When you're building a mental health practice serving underserved communities across 24 states, every minute matters. But for Cub Larkin, founder of Inclusive Therapy Group, his old financial setup was stealing hours every single day.

When Cub Larkin needed therapy years ago, he kept running into the same frustrating wall. "I couldn't find a therapist that I didn't spend a significant time educating about stuff that they could have just—if they just did a minuscule amount of Google searching—they would probably be a little bit more educated," he explains.

So he did what any entrepreneur would do when they can't find what they need: he built it himself.

Inclusive Therapy Group started in 2018 with a clear mission—to provide premier telehealth mental health services to the LGBTQIA+ community and other highly underserved, often misunderstood demographics, including people navigating kink, BDSM, polyamory, and consensual non-monogamy. Today, the practice has grown to 20 therapists serving clients across 24 states.

But rapid growth brought a challenge Cub didn't anticipate: his financial infrastructure was actively working against him.

Before Found, Cub's financial setup was a patchwork of disconnected tools that demanded constant attention:

Wells Fargo business account: $35/month, riddled with fees, and zero personalized support

Gusto for contractor payments: $161/month for contractor payments, which became unsustainable as the team grew

Multiple bookkeeping tools: Time wasted setting up and testing trials with QuickBooks, Heard, and others that never quite worked

Manual categorization: 1-2 hours every single day, trying to categorize transactions

"I would spend probably an hour to two hours a day trying to classify everything in one of those platforms," Cub recalls. "Wells Fargo as a business is fine. They are not very customer-centric. They don't really care whether or not you're a small business and medium business, or an enterprise business."

For a business accepting insurance payments through Alma and Headway—with irregular weekly payouts that could swing from $10,000 one week to $20,000 the next—staying on top of finances felt like a full-time job on top of his full-time job.

And then there were taxes. The surprises. The stress of not knowing if he was missing deductions. The quarterly scramble.

"There has to be a better way," Cub thought.

About 3.5 years ago, Cub discovered Found while going through Nicole McCance's Clinic Growth Map coaching program. What immediately caught his attention was something simple yet revolutionary: zero fees for contractor payments¹².

"The fact that Found advertised zero fees for contractor payments¹², virtual cards, even as something as a recent modification, which was Pockets—which is amazing—[I knew this was different]," Cub explains.

But it wasn't just about saving on fees. It was about having a platform that actually understood what growing businesses need.

