You're between sessions, trying to track whether your last client paid their copay while your next appointment waits in the lobby. Your "business account" is actually your personal checking with a mental spreadsheet of who owes what. Every insurance reimbursement feels like a guessing game, and you're constantly worried about missing deductible expenses at tax time.

Most therapists start their practice the same way—mixing personal and business finances until the administrative burden becomes overwhelming. Maybe you've been tracking session payments manually or tried traditional banks only to get hit with monthly fees during slower months.

Choosing the right financial tools is the foundation of your private practice, and it begins with selecting the right bank. A separate business bank account protects your income, simplifies tax season, and saves you time you can't afford to lose. Here's what you need to know about choosing a business bank account that helps you focus on client care instead of administrative chaos.

Running a therapy practice is more than providing exceptional client care. It's about staying financially organized through fluctuating caseloads and having the right financial tools to support your practice's success. A business bank account designed specifically to support therapists does more than keep your books clean; it can make or break your cash flow, insurance reimbursement tracking, and tax time readiness.

Clients seeking therapy services expect professional boundaries in all aspects of care, including payment processing. Accepting payments through personal accounts can blur professional boundaries and raise questions about your practice's legitimacy.

Professional payment options with your practice name attached

Clear, clean records for each client and insurance payment

An easier time separating business and personal finances for liability protection

When it's easier for clients and insurance companies to pay you, it's easier for you to get paid on time. No awkward money conversations required.

Therapy practices don't provide predictable paychecks. Between insurance delays, client cancellations, summer slowdowns, and holiday breaks, income can fluctuate significantly month to month. Without a flexible therapist business account, those fluctuations cause unnecessary financial stress.

Avoid minimum balance fees during slow seasons

Smooth out cash flow with better budgeting tools

Stay prepared for insurance reimbursement delays

Your business bank needs to understand your income patterns, not penalize you for them with fees.

Every continuing education course, professional liability insurance payment, telehealth subscription, and office supply expense counts. But when expenses pile up across personal and business accounts, it's nearly impossible to keep them organized. Having a separate business bank account is an important part of that, but what if your bank account goes further?

Many business bank accounts now have built-in bookkeeping and tax tools integrated directly into their platform.

Automatically track and categorize therapy-related expenses

Surface potential write-offs specific to mental health professionals

Generate reports that simplify tax preparation

A clean set of books isn't just for tax time—it protects you from audit risk and helps you truly understand your practice's financial health.

When practice administration consumes more energy than clinical work, it's time for a better solution. Managing your business finances is more than just watching money come in and go out: You're managing client invoices, insurance claims, session tracking, bookkeeping, and tax preparation.

As the healthcare landscape has evolved, many online banking platforms are now offering built-in tools to help therapists and other healthcare professionals manage all aspects of their finances, making it easier than ever to find an integrated financial solution for your practice.

Consolidate invoicing, bookkeeping, and payments into one platform

Eliminate the need for multiple subscription services

Free up hours you can put back into client care and growing your practice

Managing your practice finances shouldn't require additional software subscriptions. The right bank account can help keep you in control of your money movement and eliminate the need for additional apps, such as invoicing software or bookkeeping tools.

Most business bank accounts cover the basics: deposits, withdrawals, and a debit card. But therapists often need more than basic banking. You need a financial platform that works the way you do: flexible for variable income, supportive of your administrative needs, and ready to help you manage the unique financial aspects of running a therapy practice.

The difference between a standard business account and one that works for your business comes down to two things:

Banking features that fit your workflow

Integrated tools that eliminate the need for multiple apps

Banking features are your financial foundation. These are the must-haves that keep your practice running smoothly.

Integrated tools are your competitive advantage. Instead of juggling separate apps for invoicing, bookkeeping, and tax prep, the right platform brings everything together, so your financial management supports your clinical work rather than distracting from it.

