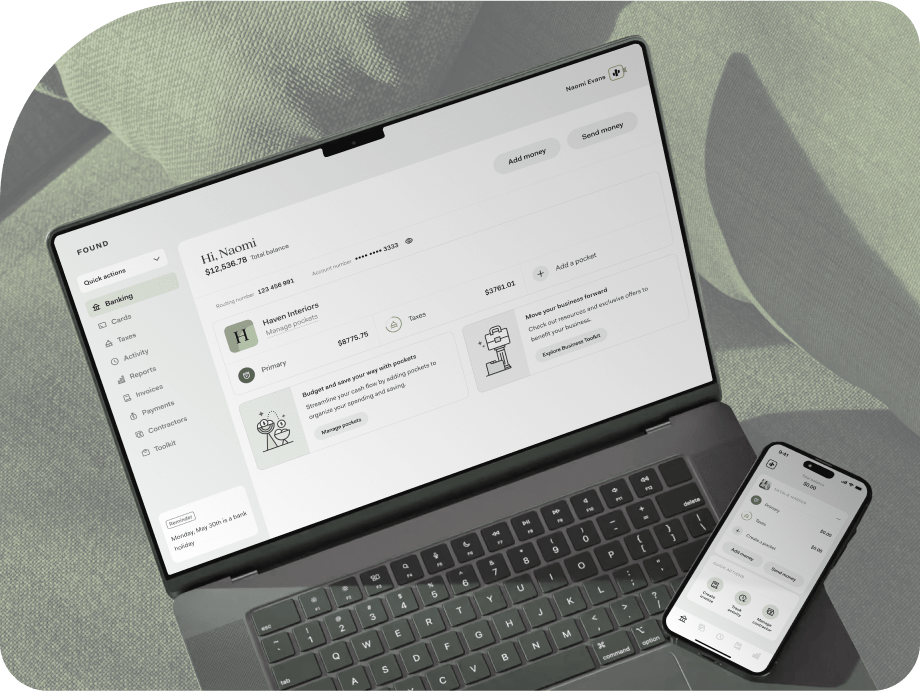

Getting started with Found

You signed up—nice! Here are quick and easy next steps to help you get the most from your account.

Step 1: Download the app

Easy to use, sleek, and full of features. Take your business banking on the go with the Found app.

Step 2: Activate your card

Turn on your purchasing power by activating your physical card. Then add to your digital wallet for easy, secure shopping online or in stores.

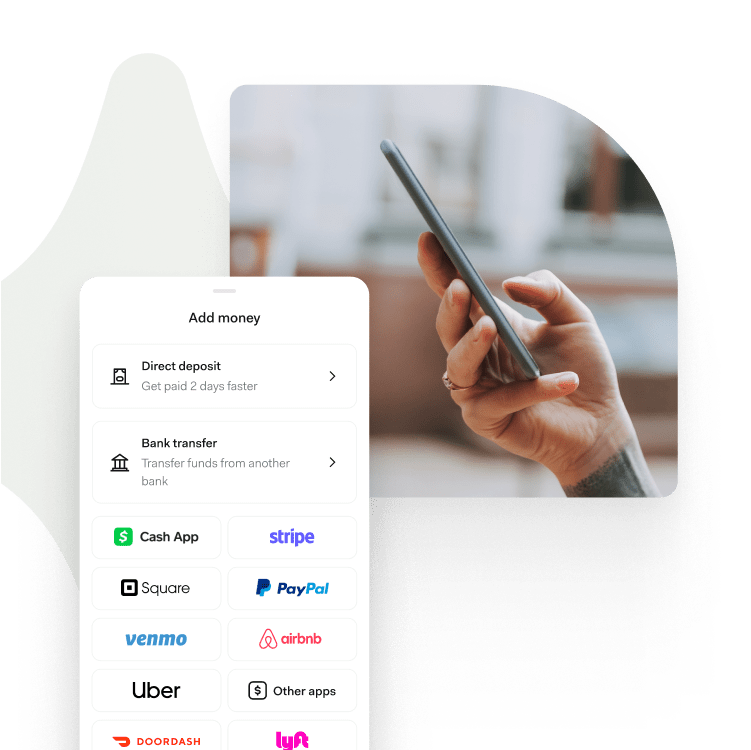

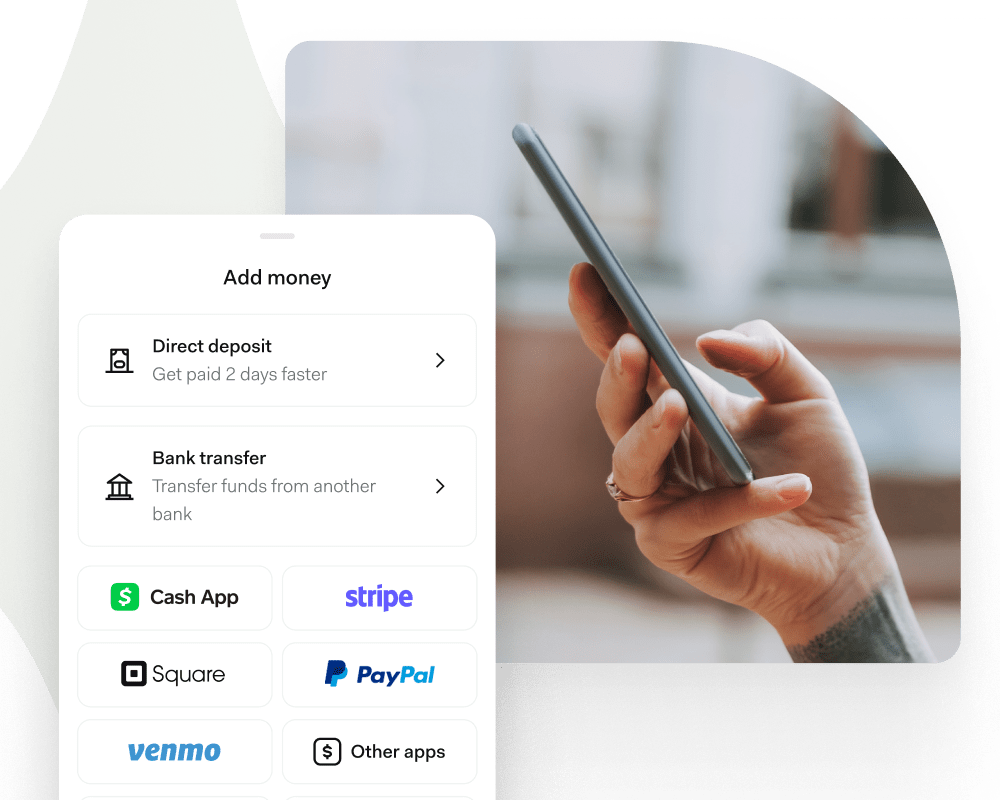

Step 3: Fund your account

Add money using a payment app, make a cash deposit, or set up direct deposit and get paid up to 2 days early.**

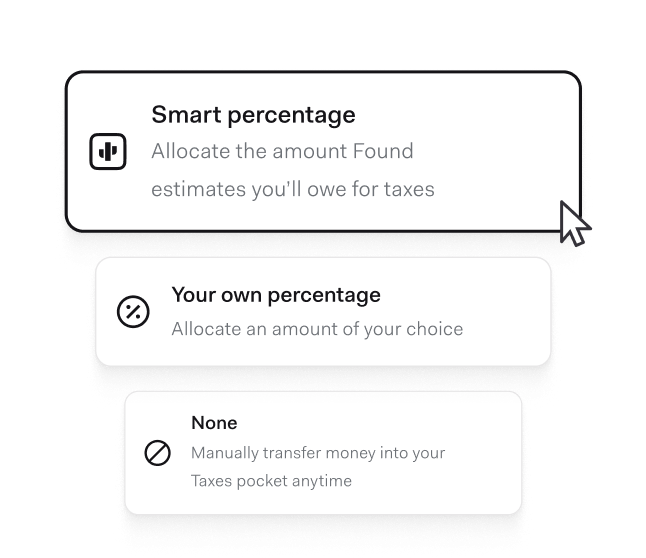

Choose how much to set aside for taxes

We’ll help you auto-save for taxes every time you get paid. Choose the percentage you want to set aside from each deposit, or use Found’s smart percentage to calculate for you.

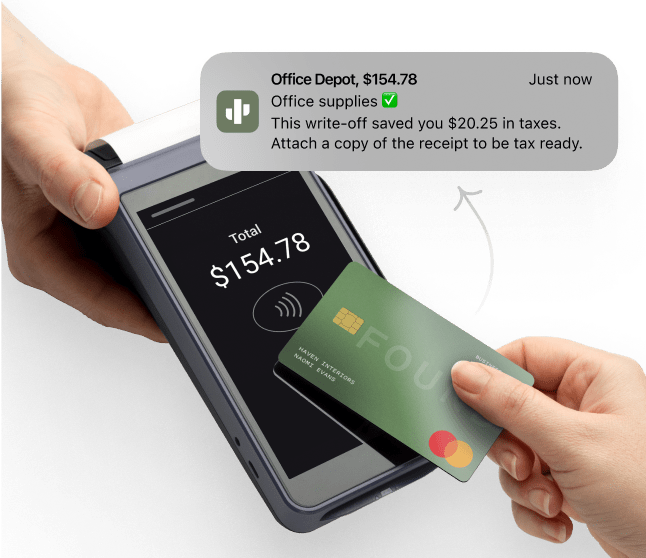

Find write-offs. Save money. Repeat.

Every time you use your Found card, we’ll automatically track your expenses so you don’t have to. Found’s auto-categorization also helps you find write-offs, saving you big at tax time.

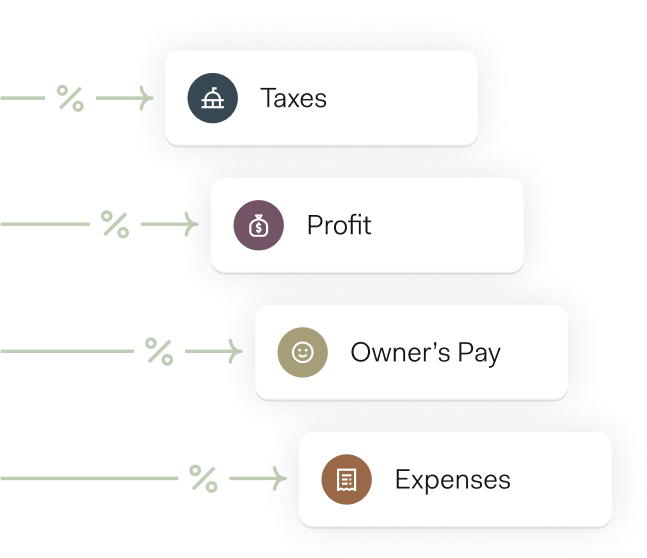

Budget and save, your way

Quickly separate and earmark money with pockets. Set up Profit First budgeting or set aside funds for payrolls, supplies, emergencies — whatever you choose.

.

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC.