Pockets are sub-accounts within your Found account that enable you to manage cash across various business needs.

They are a powerful budgeting tool that can help you track how you allocate and spend cash across your business. Each Pocket has its own account number, making it easy to deposit, transfer, and manage funds across Pockets.

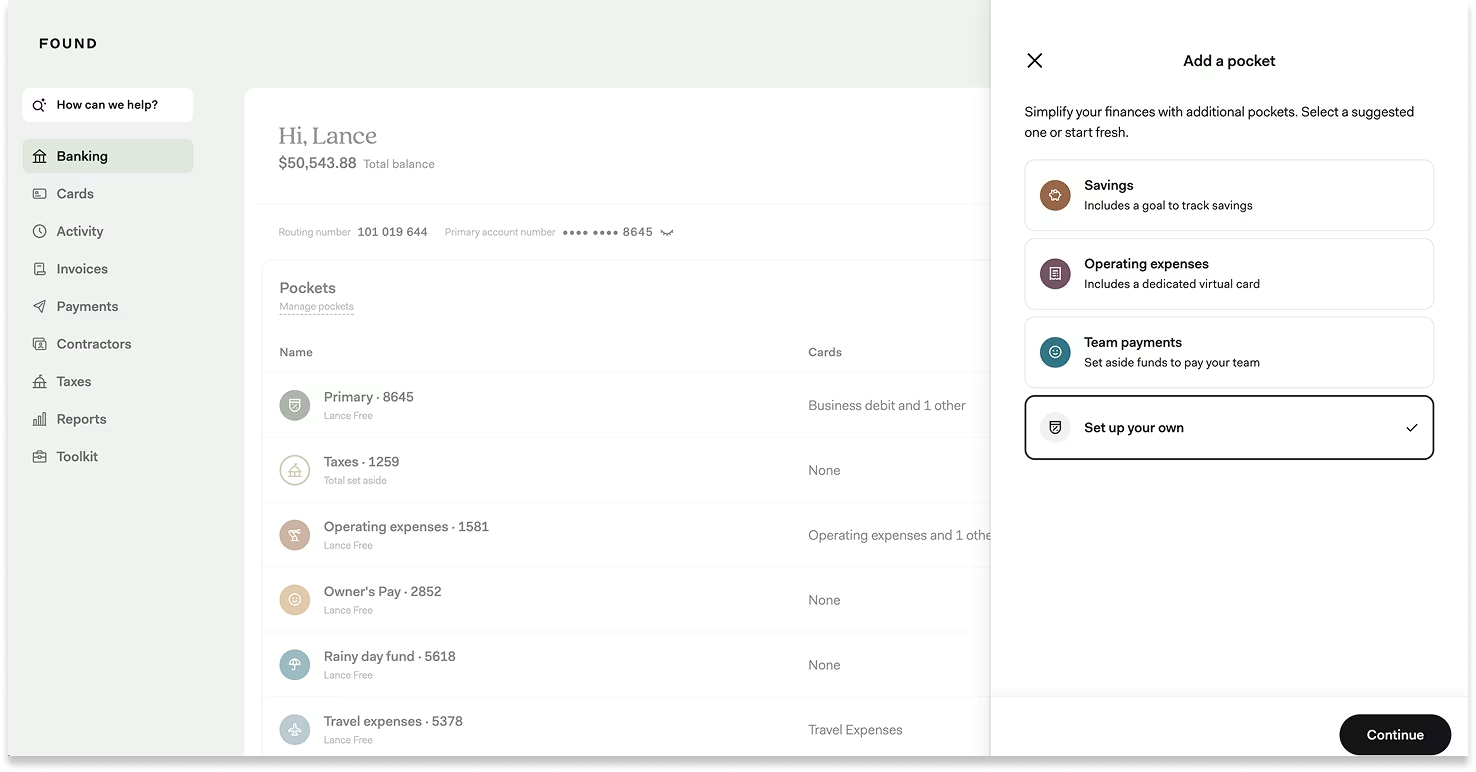

By default, every Found account starts with two pockets: Primary and Taxes. You can also create up to 8 additional Pockets to set aside money for expenses, savings goals, revenue streams, or any other purpose.

Here how to begin managing your cash flow with Pockets:

You can create custom Pockets to manage cash for:

Common expenses: (e.g. Operating expenses, Team payments)

Specific savings goals: (e.g. New equipment, Rainy day fund)

Different revenue streams: (e.g. Consulting revenue, Coaching business)

