We’re all familiar with taxes. However, most of us are only familiar with one kind of tax—income tax. As a self-employed person, you’re still responsible for paying income taxes. Additionally, you’re also required to pay what is known as self-employment tax.

Self-employment tax is a tax that self-employed individuals pay to cover Social Security and Medicare contributions. As of 2025, the self-employment tax rate is 15.3%. This tax ensures that everyone contributes to these government programs (W-2 employees have these taxes taken out of their paychecks automatically).

Collectively, these are known as FICA taxes—FICA stands for Federal Insurance Contributions Act. Self-employment tax is essentially equivalent to FICA tax for self-employed individuals.

If you’ve ever worked as a W-2 employee, you may notice that the self-employment tax is more than what you’re used to paying for Social Security and Medicare. That’s because W-2 employees split these taxes with their employers, while self-employed people are responsible for both portions (you are the employer, after all).

Self-employed people pay two types of taxes: income tax and self-employment tax (15.3%). We've established what self-employment taxes are—but how much do you owe?

You typically must pay self-employment tax if you earn $400 or more in net self-employment income for tax year 2025. This is true whether you made that money from a side hustle, a full-time freelancing career, a small business, or any other form of self-employment.

The amount you'll owe the IRS depends on your total net income from self-employment. That means the money you make minus your expenses (more on this below).

Self-employment tax owed = (Income - Expenses) × 15.3%

Here's how to calculate it: First, subtract your business expenses from your income. Second, multiply the result by 15.3%.

For example, let's say you make $50,000 in self-employed income and have $10,000 in expenses. That means your taxable income is $40,000. If you take 15.3% of $40,000, you’ll likely owe $6,120 in self-employment taxes to the IRS for 2025.

Everyone files taxes at the same time, whether self-employed or not. This means you’ll still file an annual tax return at the same time as everyone else. However, there is a difference between filing taxes and paying taxes. As a self-employed person, you’re responsible for making quarterly estimated tax payments.

Self-employed individuals must make quarterly estimated tax payments. These payments are exactly what they sound like—you estimate how much you think you'll owe in self-employment tax and income tax for the quarter and make the payment. Then, when you file your annual return, you'll file against these estimated payments. If you underestimated, you'd owe some additional tax money, but if you overestimated, you'd likely get a refund.

The IRS typically charges a 0.5% penalty per month for unpaid quarterly taxes, up to 6% annually. So, for example, if you don't pay any quarterly taxes, your penalty will be likely 6% of the total taxes you owe.

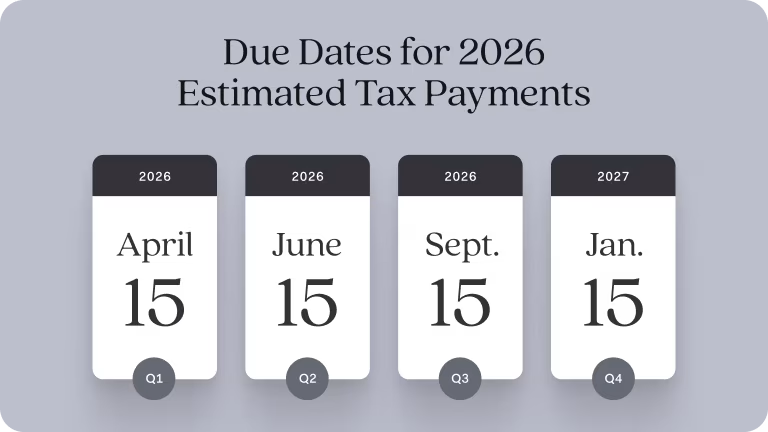

The annual deadline to file self-employment taxes is April 15, 2026 for tax year 2025. However, quarterly payment deadlines for 2025 estimated tax payments are:

Q1: April 15, 2025

Q2: June 16, 2025

Q3: September 15, 2025

Q4: January 15, 2026

The most common tax forms used by self-employed individuals are:

Schedule C: Schedule C (Form 1040) reports business income and expenses for sole proprietors. This is typically the primary form you'll use to file your taxes each year.

Schedule SE: Schedule SE (Form 1040) calculates and reports your self-employment taxes for Social Security and Medicare.

Form 1040-ES: Form 1040-ES calculates your estimated quarterly tax payments. You can use the vouchers included with it to mail in a payment, or make it online using the Electronic Federal Tax Payment System (EFTPS).

The general process of filing your taxes as a self-employed person is similar to a W-2 employee. However, there are a few additional things you’ll want to consider to minimize the amount you’ll pay. Here’s the general process.

