Understanding the Schedule C Tax Form

When you're self-employed, there's much more to tax season than just plugging in information from your W-2 form into tax preparation software and letting it do the work. You also have to file a Schedule C tax form. So whether you're just starting as a freelancer or have been running your own business for years, understanding the Schedule C is essential to being self-employed.

Don't worry; if you've been keeping good bookkeeping records throughout the year, filing a Schedule C is much simpler than it sounds. Here's everything you need to know about the Schedule C form, why it's important, and how to complete it correctly.

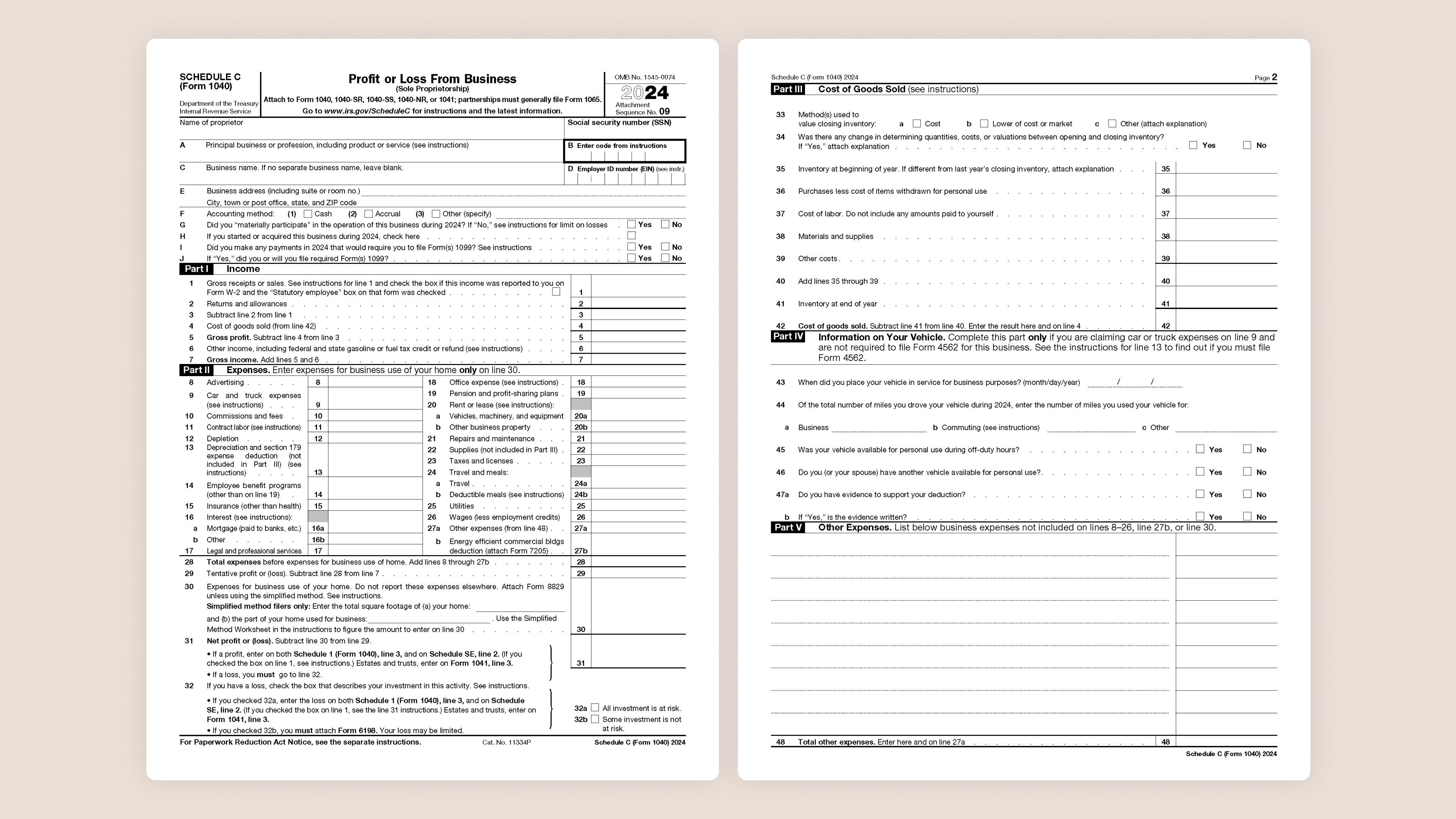

Here’s what the Schedule C (Form 1040) looks like:

