Tax day has come and gone. The relief is real but temporary. For many self-employed professionals, those final weeks before filing meant late nights sorting receipts, hunting for missing documents, and the gut punch of unexpected tax bills.

You know the feeling – that mix of dread and frustration when tax obligations pull you away from actually running your business. The mad scramble to gather documents. The stress of wondering if you've missed valuable deductions. The shock of realizing how much you owe.

Believe it or not: Tax headaches aren't inevitable for the self-employed. Your business might be complex, but your tax process doesn't have to be. Making small, strategic changes now can transform next year's experience from chaos to control.

Still mixing business and personal finances? Make this your top priority today.

Every tax nightmare starts the same way: staring at a jumbled bank statement, trying to remember if that $85 charge from three months ago was a client lunch or your grocery run. This confusion costs you time, money, and potentially missed deductions.

A dedicated business bank account instantly transforms your tax prep from detective work to straightforward accounting. No more receipt archaeology or panicked searches through email confirmations when tax season hits. The benefits go beyond convenience:

Clear audit trail that protects you if questions arise

Accurate profit and loss tracking at a glance

Quick identification of tax-deductible expenses

Professional impression with clients when they see your business name

Opening a business doesn’t have to be overwhelming. Many online business bank accounts have simple application processes, and you can start your application in as little as five minutes.

This single change eliminates the most common self-employed tax headache and sets the foundation for every other tax-saving strategy. Don't put it off another day—it's one of the easiest wins you'll get all year.

That sinking feeling when you realize you've got months of unsorted expenses? You can eliminate it forever with one simple habit: consistent record-keeping.

Photographer and small business owner Amber Garrett used to dread the weeks leading up to tax season because she’d spend an entire week categorizing a year’s worth of expenses before taxes were due. That’s a week of her life that she’ll never get back.

Like Amber, a lot of self-employed professionals wait until tax deadlines loom to tackle their books. This creates the perfect storm of stress, mistakes, and missed deductions. The solution is surprisingly simple:

Block 30 minutes every Friday to categorize that week's transactions

Use your phone to capture receipt photos immediately after purchases

Set up email folders to automatically sort digital receipts and invoices

Track mileage in real-time with a dedicated app

When tax time arrives, you'll have organized financial data ready to go—not a mountain of mystery receipts and forgotten expenses.

Don't overthink the system. A basic spreadsheet is a great place to start and works if you use it consistently. The key is making recordkeeping a non-negotiable weekly habit rather than a dreaded yearly project.

The IRS requires you to keep records that support income and deductions for at least three years. Your future self will thank you for starting this habit now.

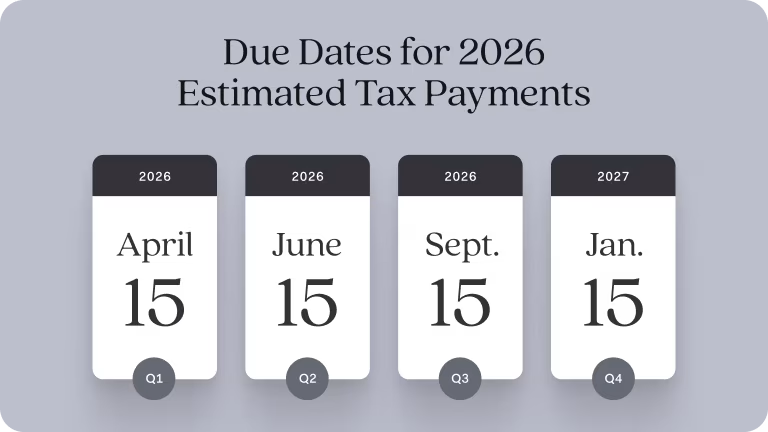

Tax day may have come and gone, but it’s not the only deadline you need to know. When you’re self-employed, you’re responsible for paying quarterly estimated taxes throughout the year. Missing quarterly tax payments can cost you hundreds in penalties—mark these dates now.

Most W-2 employees only think about taxes once a year, but self-employment means four tax deadlines that can't be ignored. The IRS expects you to make quarterly estimated payments throughout the year, not just on April 15th.

When you skip these payments, you're essentially borrowing from the government at a high interest rate. The IRS charges both interest and penalties for late payments—money that could have stayed in your business.

