to $25 per hour before expenses and taxes, though this varies by location and strategy. Your net earnings are taxed at federal income tax rates (10% to 37%) plus the 15.3% self-employment tax. To estimate your actual take-home, you'll need to project your income, subtract deductible expenses like mileage, and calculate the taxes owed on what's left.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax or legal advice.

Related Guides

The Guide to Filing 2025 Self-Employment Taxes

Accounting and Taxes

1099-NEC Instructions Explained: What is Non-Employee Compensation?

Accounting and Taxes

A Guide to Small Business Quarterly Taxes

Accounting and Taxes

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. FDIC insurance only covers the failure of an FDIC-insured depository institution.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

¹⁷Cash Back Terms and Conditions apply.

The information on this website is not intended to provide, and should not be relied on for, tax or legal advice.

Found partners with various providers to enable you to compare offers from participating institutions, such as lending, filing service, and insurance providers. Found is not a lender, a filing service, nor an insurance provider.

This website contains advertisement of Found and third party products and services.

According to NerdWallet, Found is the Best Business Checking for Paying Contractors and Saving for Taxes. (Source)

Terms of Service ・ Privacy Policy ・ Accessibility statement ・ © 2026 Found