Your first task is to determine how much money you actually made. While you typically won’t pay taxes on this entire amount, it provides the starting point for determining how much you will pay.

Ideally, you’ve been keeping solid records of your income throughout the year. You can use these to add up your income. If you haven’t been keeping records, you can use the 1099-NEC forms that you receive from customers to get close, but keep in mind that not every customer will send one, particularly if you’re below the $600 threshold, and even if they do, it isn’t guaranteed to be accurate.

Tip: It’s always a good idea to keep your own records. Be sure to double-check the 1099-NEC forms you receive with your own records to catch any discrepancies. If you find a mistake, you’ll need to reach out to the issuer to get it corrected.

Once you've added up your income, the next thing you'll want to do is determine your expenses for the year. Business expenses are typically ordinary and necessary costs you can subtract from gross income to reduce taxable income. You'll deduct these expenses from your gross income to determine how much you're responsible for paying self-employment tax on.

Common deductible business expenses include advertising, vehicle expenses, insurance, office costs, software, and bank fees. Some of the most common categories of expenses you can claim include advertising, software, office expenses, and bank fees—but there are plenty more.

Keeping accurate records throughout the year can greatly simplify this process—and it'll certainly be much less stressful than trying to do it all at once with a tax deadline looming. This is also an area where the right software can make a huge difference by automatically categorizing expenses and providing running totals for each.

Next, gather the tax forms you’ll need. At a minimum, you’ll need form 1040, Schedule C and Schedule SE.

1040 is the standard tax form for individuals—you’re probably familiar with it already.

Schedule C is a form for sole proprietors or other people with self-employed income. You use it to report your business income and expenses. The net profit from line 31 on Schedule C gets carried to Form 1040 and also to Schedule SE (Form 1040).

Schedule SE (Form 1040) is then used to calculate your self-employment taxes—typically the 15.3% paid to Social Security and Medicare.

When you file your taxes, these two forms get attached to Form 1040, and they're all submitted to the IRS together.

Tip: When you use Found, your income and expenses are automatically tracked and entered into your Schedule C. You can use your Found Schedule C when filing your taxes, saving you time and money.

Whether it’s your first or fifteenth tax season, paying self-employment taxes can sting. There are a number of ways you can reduce your tax liability as a self-employed person—primarily through tax deductions.

Tax deductions come in the form of business expenses and other purchases you make that are ordinary and necessary for operating your business. We touched on a few above, but here's a more comprehensive list:

Advertising

Vehicle expenses, including mileage

Commissions and fees, including bank fees

Insurance, including health insurance

Mortgage or rent—you may be able to take a percentage of your home mortgage if you have a home office

Office expenses, including things like supplies and furniture

Repairs and maintenance on equipment or office space

Travel and meals

Of course, the IRS has strict guidelines and rules around exactly what you can write off from each category. It’s also important to ensure you have records and receipts you can point to as proof of the expenses. However, when properly documented and qualified, tax deductions can help reduce the amount you owe the IRS.

In addition to federal self-employment tax, you may owe state income taxes. Check with your state's department of revenue for specific requirements.

Self-employed people pay income tax and self-employment tax (15.3%). Self-employed people are typically responsible for the normal income taxes that everyone has to pay. Additionally, they must pay what's known as the "self-employment tax." This tax covers payments to Social Security and Medicare and totals 15.3% of taxable income for 2025.

Set aside 25-30% of income for self-employment and income taxes combined. As a general rule, freelancers and self-employed people should set aside about 25–30% of their income for taxes. This amount may seem like a lot, but it's typically plenty to cover both the self-employment tax (15.3%) and income taxes. Setting aside a bit of extra money ensures that you've got enough when it's time to make payments, and if you end up overpaying you can even get a refund.

Self-employment taxes seem high because self-employed people pay both the employer and employee portions of Social Security and Medicare taxes. Unlike W-2 employees who typically split the Social Security and Medicare tax with their employer in the form of payroll taxes, self-employed individuals are responsible for the full 15.3%.

To calculate quarterly estimated taxes, estimate your total annual self-employment income, subtract expected business expenses, then typically multiply by 15.3% for self-employment tax. Add your estimated income tax based on your tax bracket. Divide this total by four to determine each quarterly payment amount.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax or legal advice.

Related Guides

6 Tax Mistakes Small Business Owners Make

Accounting and Taxes

17 Tax Deductions for Freelancers and Small Business Owners

Accounting and Taxes

2026 Tax Deadlines for Small Business Owners

Accounting and Taxes