Keila Hill-Trawick

CPA and Founder,Little Fish Accounting

As an entrepreneur, you wear many hats. As a small business owner myself, I know firsthand that doing the work and running the business are two different roles in the business. Those complex matters can get daunting fast, especially when it comes to finances. Considering taxes year-round instead of just at tax season allows you to feel more confident when it’s time to file your return, and helps you to be a more informed business owner overall.

As the Founder and CEO of Little Fish Accounting, our motto is “small business doesn’t mean small impact.” Our team has created a safe space for business owners—such as coaches, consultants, makers, and service providers across all industries—to face their fears head-on. We’ve seen our fair share of mistakes along the way, and today I want to share some common tax mistakes and, most importantly, how to avoid them.

When you decide to go into business, one of the first steps you’ll probably take is to open a business bank account. The immediate next step has to be making sure that only business transactions flow through it. You’ll want to ensure that any money received for the work you do is always deposited to the business account (even if you need it). Mixing business and personal transactions between accounts is a no-no, and it’s a mistake I see clients make often.

It can be hard to keep business and personal separate, especially when starting or having cash flow issues. Instead of paying personal expenses from your business account, withdraw or transfer the funds needed from your business account to your personal bank and spend it however you like! And avoid paying for business expenses from your personal bank account. Why? They are often forgotten by the end of the year, which can cause you to miss out on tax deductions.

Are you tracking what you spend and how on a regular basis? If not, you could be creating more stress for yourself around tax time. Having the right numbers to go into your tax return ensures that you’re not paying more tax than you’re supposed to, and it helps avoid amendments needed down the line if corrections end up being required to get your totals right.

Make sure to use your accounting system to categorize expenses weekly so that you’re not trying to do it all at once at the end of the year. In addition to making tax season more seamless, you create accurate financials that you can use throughout the year to make strategic decisions. Making sure that all income and expenses are tracked properly and that you are reconciling bank and credit card accounts to make sure you caught everything makes it easier for you to pull financial reports in real-time so that you can reflect on how the previous period went and plan for the future to grow your business.

There are quite a few dates throughout the year to pay attention to as a small business owner, but these are the big ones:

March 15: Deadline for Partnership and S-Corp tax returns

April 15: Deadline for Corporation and Individual Tax Returns

If you know that you aren’t prepared to have all of your documents together to submit your return on time, you should consider filing an extension to give you more time to get ready.

Tip: Keep in mind that an extension can be filed to allow an additional six months to file tax returns, but you don’t get an extension to pay. Penalties and interest begin accruing as of the original filing date. In addition, payment plans are available if you file on time but don’t have all of the funds available to pay the amount due.

