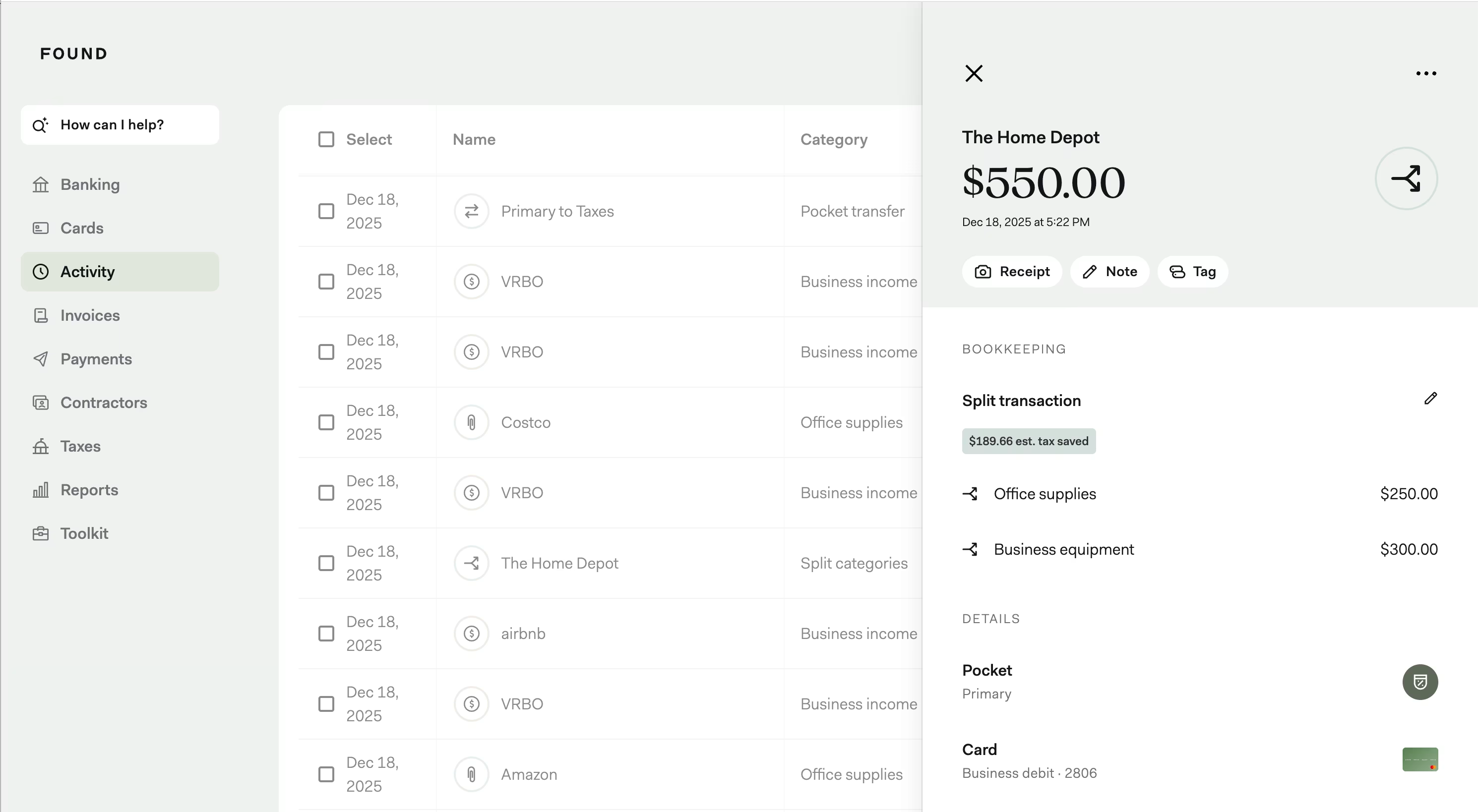

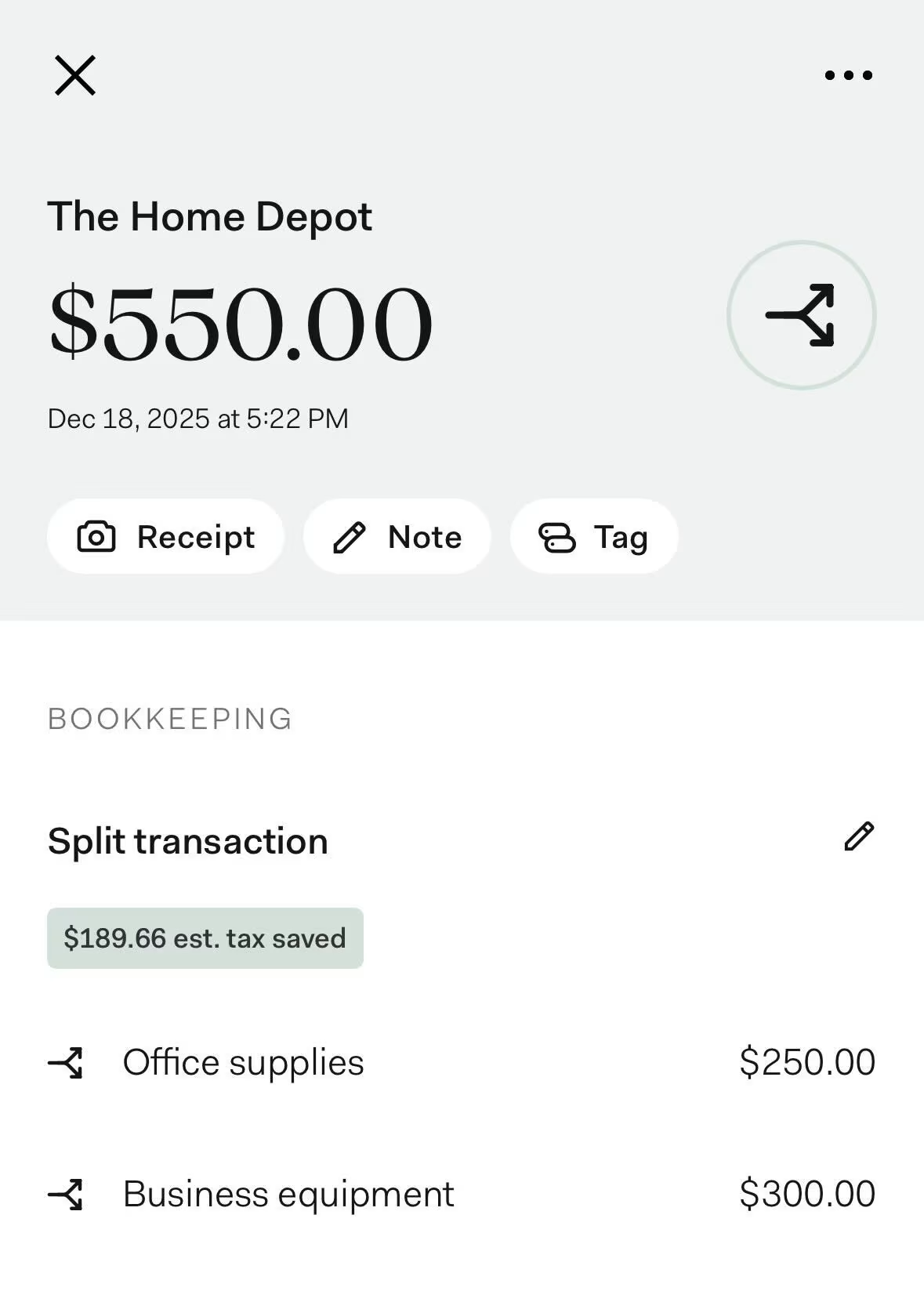

You can split income or expense transactions in your Activity feed to apply multiple categories. These split transactions help you accurately maintain your bookkeeping.

For instance, you may want to separate a payment from a client into two portions: one for business income and one for a reimbursement. Or, maybe you bought many different items for your business in one purchase and want to split that purchase to accurately categorize those items.

To split a transaction in Found:

Go to your Activity feed

Select the transaction that you'd like to split

Select Split

Enter the amount of the the first split and choose a category

Select Add a split

Assign the remaining amount and category to your second split or select Add a split again until the entire transaction is accounted for.

For income transactions, each split must also be assigned an income category and treated as income. For expense transactions, each split must be assigned an expense category and treated as an expense.

Please note that pending transactions and manually added transactions cannot be split.