A Step-by-Step Guide to Filling Out the Schedule SE Tax Form

When you’re self-employed, you have a million balls to juggle. That includes accounting and, by extension, taxes. One of the most important tax forms you’ll deal with as a self-employed person is Schedule SE. Let’s walk through this crucial form and learn what’s involved in filing one.

What is a Schedule SE?

The Schedule SE tax form calculates how much self-employment tax you need to pay. It’s technically a part of Form 1040, the main form used to file an individual income tax return.

Schedule SE isn’t actually where you report your self-employment tax—you do that on the Schedule 2 form, which is another part of Form 1040. Instead, Schedule SE provides the calculations to determine what you owe, and it must be attached to your 1040 when you file.

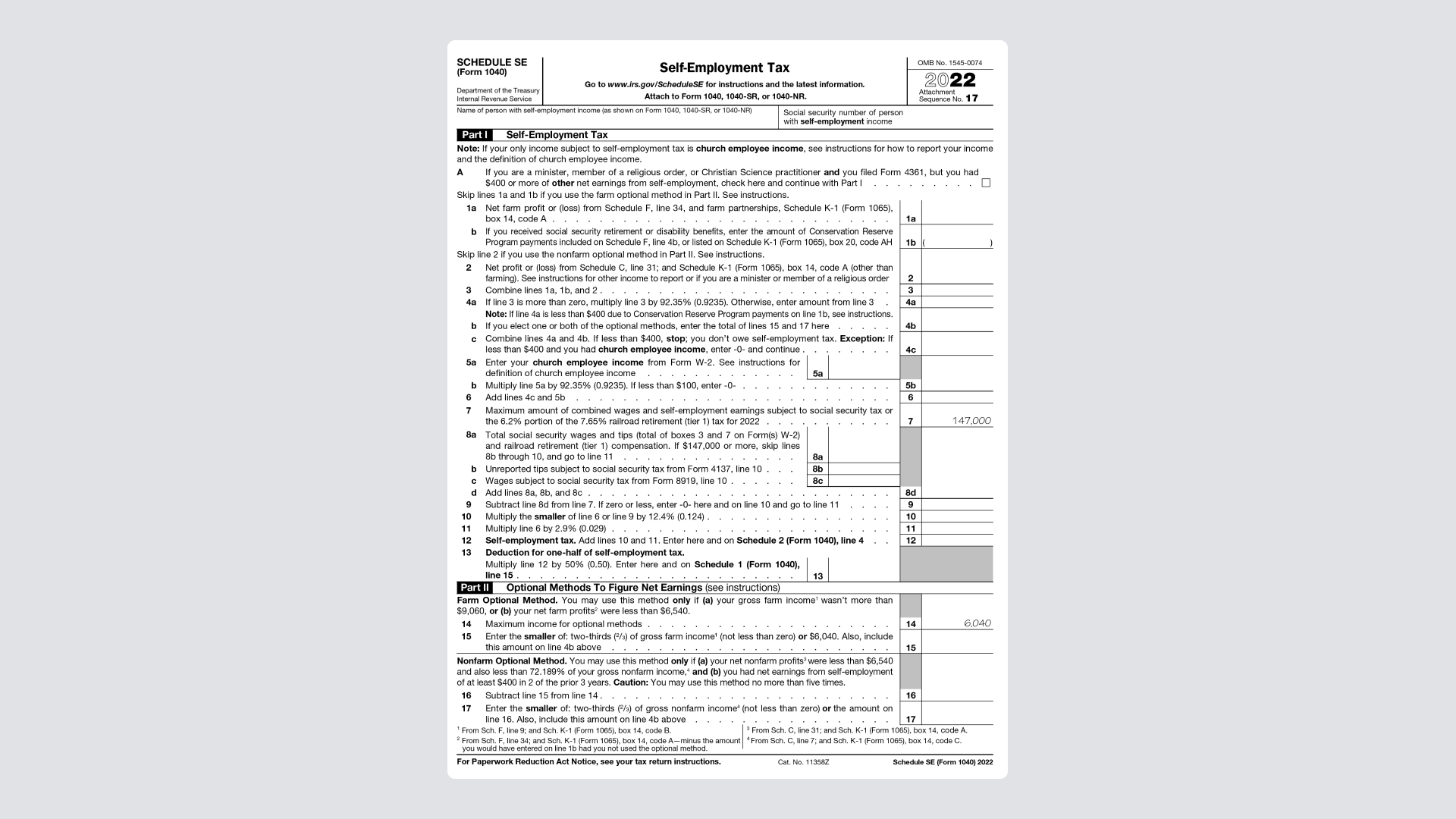

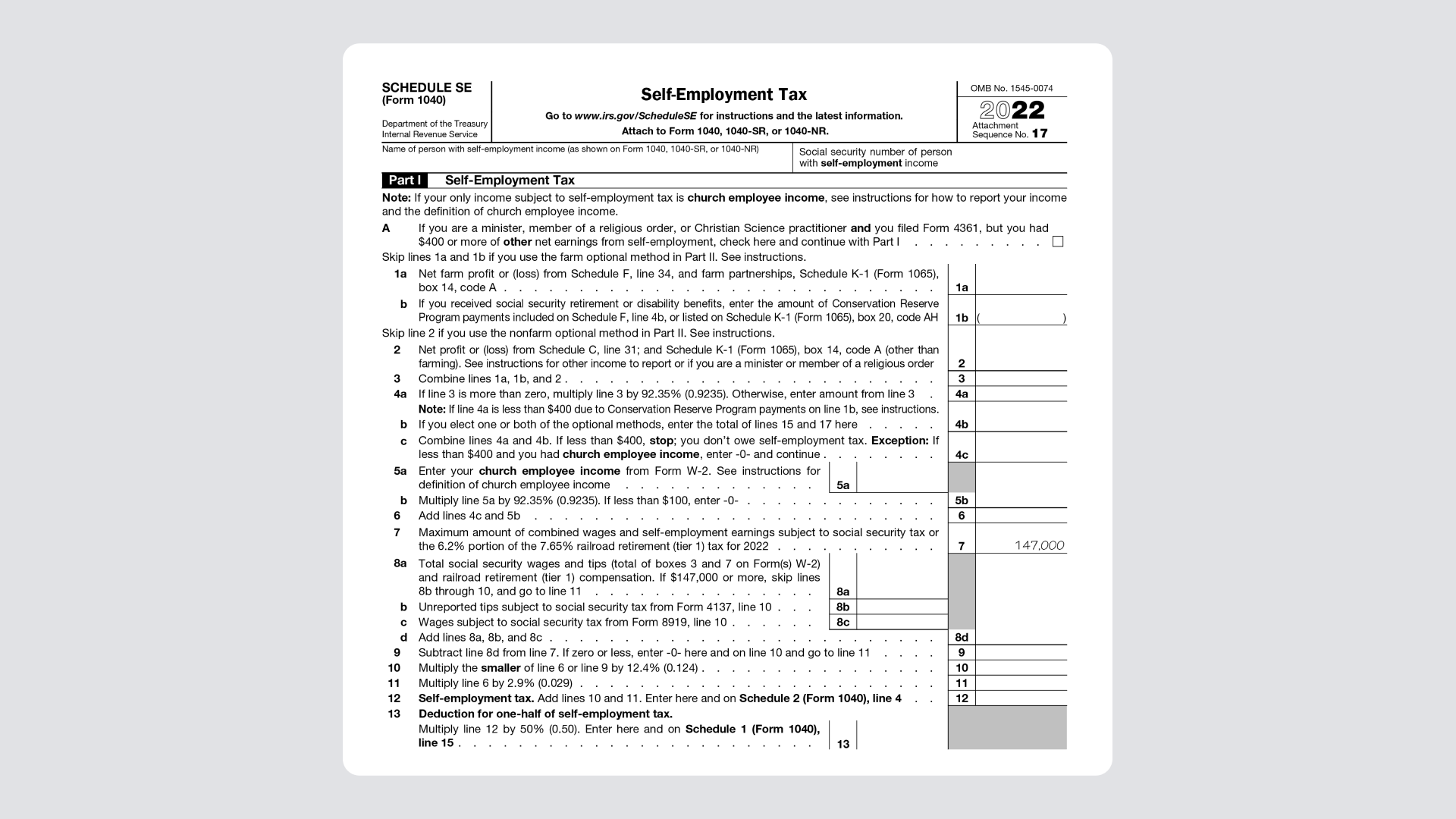

Here’s what the Schedule SE tax form looks like:

Who needs to fill out a Schedule SE tax form?

Anyone who made over $400 in self-employment income in 2022 must fill out a Schedule SE and pay self-employment tax on that income. This is true regardless of whether you earn your full living from self-employment or work for yourself as a side hustle. This includes:

Sole proprietors

Independent contractors

Freelancers

Consultants

Any other self-employed individuals

The only exception to these rules is for individuals who earned income as church employees—they’re required to file a Schedule SE if they make $108.28 or more.

What is self-employment tax?

Self-employment tax is a combination of Social Security and Medicare taxes. It’s similar to the FICA taxes that W2 employees pay, but unlike these taxes, self-employment tax also includes the employer portion.

For this reason, it may be higher than you’re used to paying into Social Security and Medicare. However, the upshot is that the employer's half is considered a deductible expense.

