As your business grows and your team expands, we’ve got you covered.

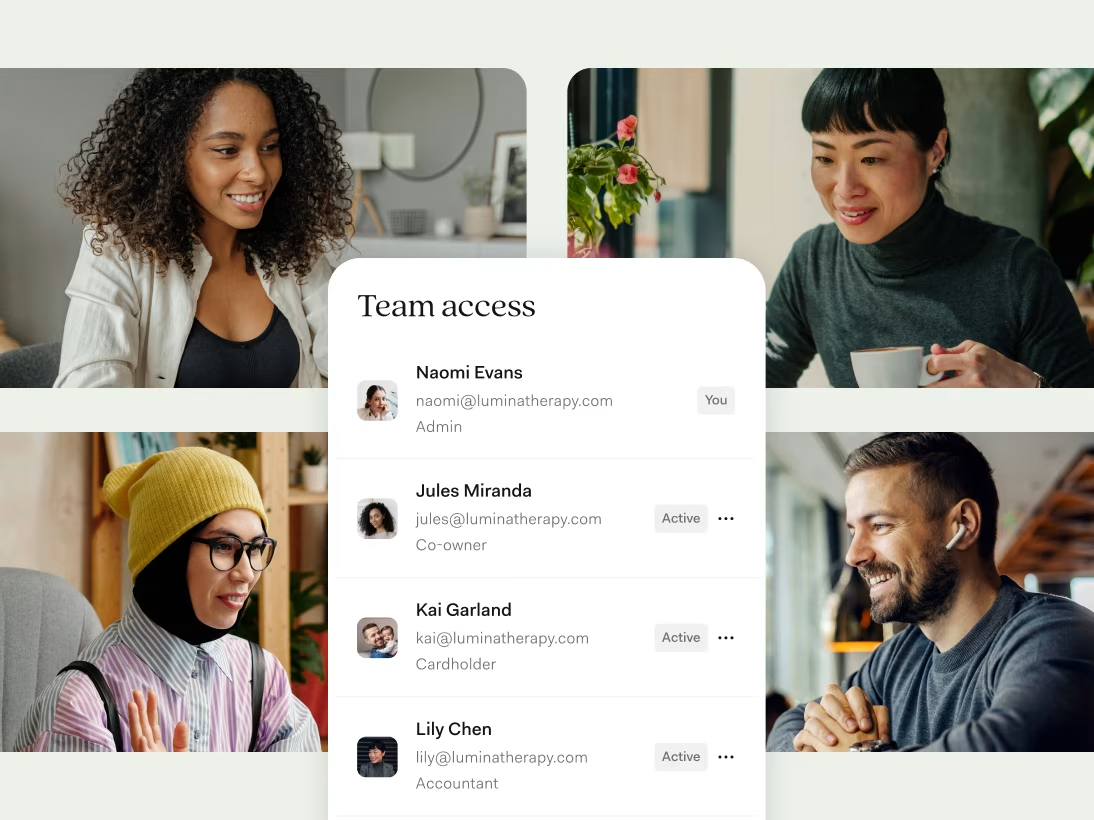

We’re excited to introduce our new “Team Access” features that make it easier to collaborate on your finances with different people on your team. Empower co-owners and senior employees with Admin access and share dedicated debit cards² with any team member so they can responsibly spend for your business. Throughout the year, collaborate with your bookkeeper or accountant by sharing Accountant access to your activity, reports, and tax forms.

Here’s how to get the most out of Found with a growing team:

Invite up to ten people to become an “Admin” on your account, so they have full access to managing your team’s finances on Found.

Admins can deposit money, order cards, make payments, and more. They can also view all account activity and even comment on transactions, which is a handy way to ensure you’re on the same page about the details of specific expenses or deposits.

This is great for co-owners, spouses, senior team members, or anyone else you want to have full account access.

Learn more: How do I share admin access? →

Admins will get their own login and can order their own physical Found debit card² in their name for an additional $5 per card.

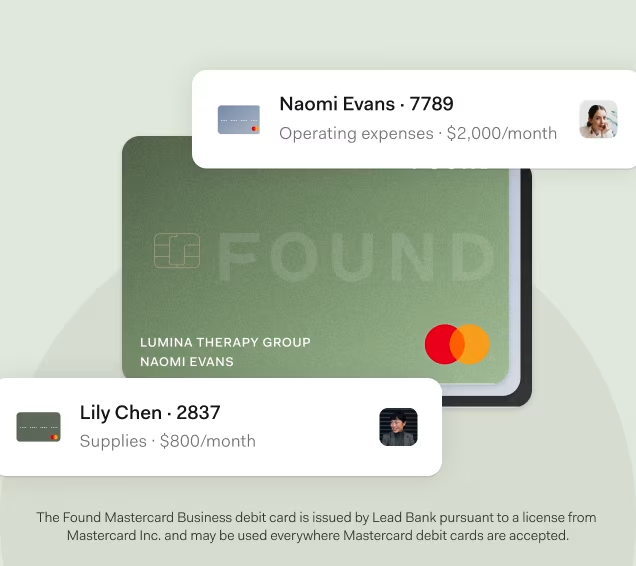

Share debit cards with team members so that they can spend on behalf of your business—from office supplies, gas, and other ongoing expenses to “per diem” allowances for meals or travel.