Feature | Why It Matters for Photographers |

|---|---|

Banking Features | |

No required monthly fees | Avoid penalties during months when your client load is lighter |

Mobile app | Manage your money between sessions or during telehealth days |

APY | Maximize earnings on irregular income while waiting for insurance reimbursements |

Accepts a variety of payment options | Get paid the way clients prefer—faster and more securely |

Integrated Financial Tools | |

Customizable transaction tagging | Sort expenses by client type service category without extra apps |

Built-in bookkeeping and expense tracking | Sync your client payments and insurance reimbursements without manual entry |

Built-in tax estimates and payment reminders | Stay ready for quarterly payments without scrambling |

Contractor payroll and tax tools | Pay associate therapists and virtual assistants seamlessly and manage tax forms for compliance |

Invoicing functionality | Send professional invoices without limits or extra fees |

We looked at five business banking platforms to find the best fit for therapists. We've analyzed features through the lens of what matters most to your practice, helping you make the best decision for your therapy business.

Data accurate as of October 2025. Features and fees are subject to change. Always verify current terms with financial institutions before making decisions.

Feature | Found | Lili | Bluevine | Chase Business | Bank of America Business |

|---|---|---|---|---|---|

Monthly Fees | $0 (Core) $19.99 (Found Plus⁴) | $0 (Basic) $15 (Pro $35 (Smart) $55 (Premium) | $0 (Standard) $30 (Plus) $95 (Premier) | $15/month | $16/month |

Automated Bookkeeping | ✅ | ⚠️ Available in Lili Smart and Premium plans | ❌ | ❌ | ❌ |

Expense Categorization | ✅ Available in all plans | ⚠️ Available in Lili Pro, Smart, and Premium plans | ❌ | ❌ | ❌ |

Real-time Tax Estimates | ✅ | ❌ | ❌ | ❌ | ❌ |

Unlimited Invoicing | ✅ Available in all plans | ⚠️ Available in Lili Smart and Premium plans | ✅ Available in all plans | ❌ | ❌ |

1099 Contractor Payment and Tax Forms | ✅ Available in all plans | ❌ No | ❌ No | ❌ No | ❌ No |

Additional Physical and Virtual Cards | ✅ | ⚠️ One physical and one virtual card per account owner | ✅ | ❌ No | ❌ No |

APY | ⚠️ 1.5% APY on balances up to $20K for Found Plus subscribers¹⁴ | ⚠️ 3.0% APY available in Lili Smart and Premium plans | ✅ APY with varying rates by balance tier available in all plans | ❌ No | ❌ No |

Physical Branches | ❌ | ❌ | ❌ | ✅ | ✅ |

ATM Network | ⚠️ Cash deposits available for a fee⁷ | ✅ Fee-free MoneyPass ATM network | ✅ Fee-free MoneyPass ATM network | ✅ Fee-free Chase ATM network | ✅ Fee-free Bank of America ATM network |

Customer Support | ⚠️ Phone and email during limited hours, digital-only support, no branches | ⚠️ Phone and email during business hours, digital-only, no branches | ⚠️ Phone and email during business hours, digital-first, no branches | ✅ 24/7 phone, live chat, AI assistant, extensive branch network | ✅ 24/7 phone, live chat, AI assistant, nationwide branches |

⁴Optional subscriptions to Found Plus for $19.99/month or $149.99/year or Found Pro for $80/month or $720/year. There are no monthly account maintenance fees, but other fees such as transactional fees for wires, instant transfers, and ATM apply. Read Found Fee Schedule.

⁷Found does not charge ATM fees, but some ATM providers may add their own fee.

¹⁴Found Plus subscribers earn 1.5% APY on balances up to $20K. Found Pro subscribers earn 2.5% APY on all balances, with no cap.

Your best banking choice depends on what matters most to your therapy business:

Want all-in-one automation? Found offers therapist-friendly banking with built-in features such as real-time tax estimates, contractor management, and integrated invoicing—no juggling multiple apps for bookkeeping and client billing.

Managing multiple practices or group practice entities? Both Found and Lili allow you to manage multiple accounts, but Found includes all essential features—automated bookkeeping, expense categorization, real-time tax estimates, and unlimited invoicing—in its free core plan. Lili requires paid plans starting at $35/month to access similar features like automated bookkeeping and unlimited invoicing.

Prioritizing high interest rates? Bluevine offers the best APY options with tiered rates and extensive ATM access through the MoneyPass network, but you'll need separate tools for bookkeeping, tax estimates, and client invoicing.