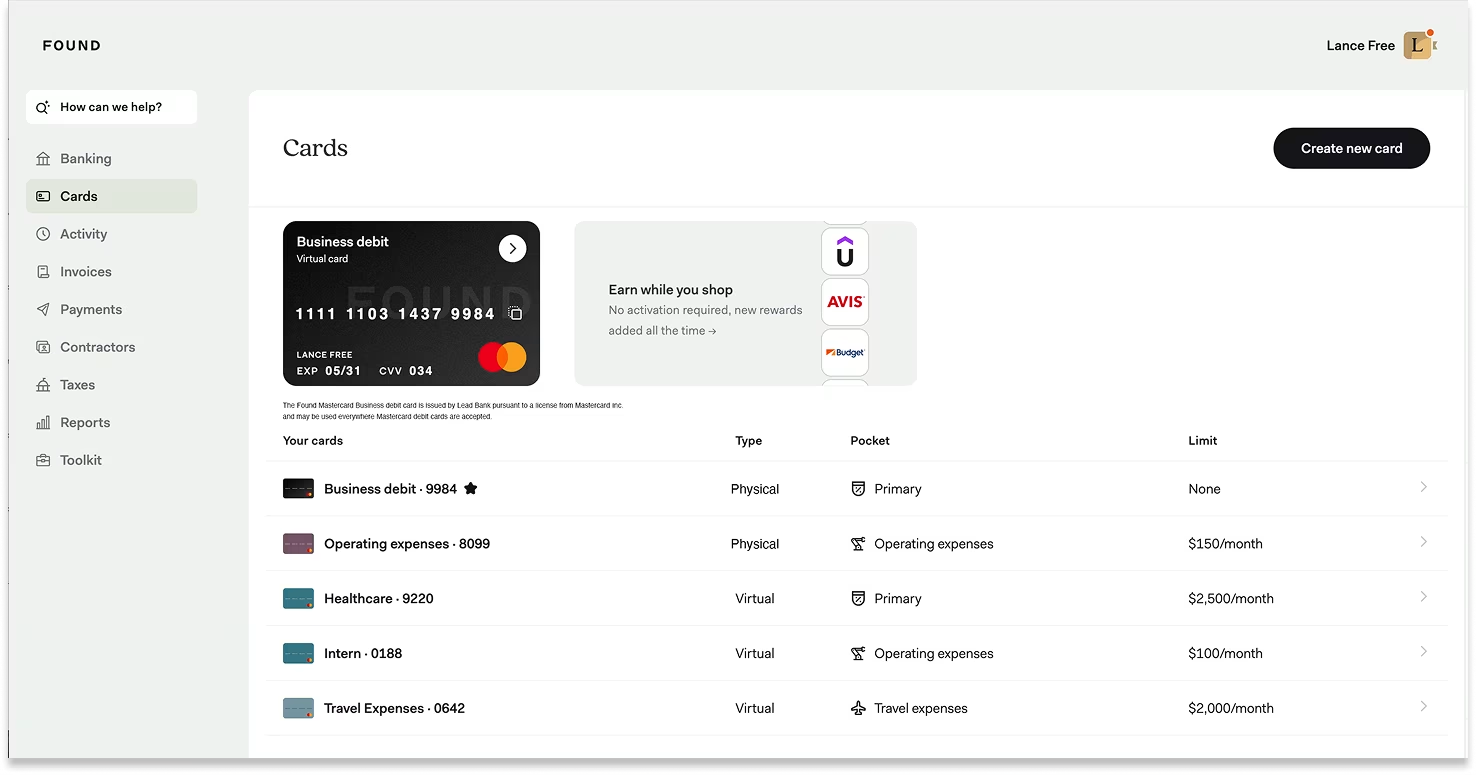

Each Pocket can have its own name, color, icon, and a “savings goal” linked to it. You can also link a physical or virtual debit card to a Pocket in order to spend directly from that Pocket.

There are three ways to deposit money into a Pocket:

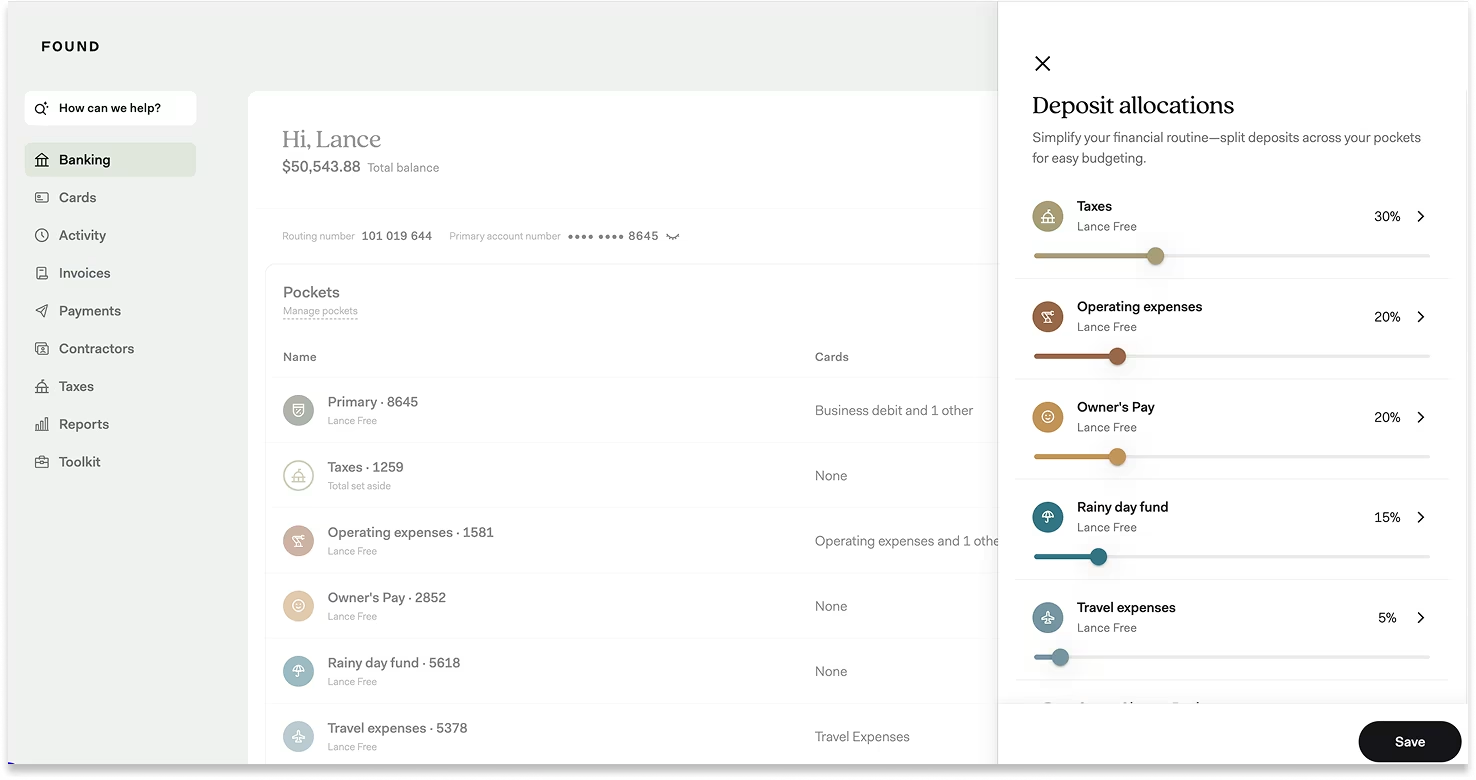

Via deposit allocations: After creating a custom Pocket, a percentage of any deposit to your Primary Pocket (i.e. your main Found account number) can be automatically directed into that new Pocket.

These percentages are called “deposit allocations” in Found.

For example, if you’re paid $1,000 each week, you could automatically allocate 30% ($300) to your Taxes Pocket, 20% ($200) to your Operating Expenses Pocket, 20% ($200) to your Owner’s Pay Pocket, 15% ($150) to refill your Rainy Day Fund Pocket, and so on. The remainder will be deposited into your Primary Pocket.

You can update these allocations for each Pocket or transfer money between Pockets at any time.

Tip: Deposit allocations are a handy way to ensure you’re proactively saving for taxes, payroll, or other common expenses as a percentage of ongoing income.

Via depositing directly into a Pocket: You can also deposit money directly into a Pocket using its unique account number.

Click into a Pocket to view and copy its unique account number. You can share this with a client or enter it into any app or platform where you receive payments to deposit funds directly into that Pocket.

Tip: Receiving deposits directly into a Pocket can be handy when managing cash for a specific revenue stream, business line, or client.

Via transferring from another Pocket: You can transfer funds between Pockets at any time. In the ‘Move Money’ flow, select ‘Internal transfer’, specify the Pockets you’re transferring to and from, along with the amount that you would like to transfer.

There are two ways to spend money that you’ve set aside into a Pocket:

Via debit card: Order physical cards or create virtual cards for common expense categories and link them to the appropriate Pockets to spend directly from those funds.

Tip: This is great for ongoing expenses like subscriptions, gas, and supplies, as well as any expense that you’d like team members to make on a shared virtual card.

Via bank transfer: When making a payment to a person or business in the 'Move Money' flow, select the Pocket you want to use in the ‘From’ field.

Alternatively, you can enter a Pocket’s unique account number into any platform that can debit funds from your account.

Tip: This is useful for common expenses that you do not want to put on a debit card, such as rent & utilities, credit card or loan payments, estimated tax payments, or payments to people.

Here’s how you can use Pockets in your day-to-day workflows:

Automatically set aside money for estimated quarterly taxes each time you’re paid. At quarterly tax time, make those payments directly from your Taxes Pocket.

Learn more: How to estimate, save for, and pay your quarterly taxes →

Set aside money to cover salaries for yourself and your team. When it’s time to run payroll, pull funds directly from that Pocket.

Learn more: How to pay yourself a salary in Found →

Create Pockets for common expense categories and set money aside each time you’re paid. Use corresponding virtual cards with spending limits to make sure you don’t spend more than you’re saving.

Learn more: How to build a budget with Pockets and virtual cards →

Create Pockets for each of your revenue streams. Receive deposits directly into each Pocket and use the funds from each Pocket for related expenses, making it easy to track finances by revenue stream.

Learn more: How to track multiple revenue streams for my business →

Want to learn more about how to get the most out of Found’s banking and budgeting tools? Check out our other articles or ask Found Assistant in the app.