What Is Schedule C Form?

A Schedule C is a tax form to report your business income and expenses to the IRS. It calculates your net profit or loss from your business, which is then reported on your personal income tax return (Form 1040).

The Schedule C helps self-employed individuals and independent contractors track how much money they made in a calendar year and how much they spent on their business expenses. The purpose of the Schedule C is to calculate your net profit or loss from your business, which is then used to determine the amount of taxes you owe.

Accurately filling out the Schedule C is important since it affects your overall tax liability. For example, you can claim tax deductions for business-related expenses on your Schedule C form, which can help to reduce the amount of taxes you owe.

Who files a Schedule C?

If this is the first time you’ve heard about a Schedule C form, you may wonder if it applies to you this tax season. Here’s a list of individuals who typically file a Schedule C form alongside their personal returns:

Sole proprietors

Independent contractors

Self-employed individuals who receive income from freelance work, consulting, or other services

The recession prompted many Americans to leap into self-employment to build a safety net and diversify their incomes. Even if you’re still working full-time and running your side hustle, you’ll be expected to file a Schedule C with your personal tax return.

Tip: If you are self-employed and your business is structured as a corporation or partnership, you will not file a Schedule C. Instead, you will file a separate tax return for your business.

Make taxes easier with Found

Found is the ultimate business bank account, with built-in bookkeeping and tax tools.

Get started

The Found Mastercard Business debit card is issued by Piermont Bank or Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

Filling Out the Different Parts of Schedule C

The Schedule C form is divided into different sections, each with its own specific purpose, and you’ll need to have a few things handy to make sure you fill it out accurately, including:

Your social security number or employer identification number (EIN)

Business income and expenses

Cost of goods sold

Total miles you drove for business purposes

Documentation for all the above

Business Overview

At the beginning of your Schedule C form, you'll enter your business name, contact information, and Employer Identification Number (EIN) if you have one. You will also indicate your business type and answer a few preliminary questions.

Part I: Income

This section is used to report all income received from your business, such as sales or services. This includes money you received from customers, clients, or patients and any other income related to your business. This is the total amount of income before any expenses are deducted.

