Placeholder

Placeholder

Placeholder

Placeholder

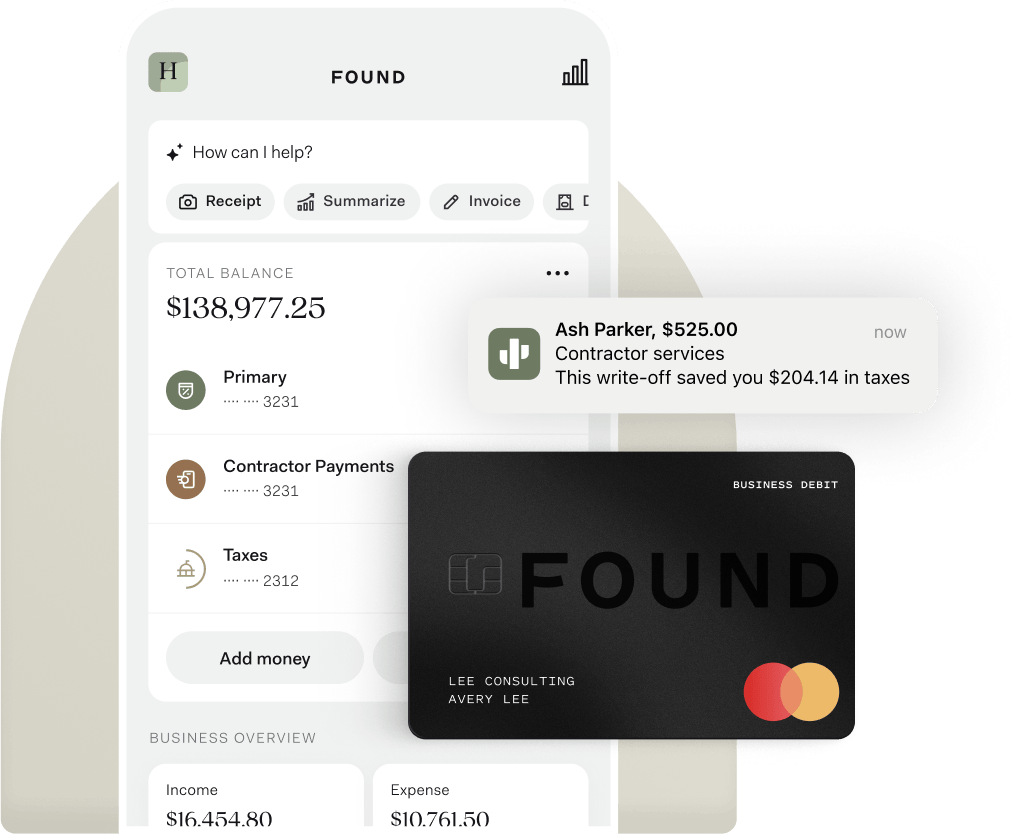

ALL-IN-ONE BANKING

Banking that simplifies contractor management

Placeholder

Found is the business banking platform that makes paying contractors, collecting W-9s, and filing 1099 forms feel effortless.

Placeholder

Placeholder

Placeholder

Placeholder

Placeholder

The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

Fast and free contractor management:

1

Pay with no per-contractor fees

Send 1099 payments via email, text, direct deposit, wires, or checks. No per-contractor fees.