Prefer in-person banking? Both Chase and Bank of America work best if you need physical branch access, an extensive ATM network, and 24/7 customer support. Both charge monthly fees ($15-16) and lack specialized tools for mental health professionals, meaning you'll need additional software for practice management, tax planning, and contractor payments.

What You Won’t Get from a Traditional Bank: Big banks typically aren’t built for small businesses. Here’s where they fall short:

No built-in bookkeeping: You’re stuck juggling spreadsheets or paying for extra software to track client sessions and insurance payments.

No tax support: When quarterly deadlines come, you’re on your own.

Hidden fees: Monthly charges and minimum balance requirements drain profits during your summer slowdowns and holiday breaks.

Limited payment options: No invoicing tools, no mobile flexibility, no contractor management.

Poor mobile apps: Old-school interfaces that don't match the pace of modern private practice management.

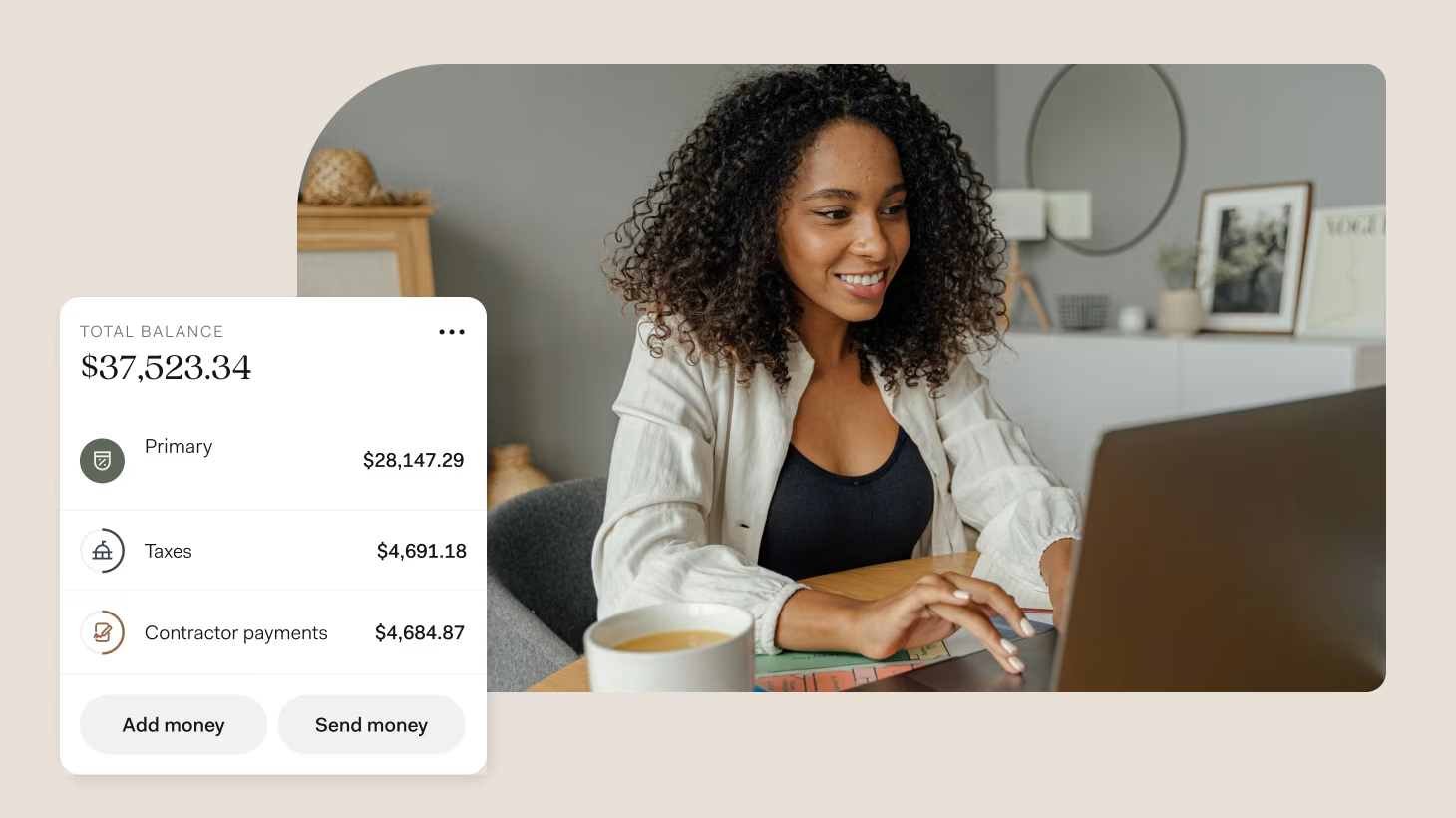

Therapists face unique financial challenges that traditional banks often don't understand. From irregular insurance reimbursements to continuing education expenses, mental health professionals need specialized banking solutions. Found was built specifically to integrate business banking with other financial tools to solve these problems:

Found provides real-time tax estimates and automatically sets aside money for taxes from your deposits. No more guessing or scrambling when quarterly deadlines hit. You can see an estimate of what you owe and have the funds ready when those quarterly tax payments are due.

Found's contractor management tool makes onboarding, paying, and managing the 1099 contractors who support your practice seamless from start to finish. With Found, you can collect W-9 forms, send and track 1099 payments, and generate and e-file those 1099-NEC forms, right from your banking app. The best part? There are no per-contractor fees, which can potentially save you hundreds of dollars each year.

Found automatically tracks and categorizes your expenses every time you swipe your card, then looks for write-offs specific to mental health professionals, ensuring you stay on top of tax deductions for tax season. Plus, Found automatically prepares some tax forms, such as the Schedule C, 1120, or 1120-S.

Found offers unlimited professional invoices, customized with your practice information. Create templates for different session types and send automated payment reminders—streamlining your entire billing process from initial session to final payment without awkward follow-ups.

