For FY 2023, the Internal Revenue Service (IRS) received more than 11 million tax returns from partnerships and S corporations. If you own a stake in one of those entities–or are the beneficiary of a trust or estate–you should receive a K-1 each year detailing your share of its annual activities.

You must be able to interpret the document to complete your individual tax return. Let’s explore how to read a K-1 and provide some context that will help you understand the role it plays in your taxes.

A K-1 is a tax schedule you may receive from certain types of pass-through entities. Pass-through entities get their name from the fact that they don’t pay taxes themselves. Instead, their income, deductions, and credits ‘pass through’ to their owners or beneficiaries, and K-1s report each individual’s share of those activities.

K-1s are informational returns, like 1099-Ks and W-2s. If you receive one, you must claim the amounts it shows on your tax return. A copy also goes to the IRS, helping the tax agency confirm that you’re reporting your earnings accurately.

The following types of entities may issue K-1 schedules:

Partnerships

S corporations

LLCs taxed as partnerships or S corps

Certain trusts and estates

If you’re self-employed, you’re most likely to get a K-1 because you own a stake in a business structured as a partnership or S corporation.

Some exchange-traded funds (ETFs) operate as limited partnerships and issue K-1s to investors, such as the United States Copper Index Fund. If you get a K-1 and don’t know why, it could be because you invested in a similar ETF.

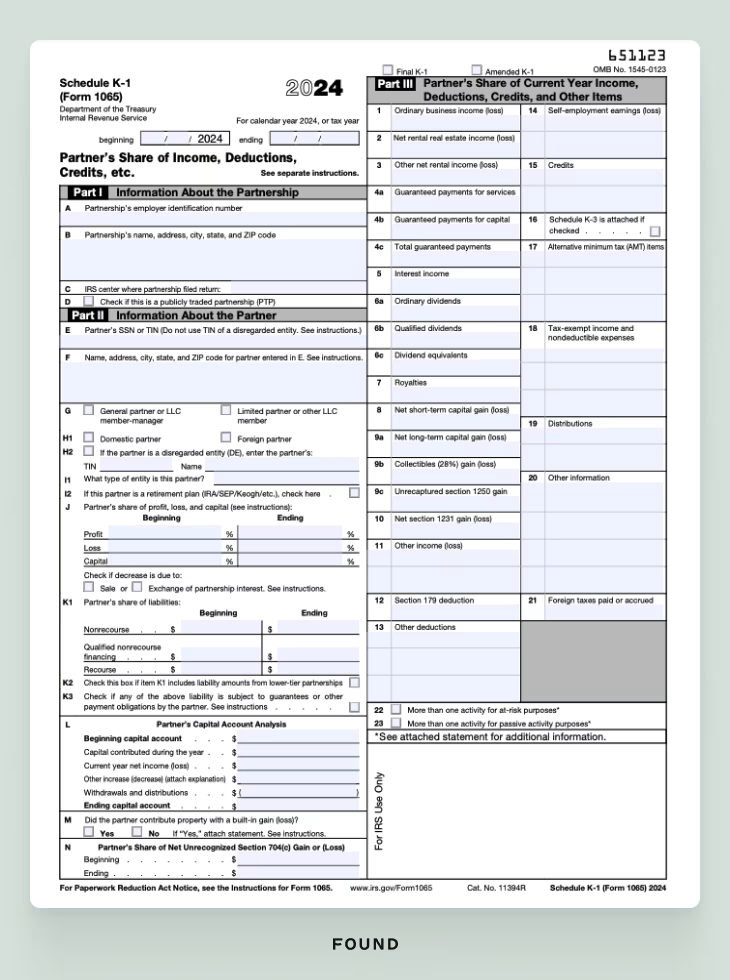

Each type of pass-through entity issues its own variation of the K-1 form, but the differences between them are mostly superficial. Here’s how to read a K-1 of any type.

Part I of every K-1 schedule provides basic identifying information about the issuing entity, whether that’s a partnership, S corporation, trust, or estate. For example, that generally includes the:

Issuing entity’s employer identification number (EIN)

Issuing entity’s name and address

IRS center where the issuing entity filed their return

The primary purpose of this section is to help you make sure you’re getting a K-1 from the right entity. If you believe you received a K-1 in error, reach out and ask the issuer to amend the document.

Part II of a K-1 schedule contains information about you, the recipient of the K-1. In addition to identifying information like your taxpayer ID number (TIN), it displays some of the first details you may need to complete your tax return.

For example, depending on the type of issuing entity, that can include:

Your percentage share of profits, losses, and capital

Your capital account, which tracks your equity in the entity

Your outstanding loans to the entity at the start and end of the year

You should already have some record of this information, so make sure that it matches your expectations. If the issuer misentered certain details, you should again have them amend their mistake to avoid complications.

Part III is the meat and potatoes of your K-1 schedule. It’s where you’ll find the amounts you need to report on your tax return to capture your share of the issuing entity’s activities for the year. For example, that may include:

Ordinary business income or losses

Self-employment earnings or losses

Ordinary and qualified dividends

Short-term and long-term capital gains or losses

Section 179 depreciation and other tax deductions

These amounts reflect the portion of the issuer’s activities allocated to you based on the percentages laid out in its formative documents. For partnerships and S Corps, you can find the percentages in your operating agreement. For trusts and estates, they should be in your trust agreement or estate plan.

For example, say you’re a shareholder in an S corporation called ABC Corp, and your operating agreement assigns you a 30% allocation percentage. If ABC Corp were to net $250,000 of ordinary business income for the year, expect your K-1 to show $75,000 in Box 1 of Part III.

There are three main tax filing duties associated with K-1 schedules. Here are the basics of how to perform them and who’s typically responsible for each:

Filing the entity’s tax return: Pass-through entities don’t owe taxes on their earnings but still have to file an annual return. The responsibility usually falls to a head owner or officer, such as a general partner, majority shareholder, trustee, or executor. Partnerships file Form 1065, S corps use Form 1120-S, and trusts and estates both use Form 1041.

Sending K-1 schedules to stakeholders and IRS: The individual who files the pass-through entity’s tax return is also responsible for completing the K-1s schedules. They must send each relevant stakeholder a copy of their K-1 and file them all with the entity’s tax return.

Claiming K-1 income on individual tax returns: Each partner, shareholder, or or beneficiary must report their K-1 activities on their personal tax returns. Since the issuer should’ve already sent the IRS a copy, you don’t need to include your K-1 with your return.

Whether you’re responsible for preparing K-1 schedules or just reporting their amounts on your personal returns, your tax situation is likely complex enough to warrant hiring a Certified Public Accountant (CPA).

Reporting K-1 activities can be surprisingly complex. For example, if your K-1 shows a loss, there are several limitations on how much you can claim, including basis limitations, passive activity limitations, and at-risk limitations.

To save yourself the headache and avoid costly mistakes, it’s often worth letting an expert handle the tax preparation for you. Fortunately, whatever professional service fees you pay are likely tax deductible. Here’s how to hire a CPA →

Partnerships and S corporations must file their K-1s and send copies to each business owner by the fifteenth day of the third month following their tax year. For example, the K-1 deadline for calendar-year partnerships and S corps is March 15.

You can file a six-month extension to push it back to September 15, but that often forces each owner to file an extension too. Otherwise, they may not get their K-1s in time to file their returns by their original due date, April 15.

Trusts and estates must file their K-1s by the fifteenth day of the fourth month after their tax year. When they follow the calendar year, their K-1 deadline is April 15. As a result, beneficiaries also usually need an extension to file their individual returns.

For each K-1 you send to a partner, shareholder, or beneficiary after the deadline, the IRS can impose a penalty that starts at $310.

Reading K-1 schedules is far from the only tax challenge self-employed people face. You also have to stay on top of your bookkeeping, set aside funds to cover estimated tax payments, and complete complex tax returns.

Juggling all of these responsibilities on top of running your business can be overwhelming, but Found can help streamline many of them. For example, our platform provides:

A business bank account to separate your personal and business transactions

Automation software that helps you track your income and categorize your deductions

The ability to automatically set aside a percentage of all deposits for estimated taxes

Automatic transference of the financial data tracked in Found to Schedule C

Found was built with one goal in mind: to make life easier for the self-employed. Open an account and simplify your taxes so you can focus on growing your business.

K-1 income is non-taxable at the entity level but gets allocated to certain owners or beneficiaries and taxed at the personal level. However, there are multiple types of K-1 income, including interest, dividends, and capital gains, all of which are taxed differently.

For self-employed people, the most significant type of K-1 income is often ordinary business income, which is subject to ordinary income and self-employment taxes. For partners and S corp shareholders, the amount is in Box 1 of your K-1.

K-1s are due on March 15 for calendar-year partnerships and S corporations. For calendar-year trusts and estates, they’re due on April 15.

Form 1065, the U.S. Return of Partnership Income, is the tax form partnerships use to report their annual activities to the IRS. Partnerships must file it along with K-1 schedules for each of their partners.

Form 1120-S, the U.S. Income Tax Return for an S corporation, is the tax form S corporations must use to report their annual activities to the IRS. Like partnerships, they must file it alongside K-1 schedules for each shareholder.

Trusts and estates must file Form 1041, Income Tax Return for Estates and Trusts, when they earn $600 or more during a tax year. If they distribute property or allocate an item to any beneficiaries, they must also file K-1 schedules for those individuals.

The information on this website is not intended to provide, and should not be relied on, for tax advice.

Related Guides

Understanding the Schedule C Tax Form

Accounting and TaxesA Step-by-Step Guide to Filling Out the Schedule SE Tax Form

Accounting and Taxes

1099-NEC Instructions Explained: What is Non-Employee Compensation?

Accounting and Taxes