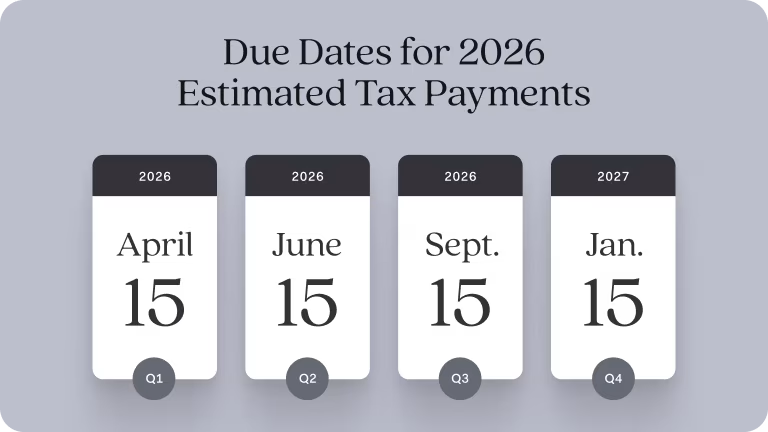

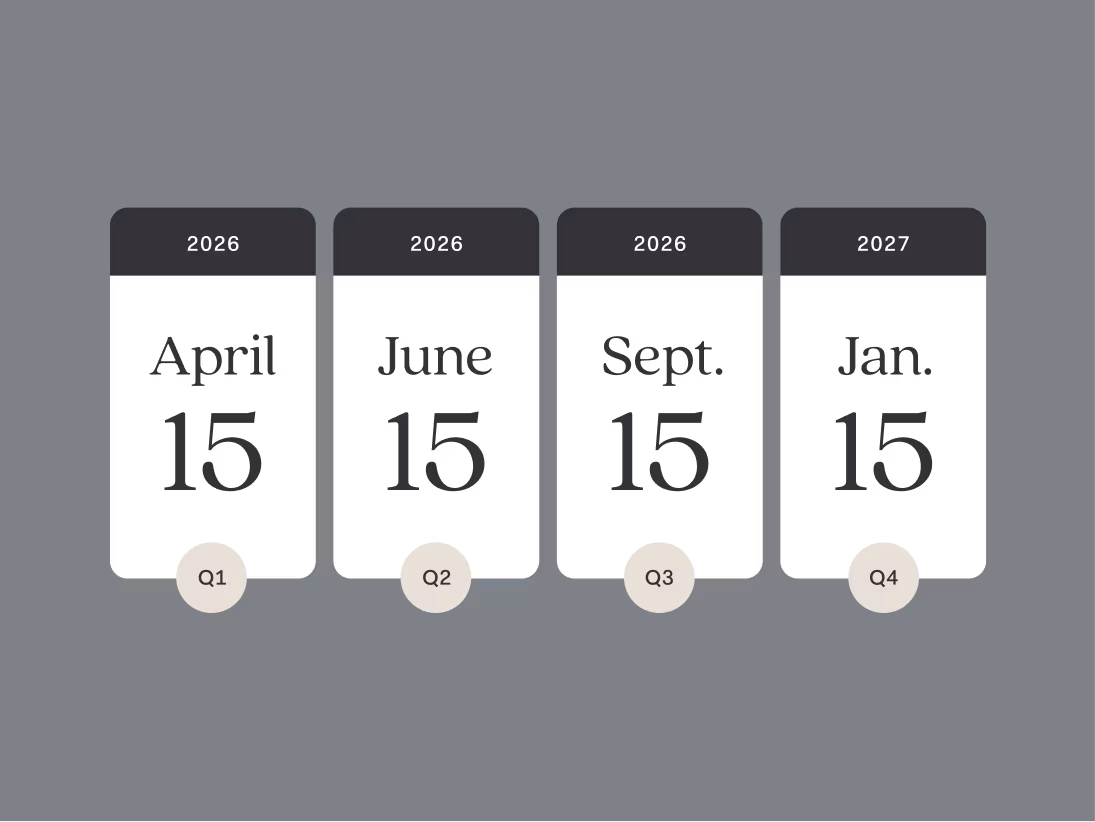

The IRS generally requires that you make quarterly estimated tax payments if you expect to owe at least $1,000 in taxes for the year. These payments can be made directly online using the following deadlines:

Q1 (January 1 - March 31): due April 15

Q2 (April 1 - May 31): due June 15

Q3 (June 1 - August 31): due September 15

Q4 (September 1 - December 31): due January 15

If a deadline falls on a weekend, it is generally due the next business day. One good habit is to mark these tax deadlines on your calendar to always be prepared for the upcoming dates.

One of the worst feelings about taxes is the element of surprise. I’ve seen countless entrepreneurs enter tax season with no idea how much money they’ll owe and no idea how to prepare so they’re not shocked by a tax bill. But there are ways to know what you’ll potentially owe early enough to prepare so you’re not caught off guard when you file your annual tax return.

If you’re not sure how much to set aside, you can start by looking at your prior-year tax return. Here are a few things to look for:

You should find vouchers that provide a safe harbor payment to help guide you to avoid underpayment penalties if you haven’t submitted enough by the time you file.

Your prior tax return reflects your most recent tax bracket. Tracking your income and expenses throughout the year tells you your profit, which is what you’ll ultimately be taxed on. If you keep up with your bookkeeping throughout the year, you can get a more accurate reflection of taxes due, which is especially helpful if you make significantly more or less than last year.

We recommend that business owners keep their savings for tax payments in a separate place so that it’s clear that this money is allocated for something outside operational expenses.

Tip: Found makes it easy to see real-time tax estimates, and save for those tax payments. As you earn and spend, Found updates your tax estimate so you'll have an ideal of what to expect when your next tax payment is due.

With Found’s pockets feature, if you’re a Schedule C filer, Found’s auto-save feature will set aside money for taxes when you get paid, and automatically allocate those funds to your Taxes pocket.