The self-employment tax rate is 15.3% of your self-employed income. This amount is comprised of 12.4% for Social Security and 2.9% for Medicare. A few other things to know about self-employment tax:

The Social Security component (12.4%) only applies to the first $147,000 in 2022 and the first $160,200 for the 2023 tax year.

There's no limit to the Medicare component, and you must pay the 2.9% Medicare part of the SE tax on all your net earnings.

Generally, the amount subject to self-employment tax is 92.35% of your net earnings from self-employment. Why not 100% of your net earnings? Tax code allows for a deduction of half of your self-employment tax when you calculate your adjusted gross income (AGI), effectively reducing the amount of self-employment tax you owe. That’s why you see this number on line 4a.

Here’s a simplified example: let’s say you made $50,000 in self-employed income in 2022 (congratulations!). You would need to pay 15.3% of that in self-employment tax, so we get this equation:

50,000 x 15.3% = 7,650

That means your self-employment tax for 2022 is $7,650, half of which ($3,825) is a deductible expense.

Why is the Schedule SE tax form important?

Schedule SE is important because it walks you through calculating and reporting your self-employment tax for the year. This is mandatory for anyone earning over $400 in self-employed income, and failing to pay it can result in significant penalties (and potentially federal charges!).

Walkthrough of the Schedule SE tax form

Schedule SE has two parts. The first part focuses on calculating your self-employment tax, while the second part focuses on so-called “optional methods” that can help if your self-employment income is either very small or a net loss.

Part I

Lines 1a and 1b

These lines are specific to farmers—if that’s you, you’ll put your farming profit or loss and any social security retirement or disability benefits in the appropriate lines. If you’re not a farmer, you can simply leave these blank.

Lines 2–4c

On these lines, you’ll enter your total self-employment income from various sources. You can find this on line 31 of your Schedule C form. You’ll then multiply this number by 92.35% to get the total earnings that are subject to self-employment tax. Remember how the tax code allows for a deduction of half of your self-employment tax when you calculate your AGI? That’s where this 92.35% number comes from on line 4a.

Line 6

Enter the result from line 4c on Line 6.

Line 7

This line contains the maximum amount you can pay Social Security tax on—currently $142,800. This may already be filled in for you.

Lines 8a–8d

On these lines, record any earnings from jobs you already paid Social Security tax on. The most common example here is the salary you earn as a W-2 employee, which you can find on the W-2 form you receive from your employer. If you are strictly self-employed, you’ll leave these lines blank.

Lines 9 and 10

On these lines, you calculate how much Social Security tax you owe the IRS.

Line 11

This line calculates the Medicare tax you owe.

Line 12

Line 12 combines the totals from lines 10 and 11 to determine the total amount of self-employment tax you owe.

Line 13

Finally, line 13 is where you’ll calculate the amount of self-employment tax you can claim as a deduction. This is 50% of the total from line 12.