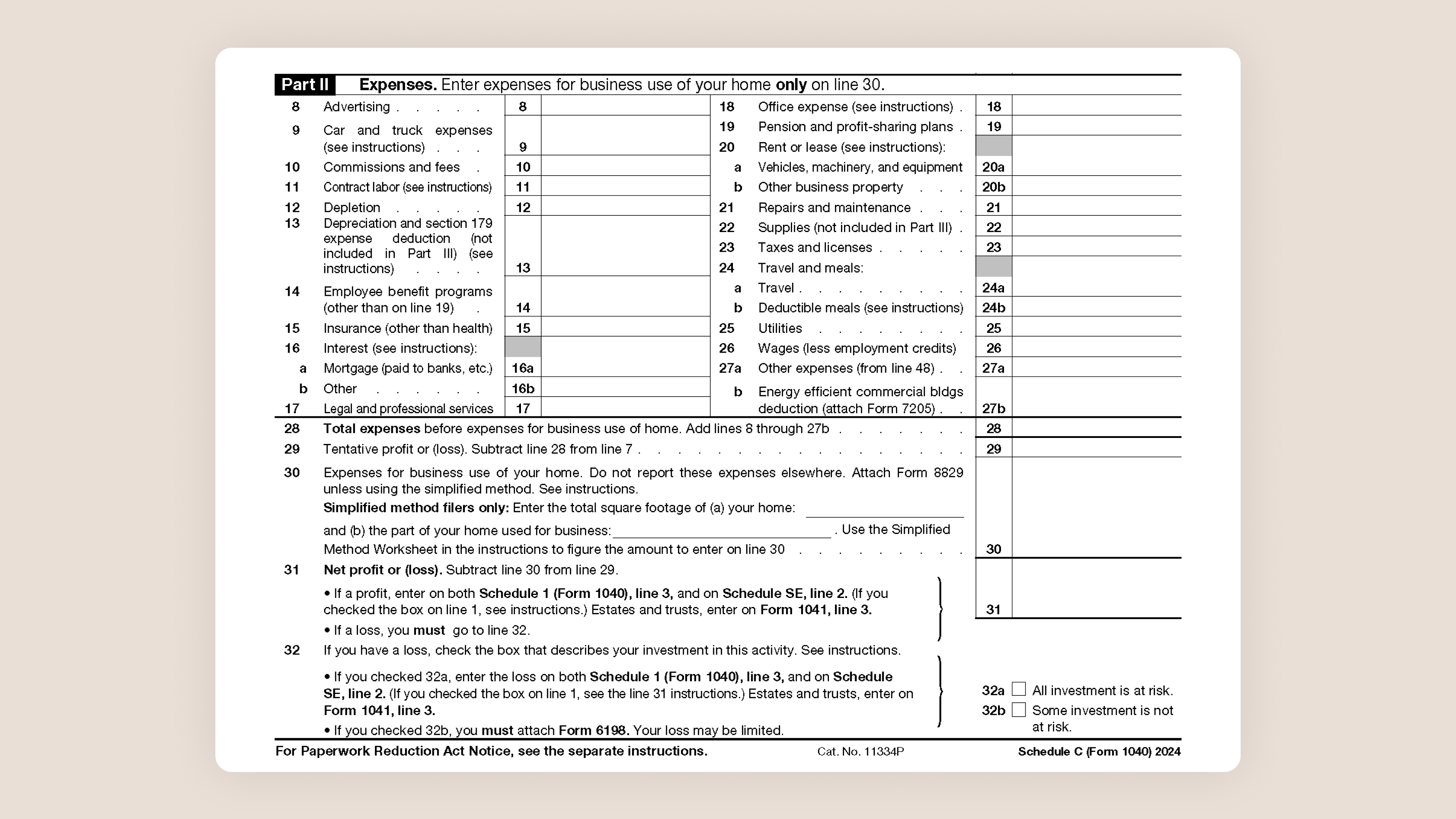

Part II: Expenses

Next, you'll use this section to report all the expenses incurred in running your business, such as rent, utilities, and supplies. If you've kept your business and personal expenses separate, this section will be easy to fill out. The expenses section is an integral part of the Schedule C form since it helps calculate your net profit or loss from your business.

Learn more: One of the best ways to keep your tax bill as low as possible is to track your business expenses as you go. A good bookkeeping routine is essential here since you must keep accurate records and documentation.

Part III: Cost of Goods Sold

The cost of goods sold (COGS) section of a Schedule C form reports the cost of materials and direct labor used to produce the goods you sold during the year. This is important because the COGS figure is subtracted from your gross receipts to determine your gross profit. This information is then used to calculate your net profit or loss from your business, which is then reported on your personal income tax return (Form 1040) and is used to determine the taxes you owe.

Part IV: Information on Your Vehicle

This section reports the business use of your vehicle, including the total miles you drove and the expenses related to the car. There are two different methods for deducting your vehicle expenses: the “actual expense method” and the “standard mileage method.”

Learn more: You can typically only deduct the business-use percentage of the vehicle expenses, so you must have accurate records and receipts of your vehicle's expenses and the miles you drove for business purposes. Learn more.