To ensure employees are spending responsibly, set custom spending limits per card and get real-time alerts when team members make purchases on these cards. Easily filter your activity to see transactions and reporting by card.

Learn more: How can I share additional cards with team members? →

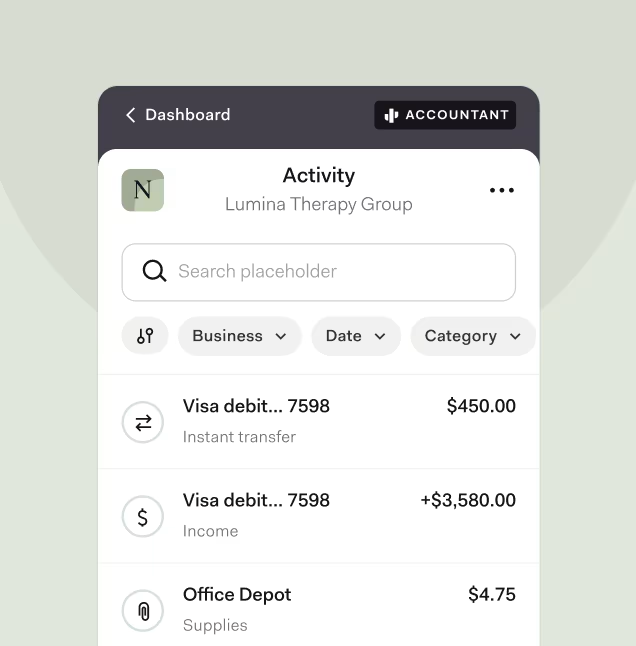

Found customers can also share account access with their accountant or bookkeeper to securely collaborate with these financial professionals.

People with the “Accountant” role can view a business owner’s transactions and reports, export tax documents, and more. Like admins, they can also comment questions about specific transactions from right within Found and categorize transactions accordingly—no more downloading statements, taking screenshots, or sending long emails.

Found also has features to pay your people, whether they’re a part-time contractor or a full-time employee.

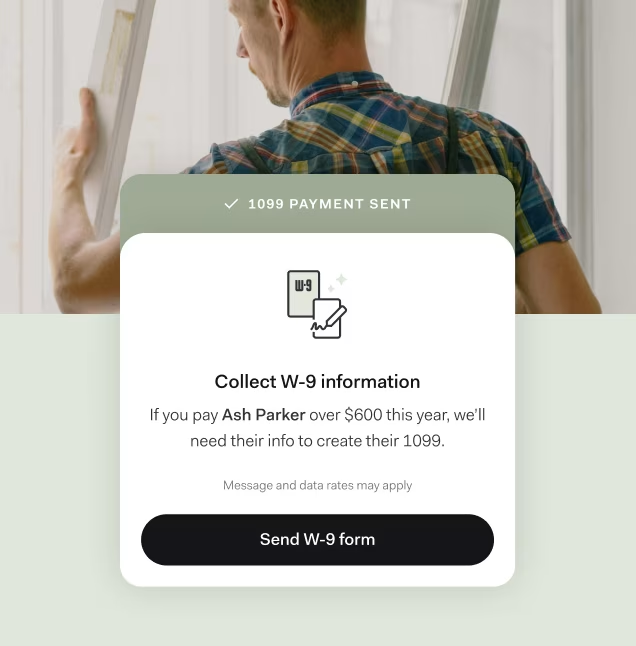

1099 contractors: Easily onboard 1099 contractors that your business hires, pay them for their services, and stay on top of the tax paperwork needed to report those payments. Found will auto-categorize these payments as “Contractor Services” in your account, log them as a deduction, and update your tax estimate and P&L report accordingly.

At the end of the tax year, Found will create your 1099-NEC forms based on all tracked payments over $600. You can then easily share a copy with your contractors and e-file these forms via the Found app—all without any per-contractor fees.

Learn more: Guide to Managing Contractors on Found →

W-2 employees: While Found is not a payroll provider, you can pay W-2 employees using a payroll provider of your choice and have them pull funds from your Found account.

Tip: Proactively set aside money into a Payroll Pocket and then have your payroll provider pull funds directly from that Pocket via its dedicated account number.

We recommend using our preferred partner Gusto to manage payroll, benefits, and other HR activities for W-2 employees. You can get one month free when you sign up with Found through this link.