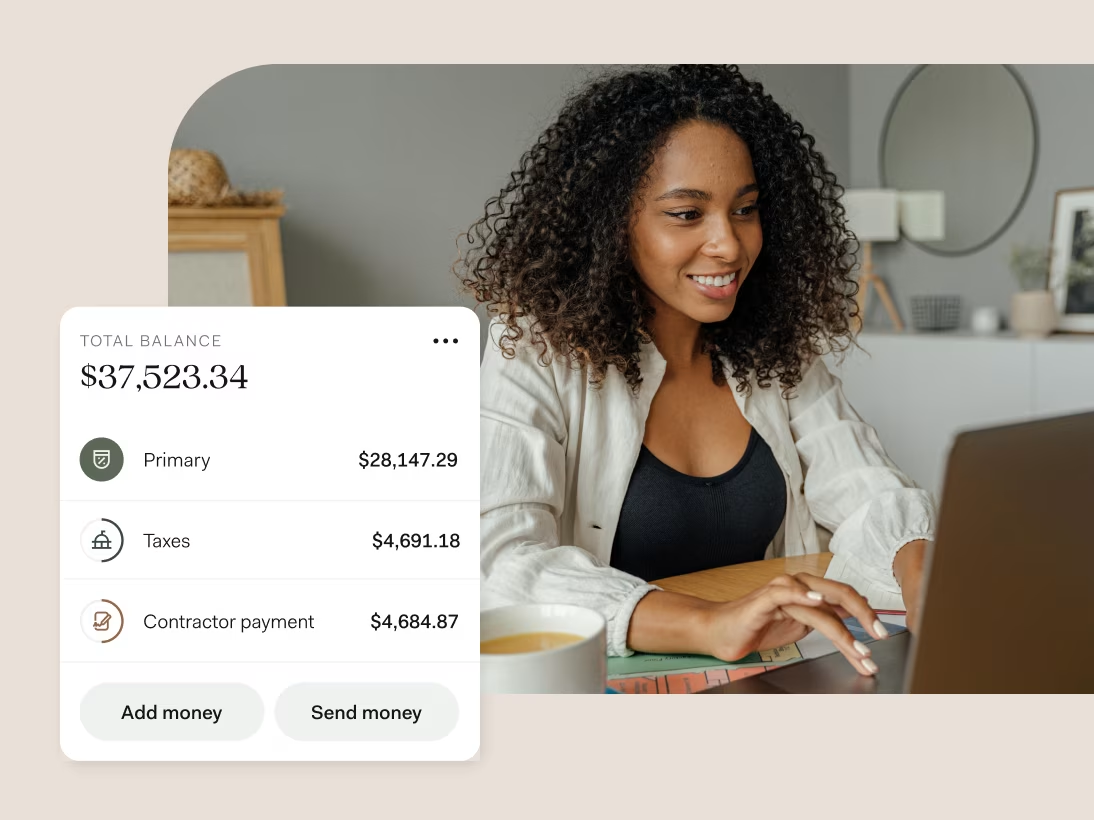

Today, Found isn't just another app Cub checks occasionally. It's his business command center.

"My day starts, and then we're taking a look at my Found dashboard. I have this 37-inch monitor—Found is up there 24 hours a day, seven days a week."

His morning routine? "I wake up, I log on immediately to my phone to take a look at my reporting, to take a look at what my income is, to take a look at what my outflows are... I take a look at my Found dashboard, and I take a look at what I need to do in terms of paying bills or paying contractors."

This isn't obsessive behavior—it's smart business management. As Cub learned from the Clinic Growth Map: "The numbers don't lie. The more that I keep in touch with my numbers, the more that I know how my business is doing."

The transformation wasn't just about convenience—it was quantifiable.

"When I was exploring other programs such as QuickBooks, I would spend probably an hour to two hours a day trying to classify everything. With Found—it maybe takes a couple of minutes a week."

Let's do the math: Cub is saving 20-25 hours per month on financial tasks alone.

How? "95% of all of our bills are repeatable monthly subscriptions. So Found is amazing with capturing those categorization rules," he explains. The few transactions that do need manual review? "It literally takes me two, three minutes a week to go in and sort and categorize things."

Even on mobile, the experience is seamless: "I'll just launch the mobile app and say, let me just add a category while I'm thinking about it."

Before Found, Cub was paying $35/month just for his Wells Fargo business account—plus $161/month for contractor payments through Gusto, a model that became unsustainable as his team grew. Add in the hours spent on bookkeeping trials and manual categorization, and the true cost was far higher.

Now? For less than the cost of his old Wells Fargo account alone, Cub gets everything through Found Plus at $149.99/year (comes out to be $12.50/month):

Business banking with no hidden fees⁴

Unlimited contractor payments (paying 20 therapists)

Automatic expense tracking and categorization

Unlimited rules, tags, and categories for bookkeeping

Invoice management

Pockets for budget allocation

Virtual cards that can be issued to team members for business expenses

Beyond the direct cost savings, those 20-25 reclaimed hours each month mean Cub can focus on seeing clients, growing the practice, and living his life.

With irregular insurance payouts swinging from $10,000 to $20,000 week to week, Cub uses Found's Pockets feature strategically:

"We have a primary Pocket, a payroll Pocket, a marketing Pocket, and a benefits Pocket. When our payouts hit, I move a chunk of money to the benefits Pocket to protect that allocation. Same thing with marketing and payroll."

The recent addition of individual account and routing numbers for each Pocket made the system even more powerful: "Now we can tie in our marketing pocket with its own account and routing number; we can target our benefits that we pay for our W2 members of the team."

This feature? Cub had suggested it to the Found team—and they built it.

The numbers speak for themselves:

Three and a half years ago: $3,000/month in revenue

Today: $70-75,000/month in revenue

Next year's goal: $2.5 million company

"After Nicole McCance's program, we literally did tenfold," Cub shares. But he's quick to point out that Found has been essential to managing that growth.

With 20-25 hours back in his schedule every month, Cub can focus on what matters:

Seeing 4-6 clients per day: His caseload is so loyal that when he tried to redistribute clients, they said, "No, I love you, Cub. I'm staying with you."

Strategic business planning: Working toward that $2.5M revenue goal

Life outside work: Spending time with his polycule, his five cats and corgi, and yes—planning Disney vacations (he's a proud Disney Vacation Club member and annual passholder)

Gone are the days of tax season surprises. Cub's tax accountant confirmed that "the default tax package that Found provides—outside of having to provide some additional expense breakdown—is all that he needs to do our taxes."