Part V: Other Expenses

The final section of the Schedule C form is used to report, you guessed it, any other business expenses that aren't reported elsewhere on the form. For example, if you have a home office, you can claim a percentage of your rent or mortgage, utilities, insurance, property taxes, and repairs as home office expenses.

We may start to sound like a broken record, but like all things related to taxes, keeping accurate records and receipts is essential. Not only will it make it easy for you to fill out your Schedule C form, but it is also essential to have documentation in case of an audit.

When do you file a Schedule C?

If you are self-employed, you will typically file a Schedule C along with your Form 1040 on your annual tax return since it's filed as part of your personal tax return. The deadline for filing your personal tax return, including the Schedule C, is April 15 each year or whenever the annual tax deadline is.

Tip: 2024 taxes are due by April 15, 2025.

Unable to file your tax return by the deadline? You may be able to request an extension, but it's important to note that an extension of time to file is not an extension to pay any taxes you owe.

Learn more: You'll still be required to pay any taxes due on or before the original due date, even if you file your return later. If you don’t, you’ll be subject to penalties and interest charges.

What happens if I don't file a Schedule C form?

Not filing a Schedule C form could result in serious financial penalties. Self-employed income is considered taxable income by the IRS, so you want to make sure you are filing one each year.

Do I only need to file a Schedule C form if I'm profitable?

Even if your business didn't profit for the year, you must file the Schedule C form. This is because the IRS wants to see that you've been active in your business and trying to make money from it.

What’s the difference between expenses and cost of goods sold (COGS) on a Schedule C form?

Expenses are the costs incurred in running a business not directly related to the products or services sold. In contrast, the cost of goods sold is the cost of the products or services that a business sells or provides to its customers, including the cost of materials and labor used to produce them. For example, a self-employed hairdresser would report both expenses and COGS on their Schedule C form:

Cost of goods sold might include beauty products and supplies used in customer services, such as hair dye, shampoo, conditioner, styling products, and any other products used in the salon's services.

Expenses include rent and utilities for the salon's physical location, marketing and advertising costs, and office supplies. These expenses are incurred in running the business but are not directly related to the services provided.

Make taxes easier with Found

Found is the ultimate business bank account, with built-in bookkeeping and tax tools.

Get started

The Found Mastercard Business debit card is issued by Piermont Bank or Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

Fill out your Schedule C Form with ease

Whether you left your job during the “Great Resignation” or are pursuing your side hustle during your free time, we guess you aren’t doing it because you love paperwork. However, completing your Schedule C is essential to filing your self-employment taxes correctly. Not only will it help you avoid penalties, but it can also assist you in claiming any deductions or credits you may be eligible for.

If you've been using Found's tools to track your expenses, find write-offs, and save receipts, then you're in luck! Found customers can download a pre-filled Schedule C when you log into your account under "Taxes." Not using Found? Sign up for free and get started today.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax advice. Found partners with TurboTax, and is not a filing service. Restrictions may apply, see TurboTax terms.

Related Guides

8 Common Myths About the Schedule C Form

Accounting and TaxesA Step-by-Step Guide to Filling Out the Schedule SE Tax Form

Accounting and Taxes

The Venmo Tax: What You Should Know About the New 1099-K Form In Your Mailbox Next Year

Accounting and Taxesfor the self-employed

*Found is a financial technology company, not a bank. Banking services are provided by Piermont Bank or Lead Bank, Members FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category.

The Found Mastercard Business debit card is issued by Piermont Bank or Lead Bank pursuant to a license from Mastercard Inc.

The information on this website is not intended to provide, and should not be relied on, for tax advice.

**Direct deposit funds may be available for use for up to two days before the scheduled payment date. Early availability is not guaranteed.

Found partners with various providers to enable you to compare offers from participating institutions, such as lending, filing service, and insurance providers. Found is not a lender, a filing service, nor an insurance provider.

This website contains advertisement of Found and third party products and services.