For estimated tax purposes, a year has four payment periods, and taxpayers must make a payment each quarter. Here is the traditional schedule:

April 15: First quarter estimated tax payment due

June 15: Second quarter estimated tax payment due

September 15: Third quarter estimated tax payment due

January 15 of the following year: Fourth quarter estimated tax payment due

Note: If these dates fall on a weekend or holiday, the due date is the next business day.

Now that you have those quarterly estimated tax due dates on your calendar, the next step is making sure you have money to pay them when the due dates roll around. Typically, the best way to save for tax payments is to save money as you go.

That sinking feeling when a quarterly tax deadline approaches but your account balance doesn't match your tax bill—it's completely avoidable. The self-employment tax rate currently sits at 15.3%, plus you'll owe income tax on top of that. Waiting until the tax deadlines to find money means you might end up with credit card debt or payment plans that’ll cost even more in the long-run.

A good rule of thumb is to save 25-30% of your income for taxes. Remember that the actual percentage you'll need to save will vary depending on your income level, deductions, and other factors. For every income or deposit you receive, move 25-30% to a separate account earmarked for tax payments.

As a self-employed individual, your income may not always be predictable. That’s why it’s important to set a goal for how much you want to save each month or based on each source of income. Make it a habit to transfer that amount to a separate savings account. Saving money can be tough, but trust us, it’s worth it in the long run.

When you use Found, you can set up a Tax pocket specifically for quarterly tax payments. Your deposits go to your Primary pocket, and if you choose, a portion of your earnings can be automatically set aside in your Taxes pocket to help you save for tax time.

Tax complexity increases with each dollar you earn as a self-employed professional. Many freelancers and small business owners feel overwhelmed by tax requirements or seemingly never-ending tax changes, leading to costly mistakes and unnecessary stress.

The DIY approach might save a few hundred dollars in professional fees but could cost you thousands in missed deductions, penalties, or your own billable time. That's why knowing when to bring in experts isn't just smart—it's profitable.

Consider hiring a Certified Public Accountant (CPA) or tax preparer to handle your tax filings and financial planning. A CPA or tax preparer can ensure that your taxes are filed accurately and on time, while also providing valuable financial advice and planning strategies to optimize your tax situation.

The right professional doesn't just file your return—they can also provide year-round strategic advice that often pays for itself through tax savings and stress reduction. Your hourly value in your profession likely exceeds what you'll pay a tax professional. Spending 20 hours figuring out complex tax issues means 20 fewer hours generating revenue in your actual business.

Outsourcing doesn’t have to stop at tax time. You can also consider outsourcing other administrative or non-financial tasks to a virtual assistant or 1099 contractors. Think of it this way: If it’s not your forte, delegate it. For example, you can delegate administrative tasks like scheduling appointments, managing emails, or social media management to a virtual assistant, allowing you to focus on the things that make you money.

Outsourcing doesn't mean you're not capable or competent. It's about recognizing your limitations, valuing your time and expertise, and leveraging the skills of others to enhance your business. Whether it’s related to tax season or another area of your business, delegation is a strategic decision that allows you to focus on what you do best.

Did you know? Payments made to 1099 contractors are likely deductible as a business expense, as long as the work is directly related to your business operations.

As we look at tax season in the rearview mirror, remember that preparing for next year starts now. Taxes can be stressful for self-employed people, but they don't have to be. Take control of your finances with some planning and action—a little effort now can save you a lot of pain later.

You can make things even easier for yourself with a Found account. It’s a business checking account designed for the self-employed that helps you keep your spending organized. With automatic expense categorization, tax savings accounts, and real-time tax estimates, it’s easier than ever to manage your finances and prepare for tax season. Get started today.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

The information on this website is not intended to provide, and should not be relied on, for tax advice.

Related Guides

2026 Tax Deadlines for Small Business Owners

Accounting and TaxesA Step-by-Step Guide to Filling Out the Schedule SE Tax Form

Accounting and TaxesThe Guide to Filing 2025 Self-Employment Taxes

Accounting and Taxes

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. FDIC insurance only covers the failure of an FDIC-insured depository institution.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

¹⁷Cash Back Terms and Conditions apply.

The information on this website is not intended to provide, and should not be relied on for, tax or legal advice.

Found partners with various providers to enable you to compare offers from participating institutions, such as lending, filing service, and insurance providers. Found is not a lender, a filing service, nor an insurance provider.

This website contains advertisement of Found and third party products and services.

According to NerdWallet, Found is the Best Business Checking for Paying Contractors and Saving for Taxes. (Source)

Terms of Service ・ Privacy Policy ・ Accessibility statement ・ © 2026 Found