Found's Pockets let you automatically allocate income into separate savings pockets during busy months so you can set up automatic transfers to your "slow season fund" and stay financially prepared when client caseloads naturally fluctuate during holidays and summer months.

Found combines banking, invoicing, expense tracking, tax prep, and contractor payments into one integrated platform so you can eliminate the need to switch between multiple apps and keep all your financial data synchronized in one place.

Found's core plan has no monthly fees and no minimum balance requirements, making it easy to keep every dollar you earn, especially during slower seasons when every penny counts for covering fixed costs like liability insurance and office rent.

Found's Pockets let you create custom savings goals and automatically allocate a percentage of every deposit to specific purposes like a "Continuing Education" pocket for that advanced training or certification. Set up deposit allocations so that money automatically goes into your professional development fund, and when it's time for that conference or new assessment materials, you'll have the funds ready.

Disclaimer: The information on this website is not intended to provide, and should not be relied on, for tax advice. Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC.

Related Guides

Filing Taxes as a Therapist: Your 2025 Guide

Accounting and Taxes

Found vs QuickBooks: Which Is Right for Small Business?

Accounting and Taxes

Common Therapist Tax Deductions to Shrink Your Tax Bill

Accounting and Taxes

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. FDIC insurance only covers the failure of an FDIC-insured depository institution.

⁴Optional subscriptions to Found Plus for $19.99/month or $149.99/year or Found Pro for $80/month or $720/year. There are no monthly account maintenance fees, but other fees such as transactional fees for wires, instant transfers, and ATM apply. Read Found Fee Schedule.

⁷Found does not charge ATM fees, but some ATM providers may add their own fee.

¹⁴Found Plus subscribers (for $19.99/month or $149.99/year) earn 1.5% APY on balances up to $20K. Found Pro subscribers (for $80/month or $720/year) earn 2.5% APY on all balances, with no cap.

¹⁷Cash Back Terms and Conditions apply.

The information on this website is not intended to provide, and should not be relied on for, tax or legal advice.

Found partners with various providers to enable you to compare offers from participating institutions, such as lending, filing service, and insurance providers. Found is not a lender, a filing service, nor an insurance provider.

This website contains advertisement of Found and third party products and services.

According to NerdWallet, Found is the Best Business Checking for Paying Contractors and Saving for Taxes. (Source)

Terms of Service ・ Privacy Policy ・ Accessibility statement ・ © 2026 Found