Taxed as an S-Corp? You can choose the deposit allocations for your Taxes pocket to build up your tax savings all year long. You’ll see this money build up over time and know you’re prepared when it comes time to make your payments.

This mistake won’t apply to everyone but comes up often for small business owners who are unsure as to how their taxes will work. A tax entity is the legal structure under which a business operates, such as a sole proprietorship, partnership, corporation, or limited liability company (LLC), determining how the business's income is taxed.

Solopreneurs and single-member LLCs file business income and expenses on Schedule C, which is part of the individual tax return (Form 1040).

Partnerships and multiple-member LLCs file a partnership return, which is separate from the individual 1040 with a different due date. The result of this return is a K-1 for each partner, which is then used on the individual return to determine taxes due.

Businesses that have elected to be treated as an S-Corp will also have a separate return, with K-1s for each member. Like partnerships, an S-Corp is a passthrough at the Federal level, and taxes due will be reflected on individual returns.

For all of the entity types listed above, taxes are generally paid to the IRS at the individual level. Entrepreneurs can better plan for tax filing fees and expected timelines based on the type of entity you’re running, and be made aware of specific nuances based on that choice.

For example, how you categorize money withdrawn, including paying yourself, is affected by which business entity type is assigned to your company. In addition, all states have their own rules about how to handle taxes for these entities, and you’ll want to be aware of those requirements as well, which leads me to the last mistake we see small businesses make when it comes to taxes.

Self-employed individuals wear many hats, and tax professionals aren’t usually one of them. You may not always have the time or expertise to fully understand your tax obligations, leading to expensive mistakes and sleepless nights.

If your return involves a complex business structure, multiple types of income, or lots of unorganized receipts and documentation that you don’t have time to review—and if you’re not confident about filing on your own—then hiring a CPA is a great option.

Accountants offer a variety of services that range from regular bookkeeping to tax prep to tax strategy. If you don’t know what you need, most firms will offer introductory calls to help you see what service makes the most sense for your business. For example, at Little Fish Accounting, we offer year-round tax support through our Tax Prep Suite that includes handling your quarterly and annual returns and semi-annual tax planning sessions. If you want additional support like weekly bookkeeping, monthly reports and calls, and budget forecasting, we offer Fractional CFO services.

Learn more: As tax season gets busier, the availability of tax professionals may become limited. You might find many professionals aren’t accepting new clients. Don't wait until it's too late to seek professional help and hire a CPA.

When you’re ready to bring someone on board to support you, you can’t just hand off finances completely. You’ll still want to make sure your business expenses are separated in your business account and you’re staying on top of bookkeeping. Found’s all-in-one banking platform can help you manage your bookkeeping and track your tax deductions. You can also give your accountant access to your Found account to access your account activity, profit and loss report, and tax documents.

A final word of encouragement from someone who has been there: At the end of the day, you didn’t start your business to just focus on taxes. There is much to remember and be responsible for, and it’s normal to make mistakes along the way. The important part is to learn as much as you can at the beginning so that you are better prepared in advance. The more organized you are approaching tax season, the less stressful the whole experience will be.

How you handle your business finances can have a profound impact on your mental health and overall satisfaction, too. Remember, your business's financial health directly impacts your personal well-being. By prioritizing sound financial management practices, you're not only safeguarding your business but also protecting yourself from the pitfalls of burnout.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax advice. Found is not a filing service, Found partners with Turbo Tax for filing. Restrictions may apply, see Turbo Tax terms.

Related Guides

17 Tax Deductions for Freelancers and Small Business Owners

Accounting and TaxesThe Ultimate Guide to Self-Employment Taxes

Accounting and Taxes

2026 Tax Deadlines for Small Business Owners

Accounting and Taxes

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. FDIC insurance only covers the failure of an FDIC-insured depository institution.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

¹⁷Cash Back Terms and Conditions apply.

The information on this website is not intended to provide, and should not be relied on for, tax or legal advice.

Found partners with various providers to enable you to compare offers from participating institutions, such as lending, filing service, and insurance providers. Found is not a lender, a filing service, nor an insurance provider.

This website contains advertisement of Found and third party products and services.

According to Nerdwallet, Found is the best banking option for self-employed business owners. (Source)

Terms of Service ・ Privacy Policy ・ Accessibility statement ・ © 2025 Found