"Bookkeeping and expense tracking is all done through Found natively." Clean, organized data ready for tax time—no juggling multiple platforms, no manual exports, no headaches.

Perhaps what Cub values most is that Found actually listens to customer feedback and builds features that matter.

"You guys really listen to your customer base. And I can't stress it enough that that is critically important when we're small businesses or hopefully growing to a medium-sized business that we partner with companies that are listening to our needs."

The individual account and routing numbers for each Pocket? Cub suggested that. Virtual card improvements? Customer feedback drove those, too. And Found continues to evolve based on what growing businesses actually need—Cub stays in regular conversation with the team about features that would help him scale even further.

But listening isn't just about product development—it's about being there when customers need help. "Your customer care team, your support team, is exceptional. They answer every email within hours, if not 15 to 20 minutes. And they're very professional, very friendly, very accessible."

It's a stark contrast to traditional banking. "It's not like me giving suggestions to Wells Fargo, which I know is not going to go anywhere... They don't care."

When asked what he'd tell his younger self from 3-4 years ago, Cub is direct: "Trust my instincts a little bit more. Don't be afraid of investments into the business... And switch to Found sooner rather than later."

How strongly does he feel about that decision? We asked Cub a hypothetical: If Found didn't exist tomorrow and he had to go back to his old system, how would he feel?

"I would be very sad. I would probably cry, literally cry... And [I would] think about what I would have to do to get you guys to be back in business."

That's not just interview talk. "At least every single day, I recommended your platform to three cohorts. Like, every day, there's an opportunity for me to sing the praises of Found and how much you guys have contributed to Inclusive Therapy Group's bottom line [and] ease of expansion."

With Found as his financial foundation, Cub is focused on scaling his impact:

Growing to a $2.5 million company in the next year, with the hopes of scaling to $4 million+ further out

Continuing to fill the critically important gap in mental health services for underserved communities

Maybe even planning that Disney World team offsite he's dreamed about for his team

"At least every single day, I recommended your platform to three cohorts," Cub says. "Like, every day, there's an opportunity for me to sing the praises of Found and how much you guys have contributed to Inclusive Therapy Group's bottom line [and] ease of expansion."

Inclusive Therapy Group's story shows what's possible when your financial tools work with you instead of against you. Found isn't just banking—it's the financial operating system that lets entrepreneurs like Cub focus on their mission while the platform handles the complexity of managing cash flow, contractors, taxes, and growth.

As Cub puts it: "Found is really a part of my day-to-day operations."

And for a business doing work as important as Inclusive Therapy Group—creating affirming, expert mental health care for communities that have been overlooked and misunderstood—having the right financial partner isn't just convenient. It's essential.

Cub Larkin is a Licensed Mental Health Counselor (FL, MA), Licensed Clinical Professional Counselor (IL, ME), and Licensed Professional Counselor (OR). He founded Inclusive Therapy Group in 2018 to provide affirming mental health care to LGBTQIA+ individuals and other underserved communities. Learn more at inclusivetherapygroup.com.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax or legal advice.

Related Guides

Business Banking for Therapists: What You Really Need to Know (2025 Guide)

Business Banking

Common Therapist Tax Deductions to Shrink Your Tax Bill

Accounting and Taxes

Filing Taxes as a Therapist: Your 2025 Guide

Accounting and Taxes

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. FDIC insurance only covers the failure of an FDIC-insured depository institution.

¹Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. FDIC insurance only covers the failure of an FDIC-insured depository institution.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

⁴Optional subscriptions to Found Plus for $19.99/month or $149.99/year or Found Pro for $80/month or $720/year. There are no monthly account maintenance fees, but other fees such as transactional fees for wires, instant transfers, and ATM apply. Read Found Fee Schedule.

¹²Payments can be sent for free between Found users or by bank transfer via text, email, or direct deposit. Domestic wire transfers are available for a fee. Read Found Fee Schedule.

¹⁷Cash Back Terms and Conditions apply.

The information on this website is not intended to provide, and should not be relied on for, tax or legal advice.

Found partners with various providers to enable you to compare offers from participating institutions, such as lending, filing service, and insurance providers. Found is not a lender, a filing service, nor an insurance provider.

This website contains advertisement of Found and third party products and services.

According to NerdWallet, Found is the Best Business Checking for Paying Contractors and Saving for Taxes. (Source)

Terms of Service ・ Privacy Policy ・ Accessibility statement ・ © 2026 Found