As we move into the final months of the year, many self-employed people’s minds turn towards everyone’s favorite time of year—tax season. Business can be unpredictable, but tax time is nothing if not reliable.

That said, the IRS has made some changes over the last year that may impact how you file and what you owe. In this article, we’ll take a look at some of the most far-reaching changes for the 2022 tax year, as well as some tips to make this season as easy as possible.

First, let’s review some of the changes and updates the IRS has made that may affect self-employed people, starting with the big one—an updated 1099-K reporting threshold.

One of the biggest changes for freelancers and self-employed people is the change to the 1099-K reporting threshold. If you receive more than $600 for goods or services for the entire year through a third-party payment network like PayPal, Stripe, Cash App, Venmo, eBay, Etsy, and others, you’ll receive a 1099 form from them. The previous threshold was $20,000 and 200 transactions. UPDATE: While this change was originally slated to begin with the 2022 tax year, the IRS recently announced it delayed the new tax policy by one year.

Technically, if you’ve been paying taxes on all your income all along, this won’t make a huge difference. In fact, having an official document from these sources may make things easier. However, if you’ve been letting income from certain sources slide under the table, you may need to start reporting it to the IRS (and pay taxes on it).

In 2021, the Child Tax Credit saw some major changes. Not only was the amount of the credit increased ($3,600 for children five and under, and $3,000 for children 6 to 17 years old), but half of it was made available in advance in the form of monthly installments from July to December.

These changes have been reversed for the 2022 tax year, so the Child Tax Credit has returned to normal. This means a credit of $2,000 per child, with an age limit of 16. This will be a large change for some families—particularly if you opted to skip the monthly payments and receive the whole credit at tax time.

Another change for the 2022 tax year that may impact some freelancers is a widening of federal tax brackets. The actual tax rates within the brackets haven’t changed—just the brackets themselves. The change is also fairly minor, but worth noting in case you typically fall on the line between two brackets.

In good news for everybody, the standard deduction amounts have increased for 2022 due to inflation. Married couples get $25,900, compared to $25,100 for 2021. Single filers get $12,950, compared to $12,550 for 2021. Finally, those filing as head-of-household get $19,400, compared to $18,800 in 2021.

For those unfamiliar, the standard deduction is a specific dollar amount that lowers your taxable income. In other words, you deduct this amount from your taxable income to determine how much you actually need to pay taxes on. Each taxpayer can choose whether to itemize deductions or take the standard deduction—the choice is generally based on which is higher.

Note that this is not the same as deducting your self-employed business expenses—we’ll touch on this more below, but basically, your expenses reduce your taxable income, and then you take the standard deduction on top of that. As always, consult with a tax professional if you're in doubt!

Another change for the 2022 tax year that will likely greatly impact many is the change to standard mileage rates. The standard mileage rate is the amount the IRS allows you to deduct, per mile, as a business expense. These rates were increased for 2021 and then updated again in the middle of the year to help compensate for rising gas prices. The change is fairly significant, particularly if you log a lot of miles for work.

For the first half of the year (January 1 to June 30), the standard mileage rate for business use was 58.5 cents per mile, compared to 56 cents per mile in 2021. This further increased to 62.5 cents per mile for the second half of the year (July 1 to December 31). Learn more about maximizing your vehicle expense deductions here.

With these changes in mind, let’s look at some tax tips to help you get the most out of your 2022 small business taxes.

The first, and possibly most important thing, you should do is ensure you capture and deduct all your expenses. Every dollar you spend on your business reduces your taxable income, which can greatly affect how much you have to pay the IRS.

The IRS has a list of acceptable categories for expenses. Some of the most common include:

Advertising

Vehicle expenses (including business mileage)

Insurance

Mortgage

Office expenses

Utilities

Repairs and maintenance

As you go through your accounts, pull the expenses that fit in one of the IRS’s approved categories and log them.

Using a business bank account to make all your business purchases can really come in handy here because you don’t have to hunt—everything in that account is for your business. Some business accounts come with additional perks, like Found’s automatic categorization of expenses, that can further simplify the process.

This is huge. We highly recommend that all small business owners and freelancers keep their business finances entirely separate from personal—no matter how small your business is. This has several advantages:

It’s much easier to track your income and expenses for tax purposes when you’re using a dedicated business bank account.

You can get a quick look at the financial health of your business any time, instead of having to sort out your personal purchases.

It can keep you out of trouble if you’re operating as an LLC, which generally requires that you keep business and personal strictly separated.

The odds of you being audited by the IRS might be low, but they’re never zero. If you are audited, chances are good they’ll want to see proof that your reported expenses are real. For that, you’ll need receipts.