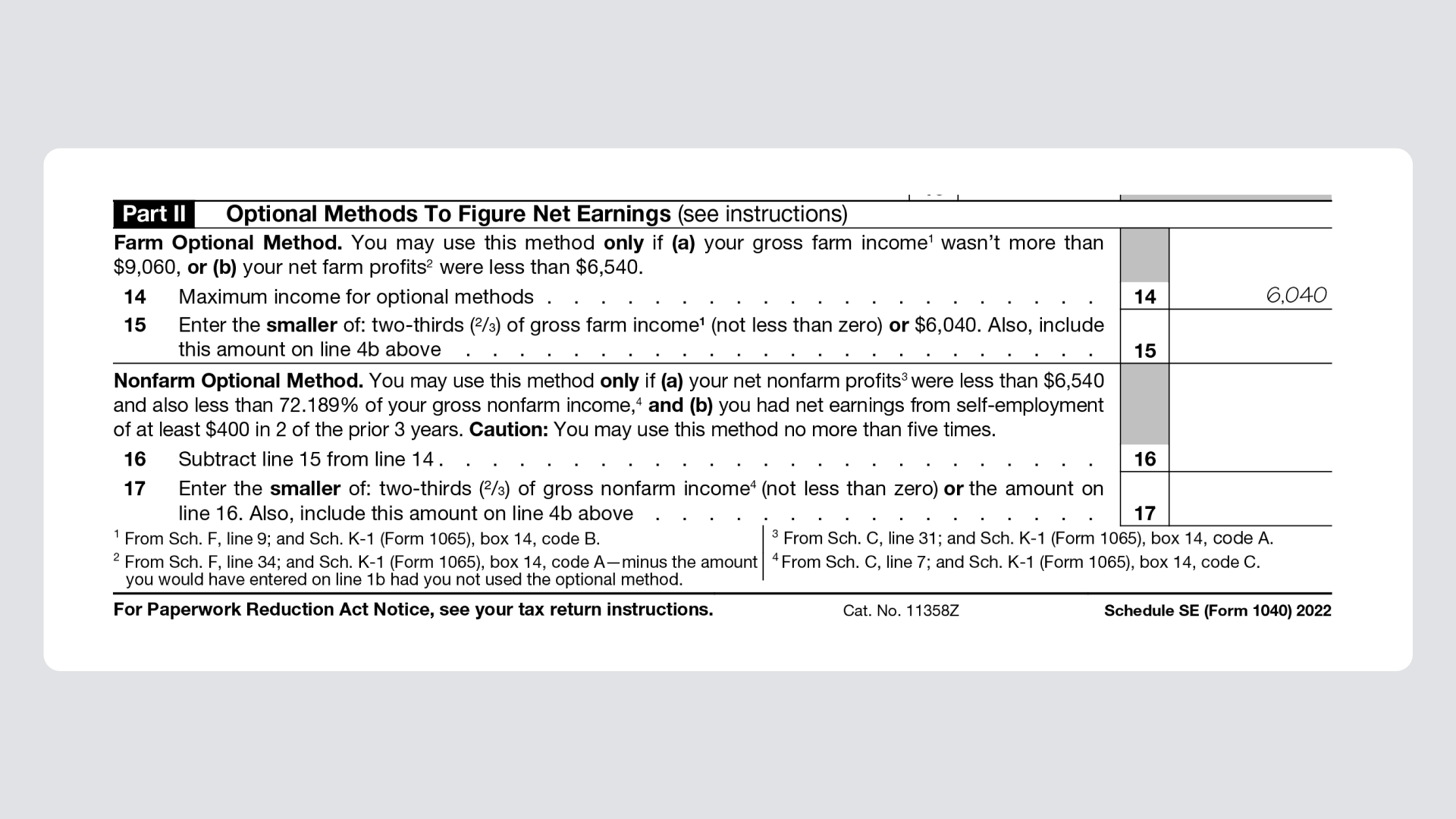

Part II

Part II of Schedule SE contains optional calculations that can help give you credit toward social security coverage if you have very little earnings (or took a loss) from self-employment income. These optional methods apply if you have net profits of less than $6,540. There’s a section for farm income and one for non-farm income. If you’re considering using one of these methods, we recommend consulting a tax professional, as they may increase your self-employment tax.

Deducting self-employment taxes

You can deduct 50% of your self-employment taxes as a business expense. This is because, as a self-employed person, you’re paying both the employee and employer portion of the tax, and the IRS considers the employer portion a deductible expense. You calculate this deduction on Schedule SE at line 13.

FAQs about Schedule SE

When is Schedule SE due?

Schedule SE must be attached to your Form 1040 when you file income taxes. As such, it’s due at the same time—April 15, unless it falls on a weekend or holiday.

Where do you find self-employment income?

Self-employment income is all money you earned as an independent contractor, freelancer, or otherwise self-employed individual. In many cases, you’ll receive a Form 1099 from clients you worked with that will show your income for that company.

However, you won’t receive a 1099 from every client, and they aren’t guaranteed to be accurate. For these reasons, the best way to keep track of your self-employed income is to maintain accurate records in accounting software throughout the year.

What income is subject to self-employment tax?

If you have net earnings of $400 or more from self-employment, you’re required to pay self-employment tax on it. This can be from any source that isn’t a W-2 position, including freelancing, contracting, consulting, and other self-employed gigs.

File easier with Found

Schedule SE—and other tax forms like the Schedule C—can be overwhelming, particularly if you’re unfamiliar with them. They don’t have to be, though. With a little help, you can make tax time a breeze.

You can really take the guesswork out of taxes with Found. Our tax tools help you run your business with newfound clarity and ease. No more toggling between costly apps—it’s all right here, and it’s free to sign up.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax advice. Found partners with TurboTax, and is not a filing service. Restrictions may apply, see TurboTax terms.

Related Guides

How To Calculate Taxable Income When You’re Self-Employed

Accounting and Taxes

Understanding the Schedule C Tax Form

Accounting and Taxes2024 Tax Deadlines for the Self Employed

Accounting and Taxesfor the self-employed

*Found is a financial technology company, not a bank. Banking services are provided by Piermont Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category.

The Found Mastercard Business debit card is issued by Piermont Bank pursuant to a license from Mastercard Inc.

The information on this website is not intended to provide, and should not be relied on, for tax advice.

Direct deposit funds may be available for use for up to two days before the scheduled payment date. Early availability is not guaranteed.