AI Productivity Hacks for Busy Small Business Owners

Free download: 25 ready-to-use AI prompts to transform your workflow

Online vs. Traditional Banking: How to Choose the Right Small Business Bank Account

Business Banking

Introducing Connected Accounts Improvements

Feature SpotlightsHow to Choose a Business Structure

Business 101

The Ultimate Guide to Small Business Invoicing: Get Paid Faster and More Reliably

Business Banking

Small Business Banking 101: What You Need to Know

Business Banking

Online vs. Traditional Banking: How to Choose the Right Small Business Bank Account

Business Banking

Ultimate Guide for Small Business Expense Tracking & Reporting

Accounting and Taxes

The Ultimate Small Business and Freelancer Tax Prep Checklist for 2025

Accounting and Taxes

17 Self-Employed Tax Deductions for Freelancers and Small Business Owners

Accounting and Taxes

How to Budget as a Freelancer: A Step-by-Step Guide

Business 101

Self-Employed Profit and Loss Statements

Business 101

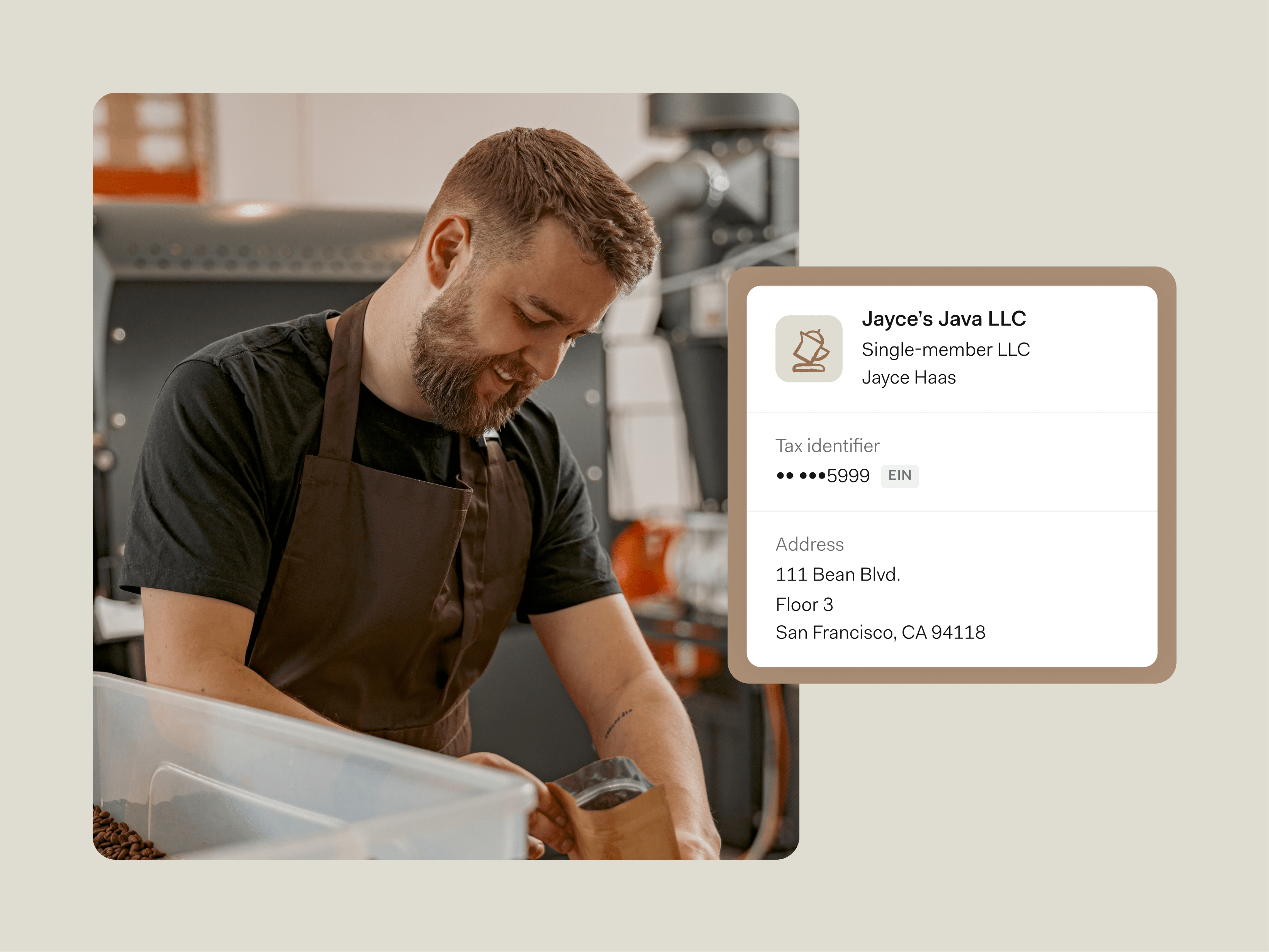

Sole Proprietorship vs LLC: Which Business Structure Is Right For You

Business 101

Introducing Invoice Estimates

Feature Spotlights

Introducing New and Improved Income and Expense Tracking Tools

Feature Spotlights

Introducing Batch Request W-9s from 1099 Contractors

Feature SpotlightsTop 9 Tips to Recession-Proof Your Small Business

Industry Trends

AI Productivity Hacks for Busy Small Business Owners

Industry Trends

Follow the Money: Where Small Businesses Spend and Why it Matters

Industry Trends

Through the Lens: How a Photographer Uses Pockets to Budget for the Off-Season

Customer Stories

Profitable by Design: How an Agency Owner Used Pockets to Grow

Customer Stories

In It For The Long Haul: Garrett Henderson’s Business Journey

Customer StoriesSign up for a free account in minutes.

Easy sign up

No credit check

No minimum balance

No hidden fees

for the self-employed

*Found is a financial technology company, not a bank. Banking services are provided by Piermont Bank or Lead Bank, Members FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category.

The Found Mastercard Business debit card is issued by Piermont Bank or Lead Bank pursuant to a license from Mastercard Inc.

The information on this website is not intended to provide, and should not be relied on, for tax advice.

**Direct deposit funds may be available for use for up to two days before the scheduled payment date. Early availability is not guaranteed.

Found partners with various providers to enable you to compare offers from participating institutions, such as lending, filing service, and insurance providers. Found is not a lender, a filing service, nor an insurance provider.

This website contains advertisement of Found and third party products and services.