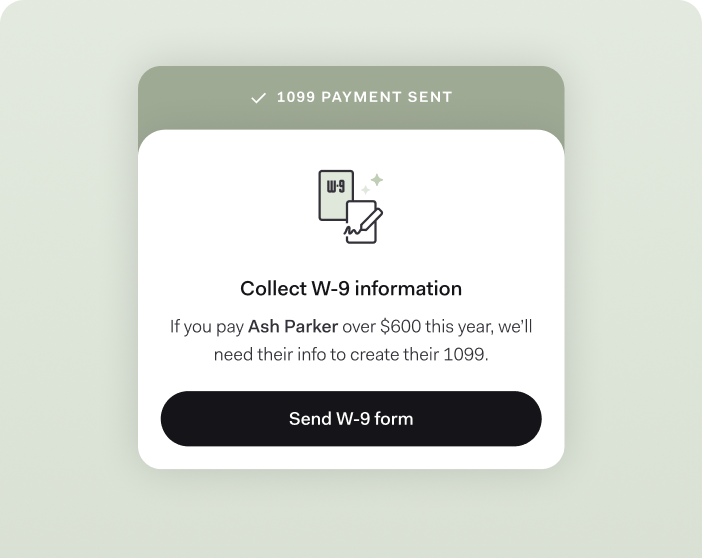

2

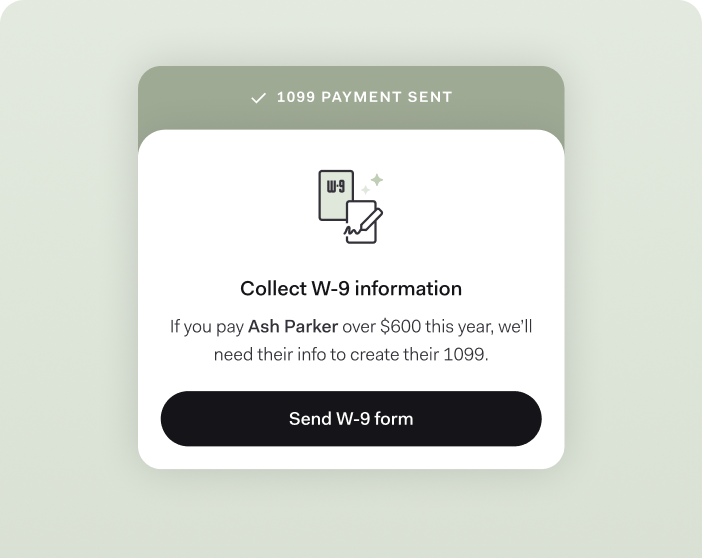

Collect W9 forms

Request a contractor’s W-9 anytime or require it before they can accept payment.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

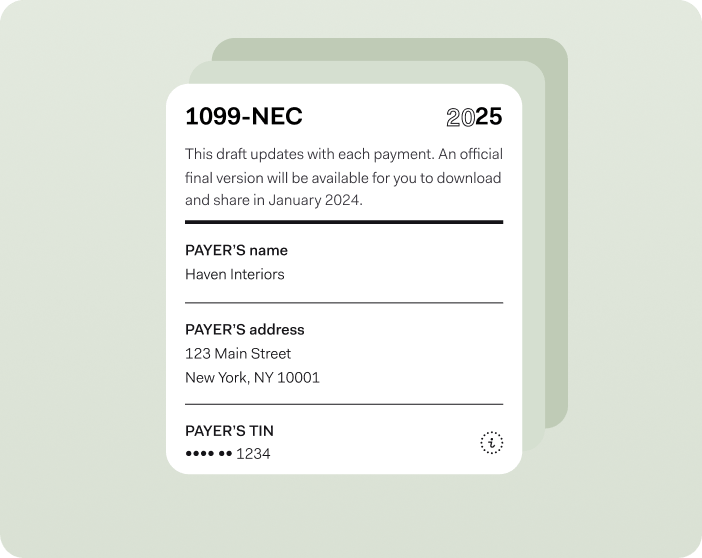

3

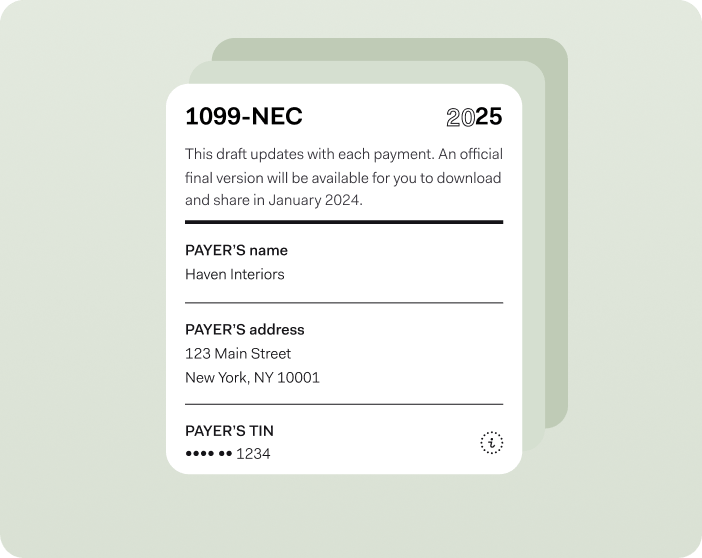

Download and file 1099-NECs

We’ll track payments and generate 1099 NECs for contractors you’ve paid $600 or more.

Fast and free contractor management:

1

Pay with no per-contractor fees

Send 1099 payments via email, text, direct deposit, wires, or checks. No per-contractor fees.

2

Collect W9 forms

Request a contractor’s W-9 anytime or require it before they can accept payment.

The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

3

Download and file 1099-NECs

We’ll track payments and generate 1099 NECs for contractors you’ve paid $600 or more.

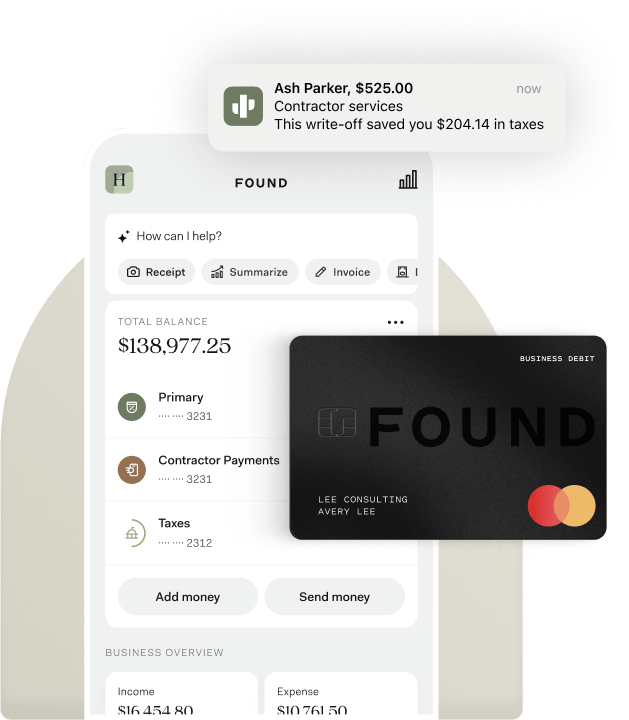

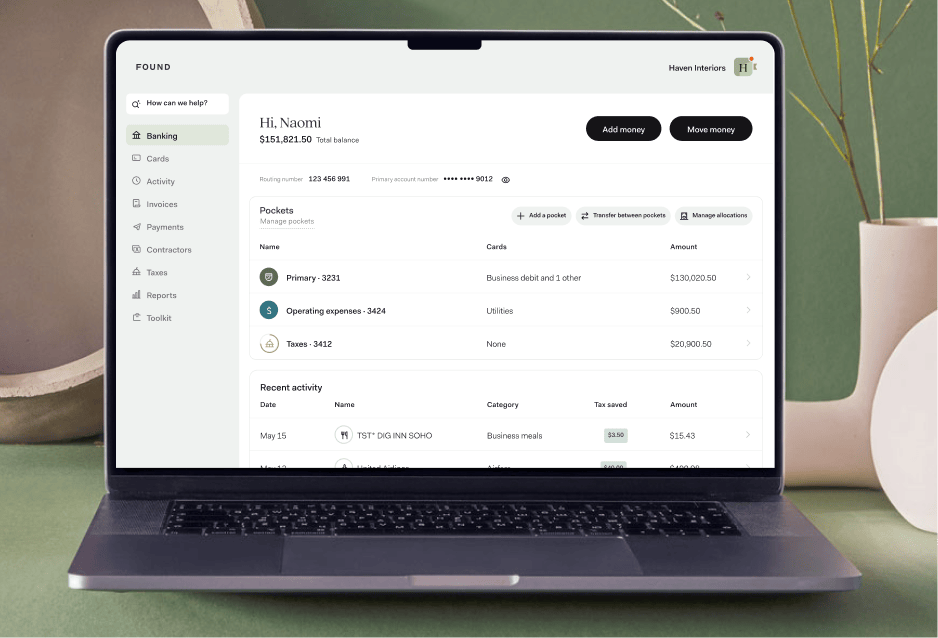

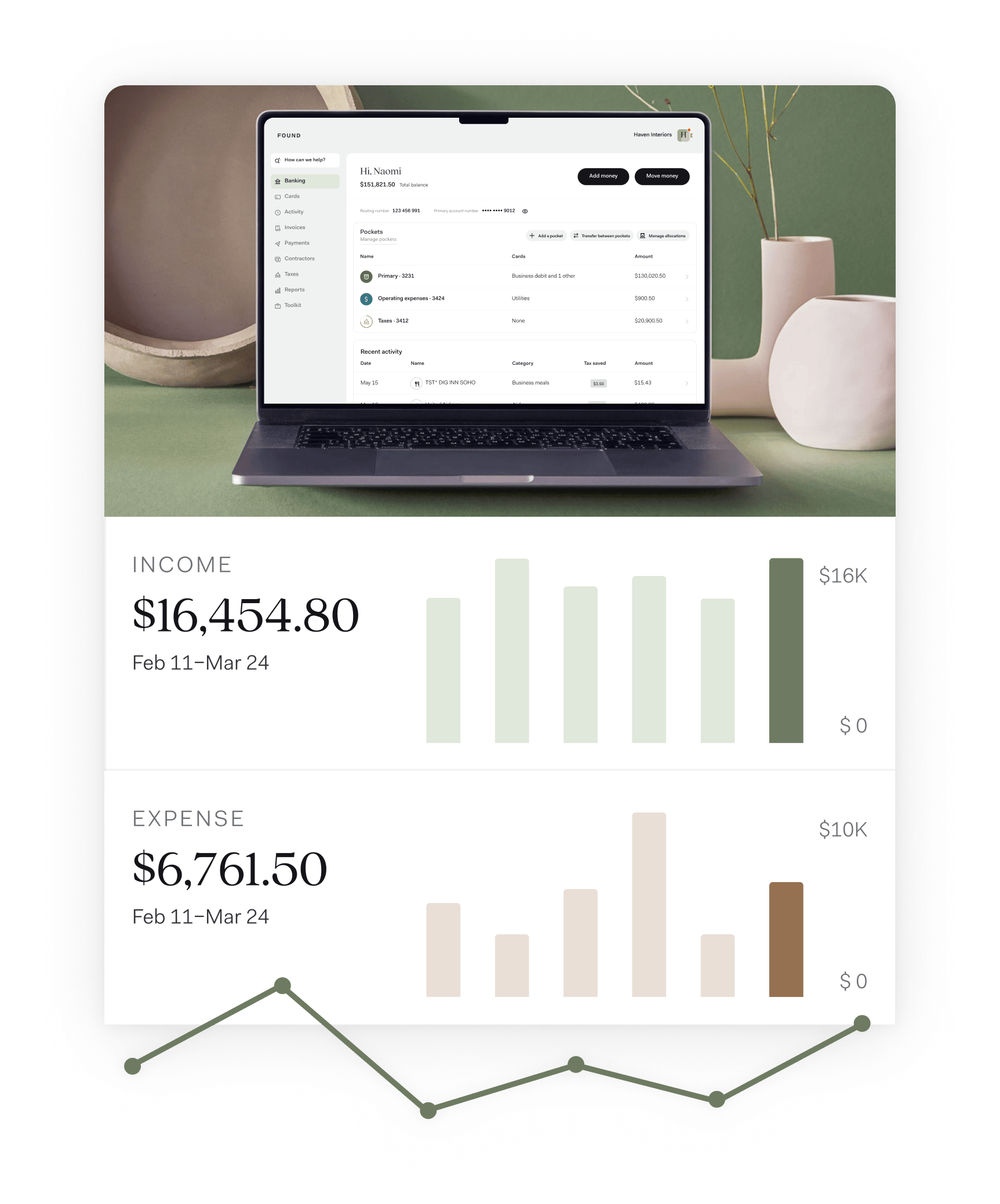

Move and manage your money—all in one place

Found consolidates your back office into one seamless platform. Get paid, send payments, manage your cash flow, and stay ahead of tax season—right where you bank.

Banking

Payments and deposits flow directly into your Found account, with the estimated taxes set aside.

Contractor management

Send unlimited payments with no per-contractor fees and easily collect the tax forms you need.

Taxes

Found helps you identify tax-write-offs, lets you request W-9s, and auto-generates 1099 NECs at the end of the year.

Bookkeeping

Expenses and receipts are automatically tracked, organized, and categorized for you.

Banking

Payments and deposits flow directly into your Found account, with the estimated taxes set aside.

Taxes

Found helps you identify tax-write-offs, lets you request W-9s, and auto-generates 1099 NECs at the end of the year.

Contractor management

Send unlimited payments with no per-contractor fees and easily collect the tax forms you need.

Bookkeeping

Expenses and receipts are automatically tracked, organized, and categorized for you.

Bring order to your finances with Found at the core

Banking

Mastercard® business debit card²

Direct deposit

Check and cash deposits

Wires and check payments⁸

Contractor payments

Sub-accounts

Bookkeeping

Expense and income tracking

Custom rules and tags¹³

Receipt scanning

Invoicing

Import external transactions

