How to Navigate Tax Season When You’re Self-Employed

Tax season can feel stressful and cause far too many sleepless nights for freelancers and entrepreneurs. And it’s easy to feel like a small fish in a big pond when you’re solo and trying to figure out your finances as a self-employed person.

When it comes to tax season, we can help you rest easy. In this video, Found and Keila Hill-Trawick, a CPA and small business owner herself, will talk through what you need to know about your numbers to prepare for tax season:

Bookkeeping best practices

Breakdown of business entities

What you should know about contractors vs. employees

Explanation of taxes and how they actually work

Deductible expenses

And much more!

Keila knows firsthand the challenges that come with managing your finances and taxes as a self-employed person. She created Little Fish Accounting to empower small business owners to have freedom in their business by properly managing their finances and providing strategic financial support in their growth—and she wants to help you do the same.

You’ll finish this video feeling empowered to handle tax season with confidence.

The information on this website is not intended to provide, and should not be relied on, for tax advice.

Related Guides

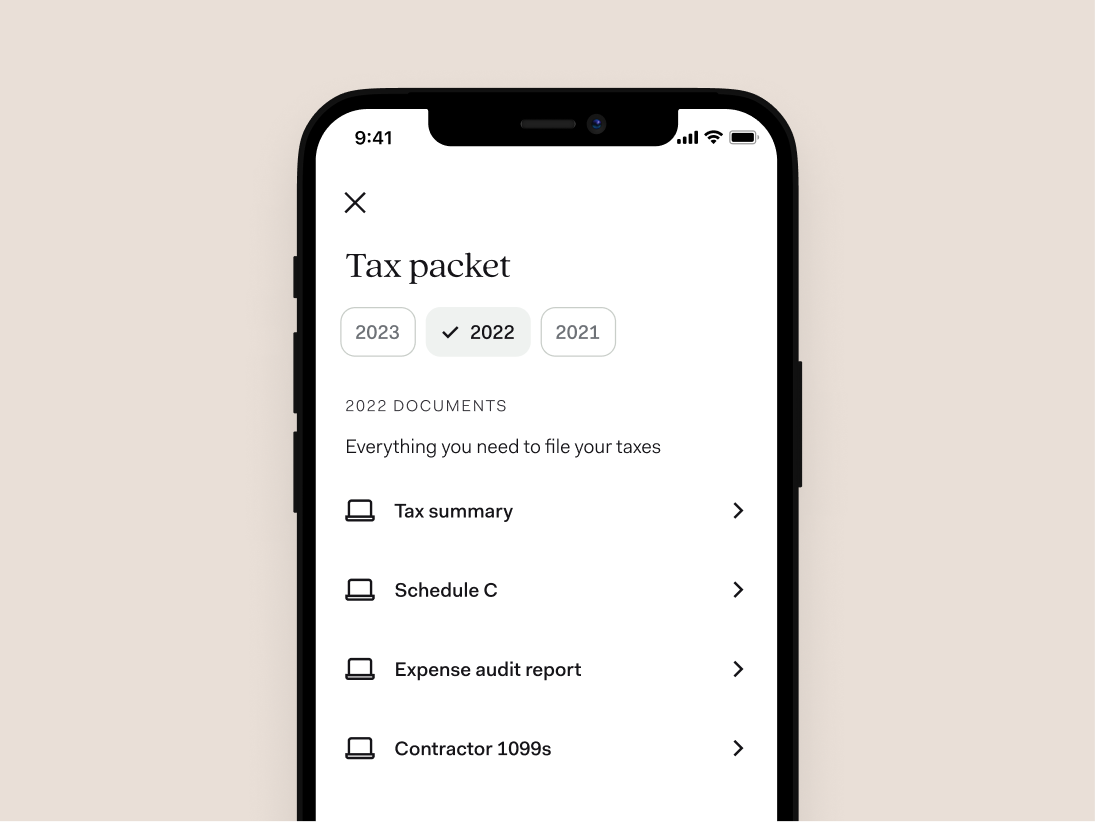

The Ultimate Guide to Self-Employment Taxes

Accounting and Taxes

Understanding the Schedule C Tax Form

Accounting and Taxes

6 Tax Mistakes Self-Employed People Should Avoid

Accounting and Taxesfor the self-employed

*Found is a financial technology company, not a bank. Banking services are provided by Piermont Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category.

The Found Mastercard Business debit card is issued by Piermont Bank pursuant to a license from Mastercard Inc.

The information on this website is not intended to provide, and should not be relied on, for tax advice.

Direct deposit funds may be available for use for up to two days before the scheduled payment date. Early availability is not guaranteed.