This doesn’t necessarily mean paper receipts, although that’s still an option. You can also save electronic copies, by scanning your paper receipts and storing them in a folder on your computer or—even better—uploading them to your accounting software. Either way, make sure you’ve got a copy for every expense.

Whether you’re newly self-employed or you’ve been independent for years, tax time can be stressful. However, knowledge is power—now that you know what’s new in 2022, you should be able to file with confidence.

For an even bigger boost of confidence, check out Found. Our all-in-one small business banking and accounting platform can make your next tax season the easiest one yet.

This material has been prepared for informational purposes only and should not be relied on as tax advice.

Related Guides

Kick the 2022 Tax Season Off Right

Accounting and Taxes

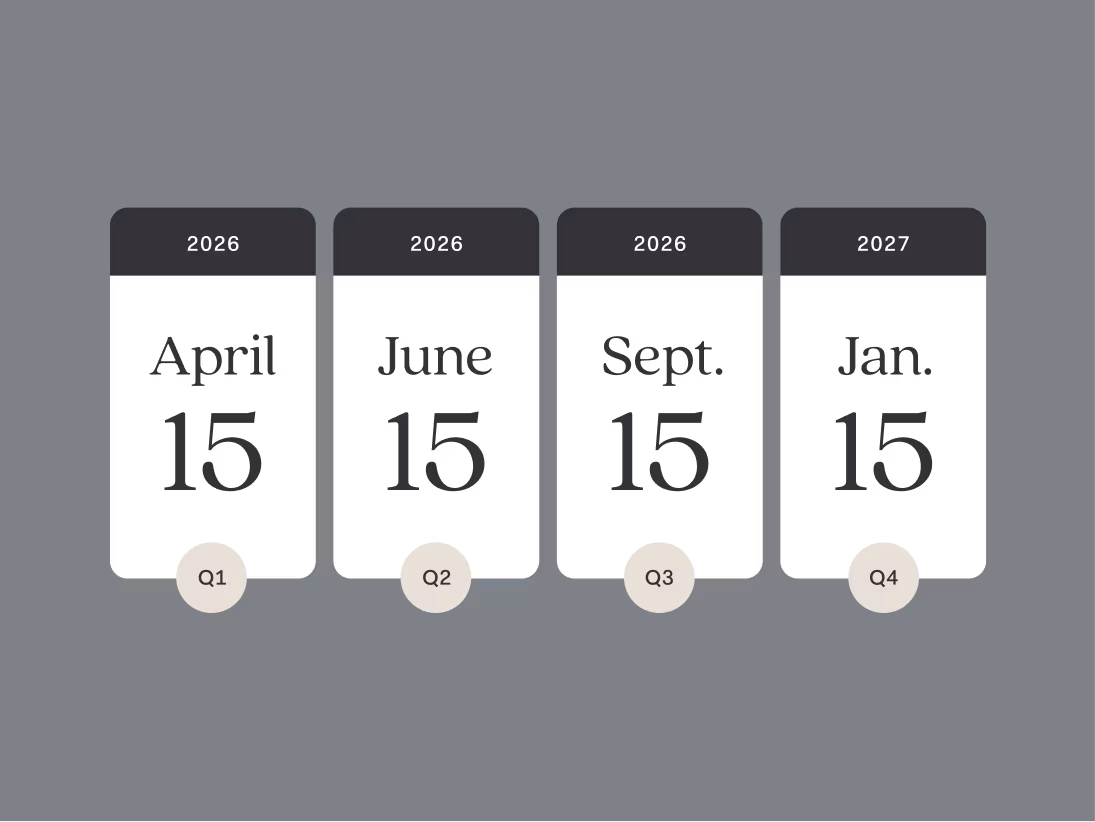

2026 Tax Deadlines for Small Business Owners

Accounting and Taxes

7 Ways Freelancers Can Benefit From a Business Bank Account

Business Banking

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. FDIC insurance only covers the failure of an FDIC-insured depository institution.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

⁴Optional subscriptions to Found Plus for $19.99/month or $149.99/year or Found Pro for $80/month or $720/year. There are no monthly account maintenance fees, but other fees such as transactional fees for wires, instant transfers, and ATM apply. Read Found Fee Schedule.

¹⁷Cash Back Terms and Conditions apply.

The information on this website is not intended to provide, and should not be relied on for, tax or legal advice.

Found partners with various providers to enable you to compare offers from participating institutions, such as lending, filing service, and insurance providers. Found is not a lender, a filing service, nor an insurance provider.

This website contains advertisement of Found and third party products and services.

According to NerdWallet, Found is the Best Business Checking for Paying Contractors and Saving for Taxes. (Source)

Terms of Service ・ Privacy Policy ・ Accessibility statement ・ © 2026 Found