Financial reports

Taxes

Automatic write-offs

Tax form generation

Tax estimates

Tax payments¹⁰

1099 form filing

Mileage tracking

Contractor management

Unlimited payments

No per-contractor fees

Flexible payment methods

Collect W-9s

Free 1099-NEC generation

Free 1099-NEC filing

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted. ⁵Subject to eligibility requirements, applicable terms and conditions, and service fees. See Terms of Service and Lead Account Terms for more details. ¹⁰Tax payments are available for Found Plus subscribers ($19.99/month or $149.99/ year) who file a Schedule C.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

⁵Subject to eligibility requirements, applicable terms and conditions, and service fees. See Terms of Service and Lead Account Terms for more details.

⁸Domestic wire transfers are available for a fee. Read more.

¹⁰Tax payments are available for Found Plus subscribers ($19.99/month or $149.99/ year) who file a Schedule C.

¹³Found customers can create 1 custom expense rule, 1 custom tag, and 1 custom category for free. Unlimited rules, tags, and categories available with Found Plus ($19.99/month or $149.99/ year).

Found has truly revolutionized the way we do business!

They collect contractor W-9s before disburse payments and automatically generate 1099s. It’s been a life-saver.

Olivia J.

KARMA YOGA

Frequently Asked Questions

Sign up in as little as 5 minutes

Easy sign up

No credit check

No minimum balance

No maintenance fees

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC.